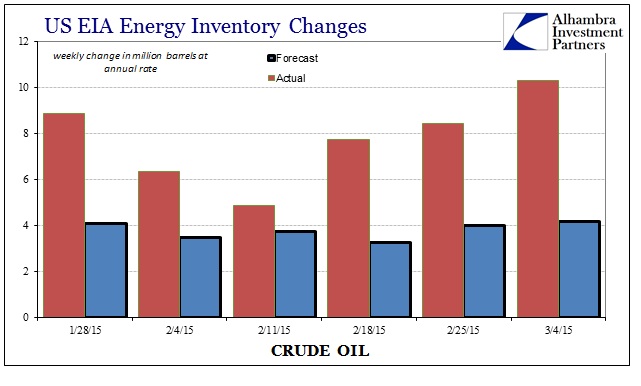

There were several updates in the crude oil data flow, including the latest “unexpectedly” huge increase in inventory that pushed spot WTI back below $50 yet again. The US EIA estimated that domestic inventory rose by a gargantuan 10.3 million barrels, far exceeding predicted builds. That figure has to include oil being shipped to the US to be stored in contango from foreign markets, but that still would not account for the overall trend or its scope. The pace of inventory these past few weeks is simply enormous.

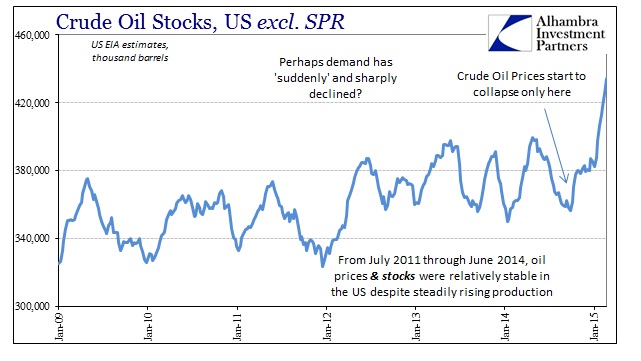

Overall non-SPR inventories have risen to record amounts, with most of that coming just during 2015 so far.

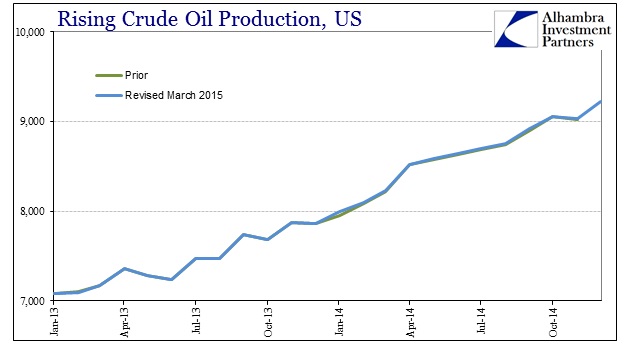

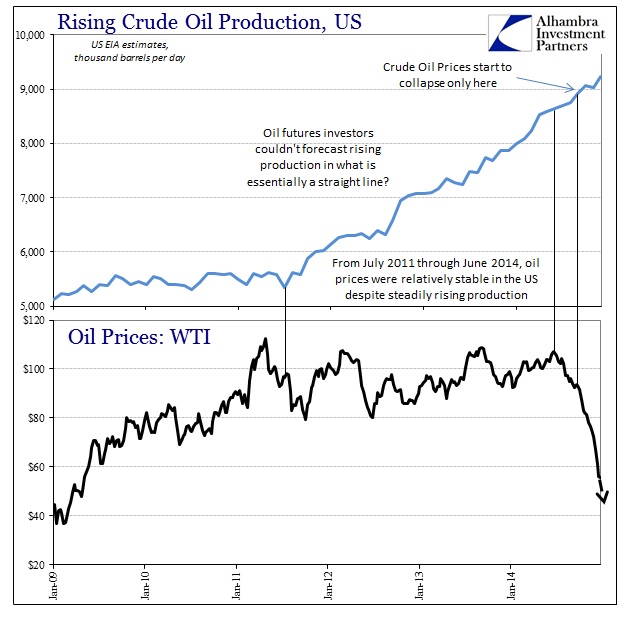

Along with inventory figures, the US EIA updated its production statistics for December and revisions going back to January 2013. There were no surprises in either, as December production was estimated in the same trend as has been in place since the middle of 2011. As far as the revisions, the new estimates are only slightly higher than the old for 2014 (and slightly less for 2013, on the whole) but so small as to be imperceptible.

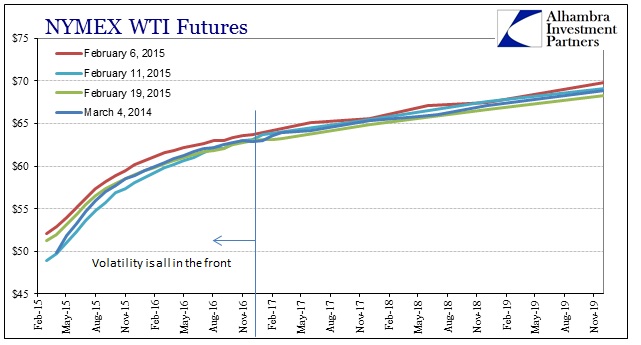

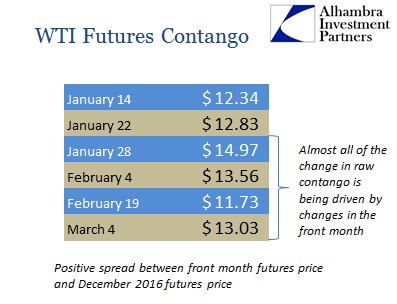

So once again there is absolutely nothing surprising about the level of domestic production. That leaves only “demand” and contango as the mechanism for price movements in the spot and futures markets. It would seem that is finally being recognized in the futures market, as the curve has settled into a somewhat stable (for now) existence dominated by volatility only in the front end (mostly 2015).

With contango all compressed into the front end, that would seem as if, again, investors are unsure about the demand component which is well down from any estimates of even late last year. After all, with supply moving along quite predictably, the fact that oil is trading under $70 all the way out to 2020 means that the entire trajectory of demand has shifted to no longer keep up with growing supply – with a heavy emphasis on the hopes that such a demand shift is limited to just 2015.

That may be the next place to see grinding volatility rise, as if the futures curve begins to bend around 2016 it would seem to be an indication of not lower rig counts or surprises in inventory but rather whether or not “demand” has any elasticity with regard to such low relative prices. The most basic of economics holds that any sharp decline in price is supposed to, eventually, shift demand upward to “take advantage.” That is what the sharp contango right now is pricing, even if at a low absolute level now.

Should the lack of demand response to lower prices not materialize roughly as anticipated, and the sharp increase in the US personal savings rate already puts that into doubt, it seems reasonable to assume the contango portion will have to increase further or the curve will shift decidedly lower especially out and around 2016. If that does happen, there is nothing “unexpected” about crude oil production and supply.

Stay In Touch