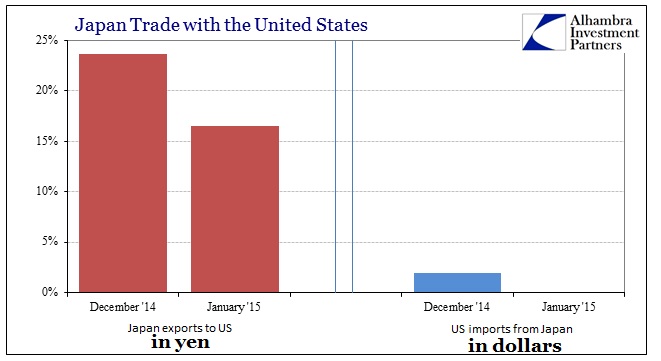

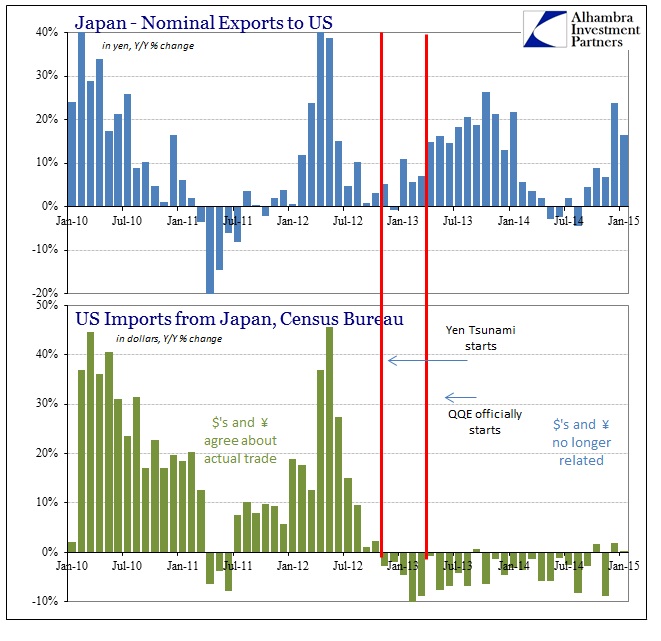

Just as a follow-up to further highlight and emphasize the “monetary illusion” of currency devaluation in this closed environment, the yen’s returned devaluation against the “dollar” more recently has renewed confusion (or intentional misdirection) about what Abenomics is supposedly accomplishing. Taken solely from the perspective of the Japanese internally, exports to the US are once more growing, and doing so rather sharply. December’s year-over-year gain, in yen, was almost 24% while January came in at an equally robust 16.5%.

Taken by themselves without context, it would seem great fortune and monetary capability to gain in exports at such huge growth rates. But, as I have shown time and again, what goes out of Japan is matched by what comes in to the US. For all that buzz over huge export growth, nothing much shows up on this end.

Both months were positive in “dollars” but barely and thus no actual growth took place. Economists and central bankers even concede the disparity, but don’t much care about it. They simply assume that Japanese exporters now flush with more yen will hire more workers and pay the ones they have even more, igniting that virtuous circle of “aggregate demand.” In reality, why would they do that?

As the figures above clearly show, just as they did in 2013 when these growth rate disparities were just as large due to the initial yen “ignition”, there isn’t anything for new workers to do – Japanese exporters are not sending more “stuff” to the US they are just getting back more yen for the same quantity (more or less, an assumption that these trends bear out). Further, not only do exports at these levels require no additional workers, there is actually a very good incentive not to pay existing labor any wage gains from the increases yen-denominated revenue.

Currency volatility is a form of financial instability that makes businesses far more cautious in operation of their financial resources, the opposite as intended. Without the ability to actually reasonably plan for future conditions, liquidity and safety become priorities over radical expansion for production that isn’t apparently needed. In the end, as the Japanese import side shows, businesses do not stand for that instability and instead actively seek out locations (where possible) to escape all the intrusiveness and artificial redistributioning. The only sector that really gains is the financial sector.

Stay In Touch