Today’s world is one of historically high US equity valuations, equity buybacks but an otherwise lack of breadth in equity performance, and little to no yield for short duration fixed income. Where does one look for value?

Today’s world is one of historically high US equity valuations, equity buybacks but an otherwise lack of breadth in equity performance, and little to no yield for short duration fixed income. Where does one look for value?

Remember that “value” is representative of things that appear on sale relative to the alternatives. This means that there is a relative excess supply of these items. These are unloved or out of favor items. This also implies a higher expected return, but also more risk.

Regions:

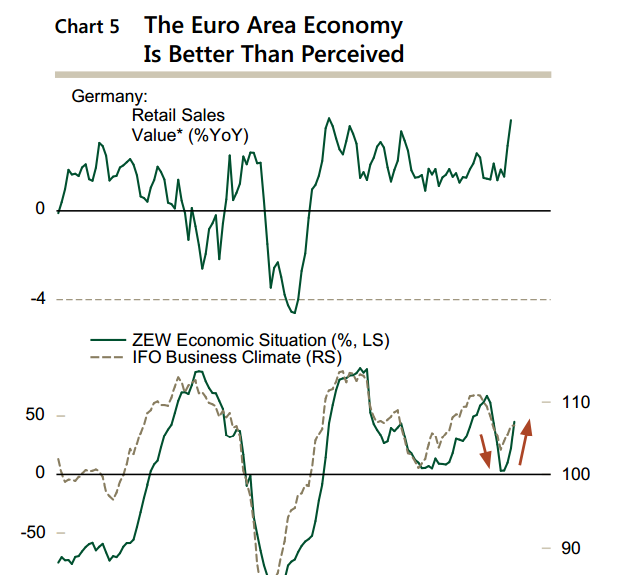

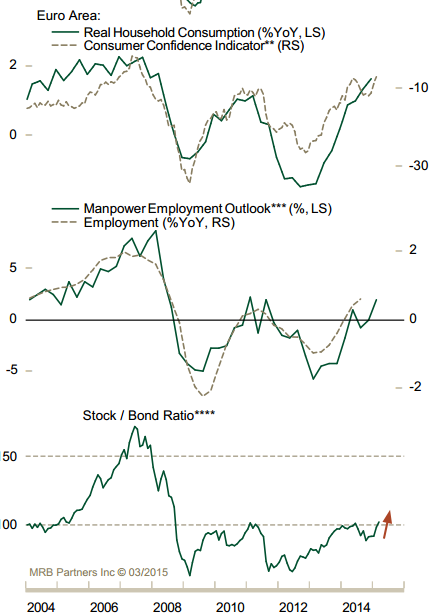

Headlines out of Europe continue to be negative. High unemployment, Greek default, QE, a plummeting currency. But could things be turning the corner? Or is this developed area just too risky?

Employment, confidence and consumption are all improving, could equities follow?

US Industries:

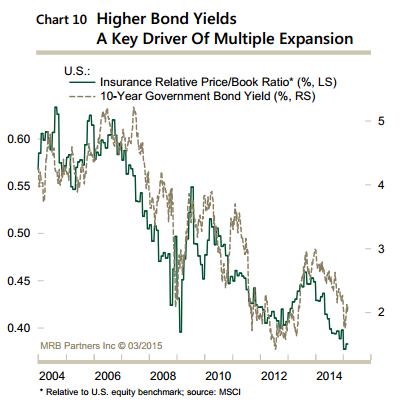

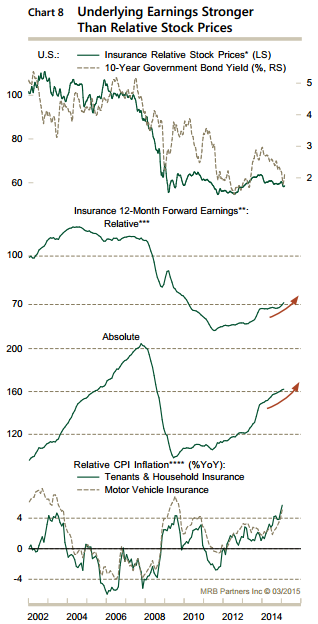

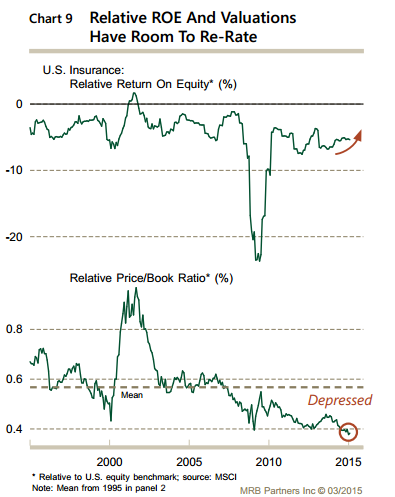

An insurance company sells future outlays (insurance claims) in return for money today (premiums). So an insurance company looks like a sales force and a portfolio.

If the economy grows and especially if there is inflation, we would expect sales and premiums to grow.

The portfolio is essentially a group of investments with the primary goal of funding these expected future claims. So the liabilities of an insurance company are long in duration like a bond, especially life insurance companies. If interest rates continue higher during the expected Fed rate cycle, the insurance companies liabilities will thus go down. And, higher yields on their portfolio (collected premiums) will better fund these future outlays (claims).

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product.

Stay In Touch