Part of the rewriting of GDP in the middle of last year involved adding more components that are not directly observable, leaving them susceptible to more imputations and adjustment processes than GDP normally counts. Changing “fixed investment” to include less well-defined concepts like R&D, “intellectual property” and “entertainment” makes sense intuitively until you actually try to piece together how they are estimated. These categories clearly belong in the discussion about economic progress, but that isn’t to say that altering GDP is the right place for them.

In some respects, it just may be since GDP itself is a conglomeration of various and often disparate pieces that do not easily get combined. Again, the general idea of the economic account requires and demands statistical intrusion to gain a figure that is “meaningful”, though often without serious thought about any such meaning. In terms of Q4’s GDP report, this new category, “Intellectual Property Products”, contributed a rather significant proportion of GDP – accounting for 0.41% of the paltry 2.2%. That would tend to suggest a good chunk of the quarterly gain is of low certainty not only because of where it comes from but also because a new account such as this will be subject to heavier revisions (than even what we have already seen) as the BEA gains practice with new data sources.

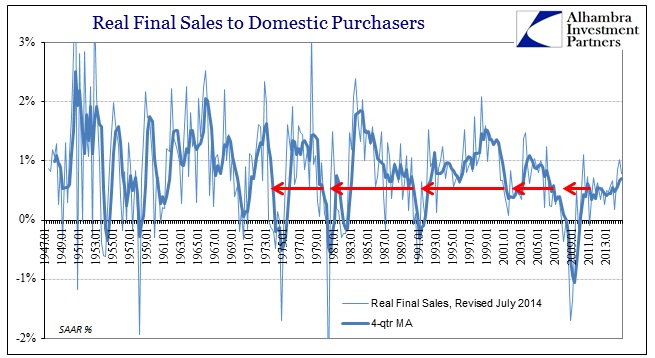

In the environment of post-2008, that leaves even greater questions about whether GDP tells us what we really want to know. A more concise, though still alterable, estimate may be real final sales which exclude any number of tangential accounts that are subject more to non-economic factors. Final sales to domestic purchasers, for example, only describes what US “demand” actually was (using the BEA definitions). We can also simplify to just PCE, though bearing in mind that PCE services is heavily influenced by several imputations including the largest for “owner’s imputed rent” (which doesn’t exist at all; it is entirely made up).

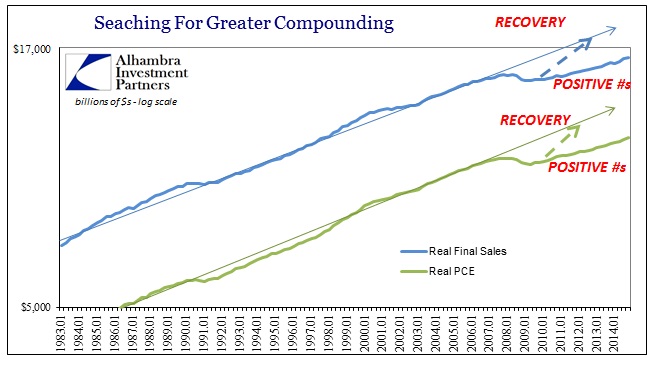

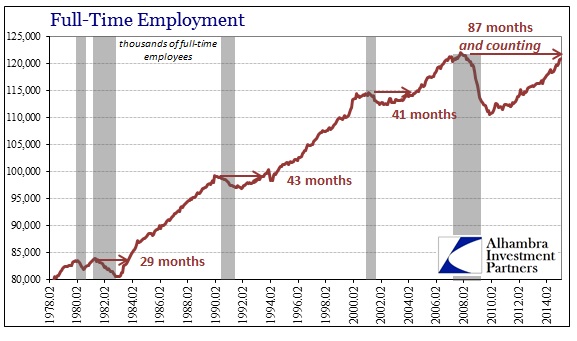

Under these narrower terms, the recovery in this cycle looks far less like a recovery and simply includes just positive numbers. That would offer a very compelling explanation as to why the economy that exists for the vast majority of Americans does not match, at all, the economy that exists in Janet Yellen’s mind. Of course, these GDP accounts align quite well with even the payroll statistics as you can plainly see how the fact that US “demand” remains well below the prior cycle trend relates very well to how US full-time jobs do also.

While economists will focus on overall GDP and only the most recent results of the Establishment Survey, these shorn internal mechanics provide a much more robust (in terms of meaning) and certainly agreeable assessment to almost everything else. No matter how you view “demand” in the US, there remains a shocking lack of it throughout – even and especially 2014 during the greatest supposed jobs expansion in decades.

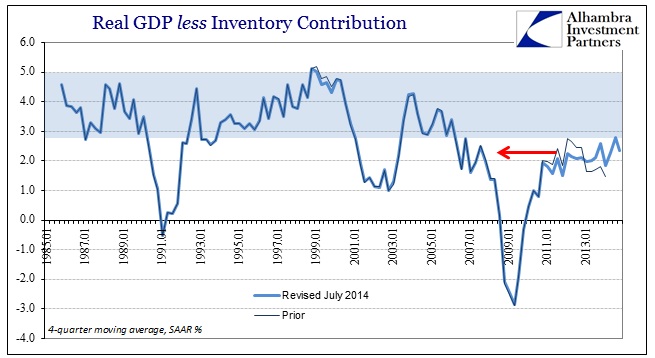

Take away the artificial “boost” provided by just inventory, and even GDP is transformed into the same economic midget. Despite better results last year than years prior it really doesn’t, in the grand scheme of compounding and opportunity cost, amount to much as far as actual progress. Instead, GDP in 2014 vs. 2013 is nothing more than navel gazing about hair splitting. In other words, it really doesn’t matter that GDP was 5% in Q3 and 2.2% in Q4, as neither individual figures really amount to the deficient state of economic loss – mostly because that is hidden as the opportunity cost of lost compounding.

US consumers, for example, are not responding to any number of inbound “stimulus” channels, at all. This is a fact of economic existence that transcends the quarterly ups and downs and transmits true dysfunction across the globe regardless of what the BEA says and calculates about just this year.

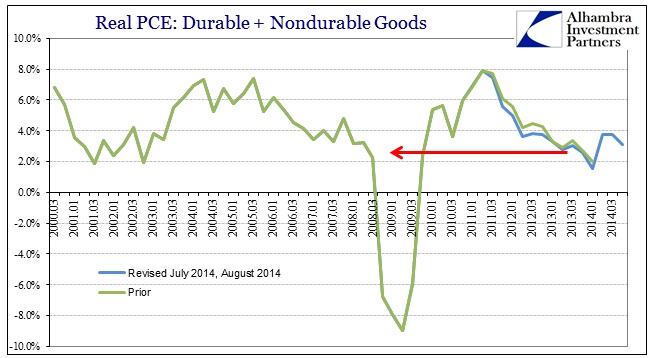

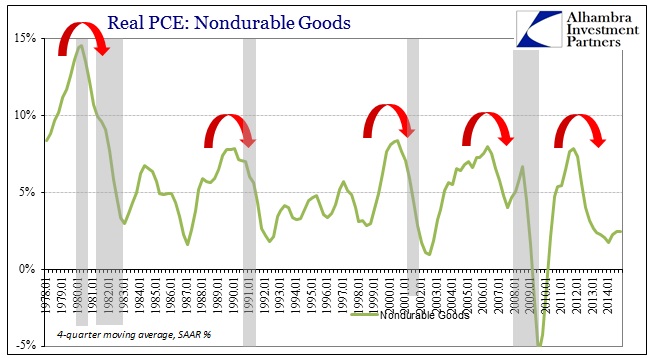

In terms of the goods economy (which includes a significant chunk of “services”, as “services” includes the transportation and selling of goods), growth rates continue to be as sickly as the first half of the Great Recession. Once more the 2012 global slowdown is obvious, and offers a good view of that transmission into China’s bubbles and how they are really giving up on them. For all the bluster about GDP, US “demand” for goods is recessionary.

However, even that might be overstating the view some. A major force in durable goods has been autos, which is running artificially high based on monetary influence more than anything like true economic progress in incomes and household balance sheets. Take away durable goods, and the growth in nondurables is and remains downright depressive.

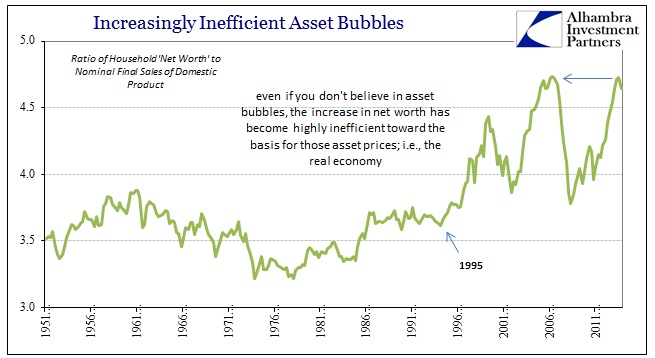

All of this raises perhaps the most salient point about monetarism in the first place. The idea and perception of asset bubbles is at least one where there are at least supposed to be trade-offs, meaning we get something in return for undertaking the great costs of financial imbalance. That was meant to be a robust economy which would eventually support asset inflation and asset prices. So in that respect, there should be a durable relation between US “demand” and overall asset debasement.

There is such a relation, though not quite what was assumed (and still manifests under “rational expectations theory”). First and foremost, asset bubbles are clearly terrible in terms of efficiency. It takes immense intrusiveness in asset prices to generate even unsatisfying levels of economic expansion. We know that very well from the housing bubble, which required an exhaustive increase in household “net worth” just to throw off or leak back some smallish quantity of economic activity in the form of home construction and consumer spending of home-equity-as-an-ATM.

So where the overall increase in “net worth” in this cycle has been less bubbly, perhaps, in terms of efficiency and imbalance it is just as great as 2007. That does not, unfortunately, mean necessarily that the bubbles here are less immense only that it offers a good reason as to why the economy has been so stuck by comparison of even the artificial advance in the 2000’s. In short, the economy doesn’t do what they think it does under these ZIRP and QE conditions; the “wealth effect” is an incomplete, at best, theory. There is no accounting for distribution of either the “wealth” (which isn’t) or its effects.

That leaves the altered state of the US economy far more degraded as the costs of undergoing massive inefficiency are very real. For a philosophical regime dedicated to the idea of “demand” above all else, it sure doesn’t seem to be very successful at it. The only place where there has been such open progress is in statistics that can be highly misleading and subject to varied interpretations. Instead, the core of the actual economy remains entrenched by financialism and, more importantly, past financialisms.

Stay In Touch