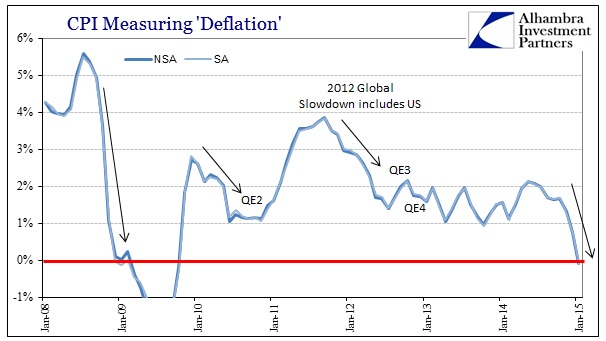

It seems to me as if there is growing nervousness in the otherwise unshakable cadre of economic commentators over the fact the economy so far in 2015 is not behaving. This is undoubtedly more than just the price of oil and the constant blurt of supply, supply, supply – in fact, oil prices no longer dominate much of the chatter as if “everyone” has finally made peace with the reality, if not fully the implications. Even the idea that the unemployment rate might be wholly misleading is simply too much to comprehend, so that everything else is rationalized inside that context.

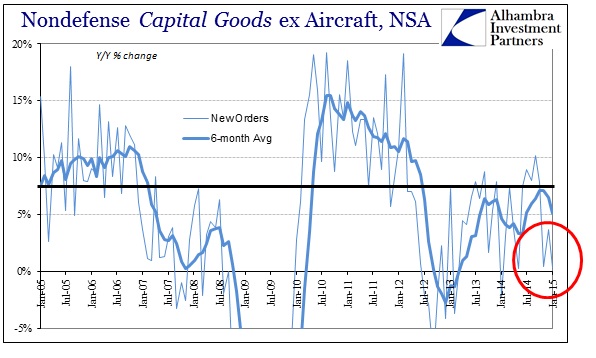

The Bloomberg ECO U.S. Surprise Index, which measures whether data beat or miss forecasts, fell to the lowest since 2009, when the nation was in the deepest recession since the Great Depression.

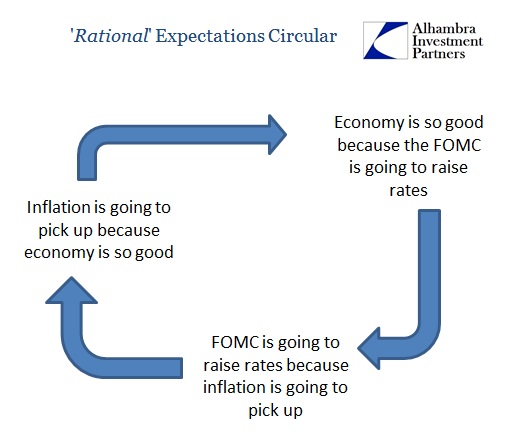

To that end, there is now widespread recognition that the economy is taking a breather because trying to describe otherwise is no longer reasonable; and thus a rush to ensure and assure that such is nothing out of the ordinary. Indeed, apparently this year is almost the same as last year; a point which will be the dominant theme for the remaining alacrity of whatever is left of last year’s unequivocal “boom.”

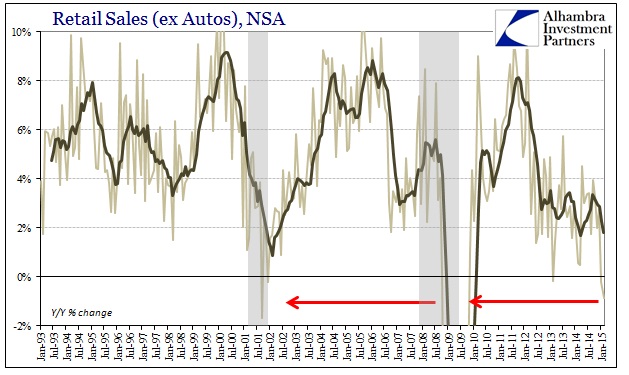

The Atlanta Fed published a tracking forecast for GDP in the first quarter, and that was halved to 0.6 percent after the retail report.

If this all seems vaguely familiar, pretty much the same thing happened last year.

Then, a contraction in the first quarter that most everyone blamed on the weather was followed by two blockbuster quarters with GDP averaging 4.8 percent.

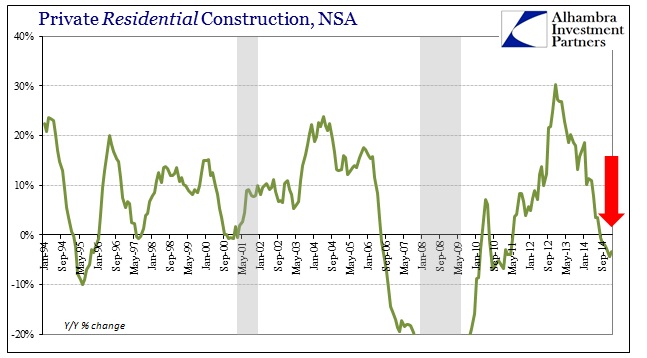

There it is, the assured nature that even a negative quarter is nothing to fret because last time “blockbuster” GDP immediately followed. It’s the weather again, so the sunshine will bring economic sunshine even if last year’s didn’t actually create the sustainable advance these same commentators were likewise so sure it would. There is a flipside to this exact attempted validation, and it isn’t so sunny. Instability in the economy thwarts all such notions of “blockbuster” growth because, axiomatically, instability is a highly negative factor that accompanies malfunction and malaise rather than the opposite and desired condition. Recoveries might be bumpy here and there, but they don’t pause every winter in worsening fashion.

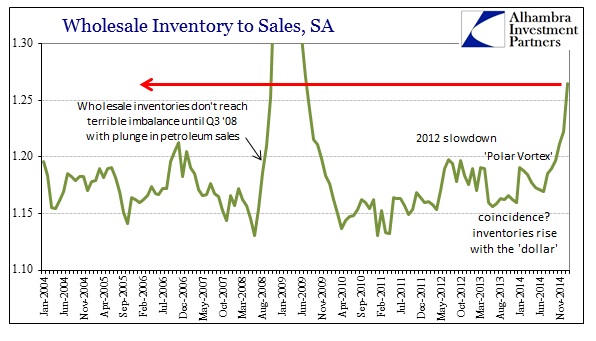

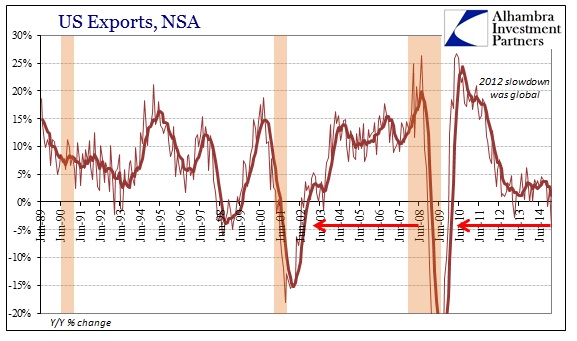

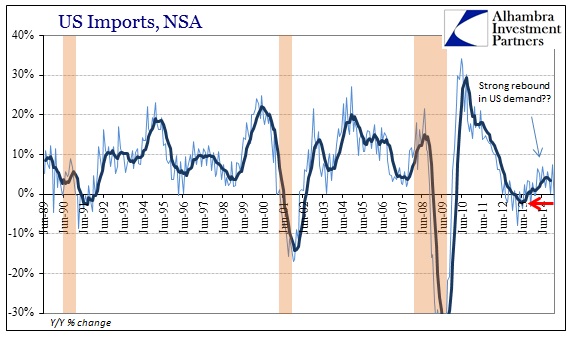

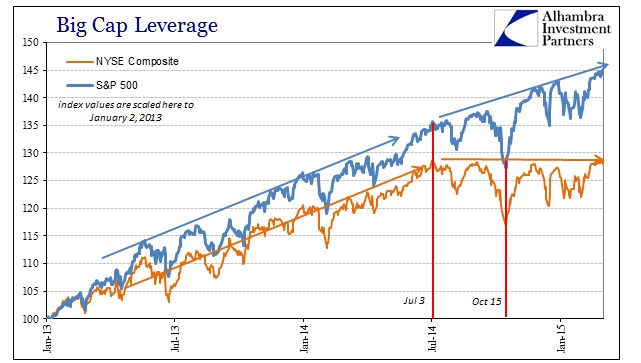

That aside, however, there is much about this year that is far and away beyond last year. This includes many raw economic accounts that are far worse than the 2014’s Polar Vortices, but mainly that credit markets, the aforementioned oil collapse and the “dollar” are all market confirmations of the crucial difference between this year and last. There is also the small matter of the domestic banking system acting completely contrary to these assumed accepted notions of everything becoming rock solid, carrying out these fears in dramatic and rather obvious ways. Instability has a way of taking these forms, and continued instability only assures that the pessimism propagates widely.

The phrase “worst since 2009” has supplanted “like last year” in far too many places, not to mention that this was not supposed to happen again anyway. There is apparently nothing so much like the regularity of “unexpected” weakness to motivate everyone toward the most optimistic interpretation of really bad and concerning trends. Even a good proportion of stock prices have stopped buying it and started paying attention to the sharp and very much relevant distinctions.

Stay In Touch