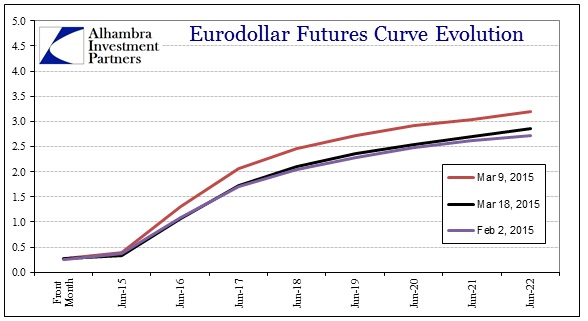

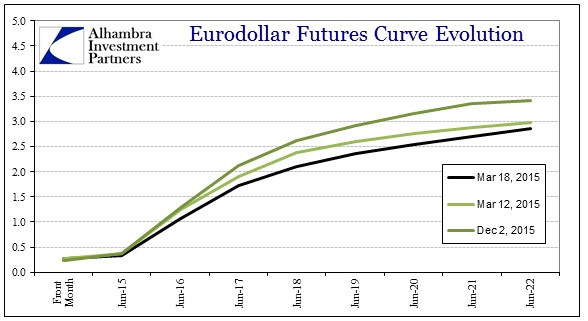

With the FOMC throwing in the towel on the US “boom”, funding markets have knee-jerked back into the same trends as predominated during the prior liquidity events. In other words, extreme pessimism has once again intruded in eurodollars. The funding curve has exploded (imploded?) back to where it was at the early part of February, when everything was still just in the aftermath of the January 15 event.

It is difficult to separate whether the eurodollar curve is reacting to the FOMC or the return to the more obvious “dollar” issue globally of late. In some ways, those factors are one and the same, so the heavy buying all over the eurodollar curve today both recognizes the FOMC’s admission about the US economy as well as pessimism of the more general and global “dollar” transmission that struck again in early March.

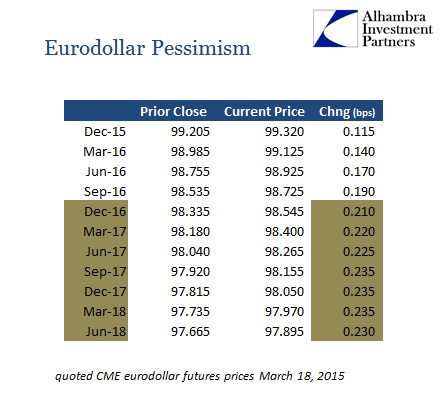

These were big moves in eurodollar futures especially where the long-term economic projections skew past the policy “window.” However, even the nearer-term maturities were bought heavily, as even the December 2015 contract price finished up almost 12 bps on the day.

In credit trading, the 10-year UST was down a few ticks to yield 2.05% just prior to the FOMC statement, but then, like eurodollars, saw immense and sustained bids (pessimism and liquidity concerns) driving the yield all the way back to 1.95%. That major selloff of payroll Friday is now a distant memory. The 30-year which peaked at 2.84% that Friday is likewise bid down to just 2.51% again.

Again, these are knee-jerk moves and may dissipate with some time, but I think with oil prices trading alongside other currencies it is increasingly looking as if the next “dollar” event is in progress. The FOMC’s data and stand only reinforce the major theme behind the “dollar”, which is the economy everyone thought existed never did and now “demand” is falling apart once more.

Stay In Touch