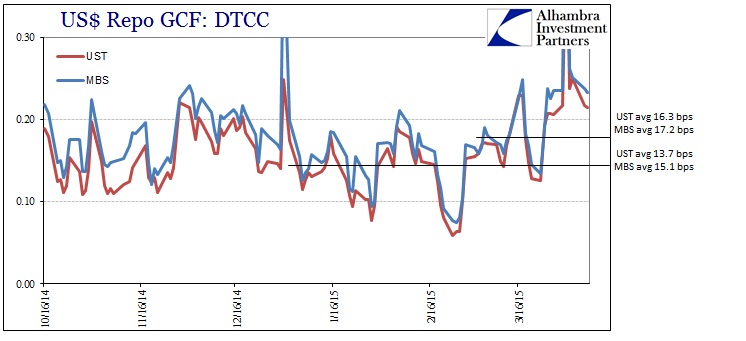

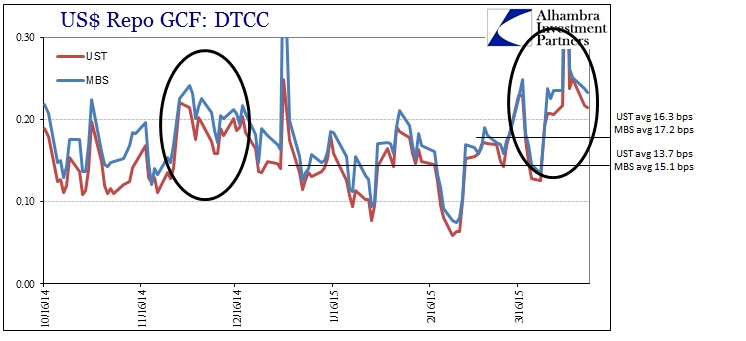

For the fourth consecutive trading session, repo rates remain in an elevated state though there isn’t any obvious reason they are doing so. GC rates in all three classes were essentially unchanged from Monday, which leaves them unfamiliar with repo mechanics that existed prior to March 25. There was a sharp surge up to just shy of 25 bps (MBS) on March 17 in the session prior to the FOMC announcement (dovishness, giving up on the recovery and all that), then relenting but curiously for only a few days. Since March 25, repo rates have been above 20 bps consistently, including the multi-year high at quarter end, and closer to 25 bps in MBS repo.

The last time repo behaved in such a manner was late November just prior to the serious “dollar” outbreak at the outset of December.

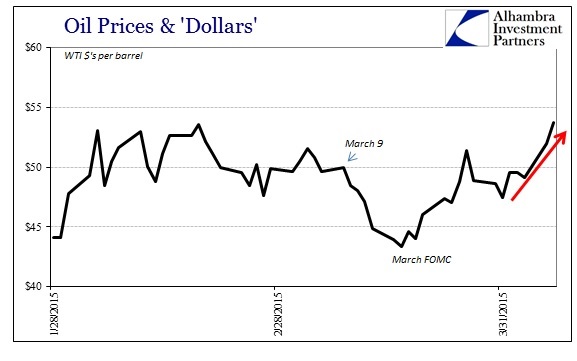

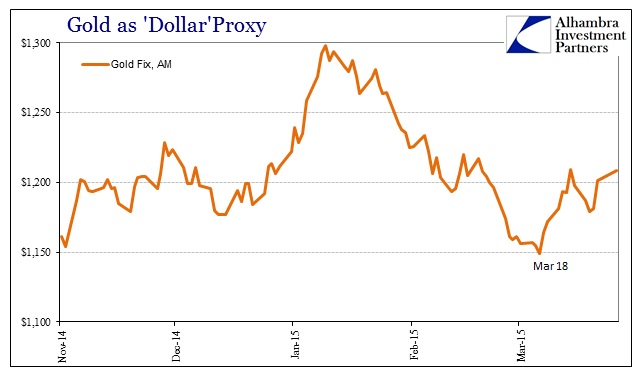

To this point, however, the “dollar” has been moving in the opposite direction in almost every proxy – gold, francs, yuan, reals, and especially oil. It is clear that if there is a liquidity issue it hasn’t affected yet actual funding conditions more broadly.

That isn’t necessarily unexpected as there isn’t a direct correlation between repo funding and overall funding – there are various and sundry mechanisms (especially in derivatives) that can offset any issues in one “market” or another. However, “strange” conditions in repo markets more often than not precede broader liquidity problems typically by some time. For example (and this is not an expectation by any means), the repo market seized up completely when Lehman failed but it still took another week and a half to erupt into open and total panic.

With so many layers to work through or around, these processes are ultimately frustrating to try to discern while in motion. So we are left with the “dollar” behaving (stocks and commodities think so) and repo not, and thus wondering what it might mean. Did repo agents not get the message that the FOMC purportedly is relenting on rate hikes and any official “tightening” (non-official tightening has been the common feature since the middle of 2013)?

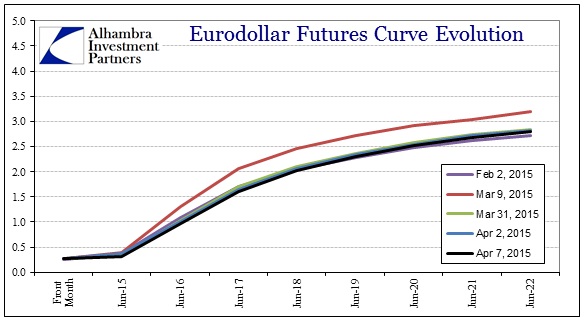

I would be more inclined to outright dismiss repo rates here as simply screwy apart from any other pieces except that eurodollar futures continue to be so dour. In fact, the futures curve has remained at or just around the February “lows” in direct contrast to the more “favorable” March 9 jumpoff point.

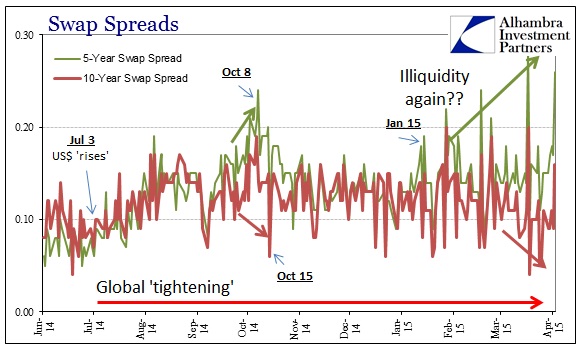

In other words, it’s more than just the MBS repo part of the funding “markets” that has a problem with current circumstances. I would even add the swaps portion to that view (especially the negative spread between the 5-year and 10-year spreads – spreads of spreads!).

Again, it’s not necessarily unexpected to see funding markets diverge from the “dollar”, but it will be interesting to see in which direction they will converge.

Stay In Touch