No inflection is ever expected in the real economy since everything is always extrapolated in straight lines by orthodox economists using econometrics. Similar interpretations are being used in stocks, and not just in the “earnings recession” that is already declared “unexpected.” In terms of share prices, there is little doubt about what is holding up the S&P 500 and larger cap exposures. With stock repurchasing providing so much emphasis, extrapolations are becoming increasingly important as justifications for price multiple rationalizations.

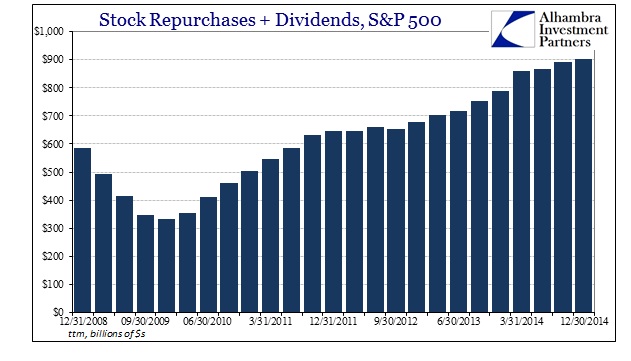

According to the Financial Times, expectations within Wall Street are for about $400 billion in dividends and $600 billion in buybacks in CY2015, returning an unprecedented $1 trillion to shareholders. Supposedly, companies have no choice:

The combination of slowing emerging market economies, concerns about the pace of the recovery in some developed markets and falling oil prices are driving down expectations for capital investment growth. This has prompted US blue chips to shift their focus, becoming the largest buyers of shares on the S&P 500 since the financial crisis, dwarfing domestic investors and helping propel the ageing bull market into its seventh year.

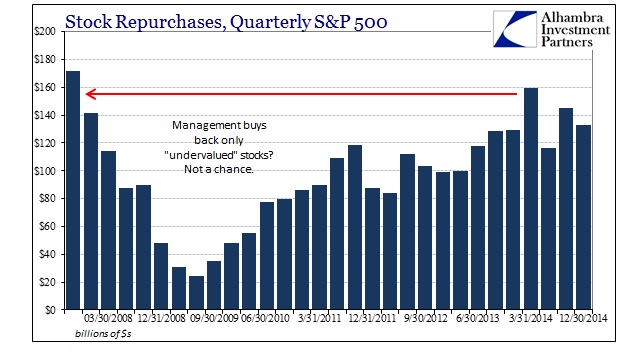

I seriously doubt that there is a shift in focus among management of US blue chips, as it is amply apparent this isn’t exactly new territory. One could easily make the opposite case that as valuations remain historically lofty, only in comparison now with the dot-com bubble or 1929, that corporate management has not turned away from idleness but toward desperation as to holding share prices so “markets” don’t ever get to reconciling all of that. In other words, it’s not like CFO’s have been running full ahead with their productive investments and capex, and only now are looking at slowing growth to cut back and “reinvest” in shares. They have been doing that all along only now reaching the point where the economy isn’t as ambiguous about future prospects related to this financial repositioning.

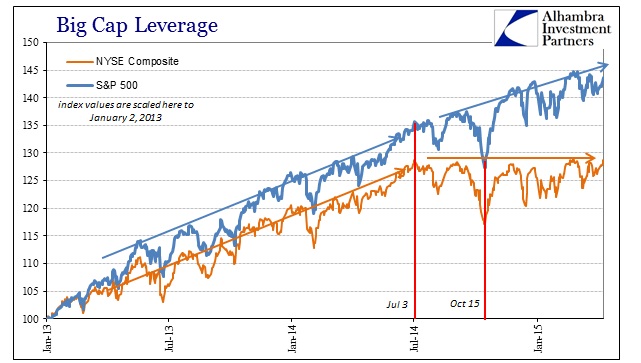

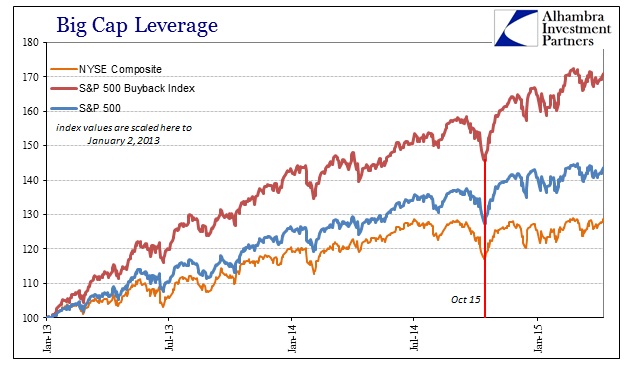

It continues to be repurchases that make the difference between the S&P 500 continuing toward that rationalized reassurance and what other stock indices are suggesting (especially about the “dollar”). The broader NYSE Composite Index has clearly hit a ceiling that doesn’t apply to the S&P 500, an upper bound that ties directly to the diminishing “dollar” liquidity; where larger cap shares continue to be funded by corporate “liquidity” instead.

Where the broad index diverges from the narrow S&P 500 view is right at the concentration of repurchases, which are nothing short of astounding not just in scope but in how much that has apparently made a pricing difference.

It is not much of a stretch at all to suggest that the whole of the stock bubble rests upon the “ability” of CFO’s to rationalize “low growth” as a means to raid corporate cash flow. But it isn’t just corporate cash flow as even that metric has come under serious pressure of late. Instead, the ability of QE and ZIRP to transform finance (though, not much else beyond that) is readily apparent under the cover of corporate debt. And it might be here that buybacks begin to face stiffer resistance alongside cash flow stumbling.

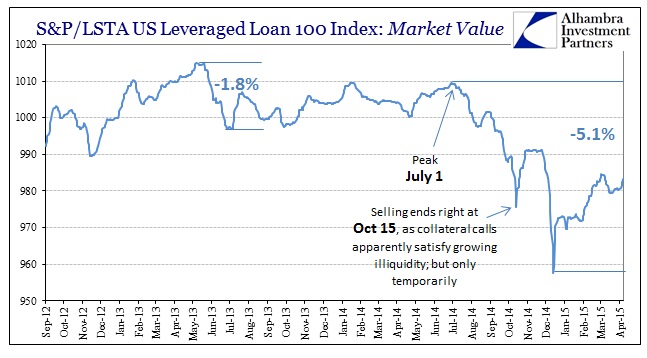

The October 15 liquidity event had already left its mark, even in stock prices, but the bond market has yet to return to pre-event positions. Corporate prices and issuance levels are better than they were in the months following October 15, but for some reason the “market” does not want to yet let go of all that. That is most visibly apparent in the riskier spaces like leveraged loans and junk.

The market value portion of the S&P/LSTA Leveraged Loan Index remains 2.5% below July 1, only a half retracement from the October 15 low, despite now half a year of time to “heal.” That would seem to suggest a serious break in some factor that has become a potentially permanent alteration in fundamental expression (systemic liquidity being only one element of that).

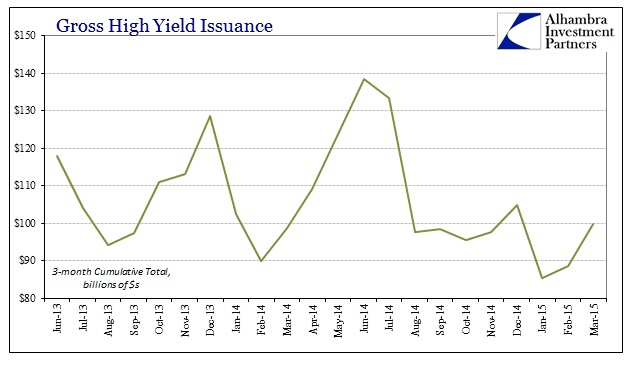

Even in high yield bonds, there is still an almost reluctant re-acceptance of new paper even though March’s volume was the heaviest since August. In cumulative 3-month running totals, high yield issuance remains at the lower end of the range post-2013 selloff. While that certainly doesn’t admit rejection or total risk aversion, it at least suggests a possible reduction in appetite that is cast right with the “dollar.”

I think the combination of these elements start to fill out a deeper understanding of the new “dollar” environment, and it is exactly what you would expect of this deeper, underground impulse that ties almost everything together. That has implications for the stock bubble as it may curtail, even if only slightly for now, the “price” at which corporate credit might attain in leveraging these repurchase levels. There has been a shift in risk attitudes that has dented the corporate space, which has very real implications if it is more than temporary (as it looks right now). Then again, if real economy credit is as impaired in March as much it appears, corporate CFO’s may not have much leeway regardless of current issuance levels or risk appetites – the shift may have already taken place.

Stay In Touch