It never really was weather to begin with, a statement that applies increasingly to not just this year. The fact that prior winters were wintry should have made no difference at all to an economy that is stable and moving via organic processes. It is only the artificial trends that can be subverted by all manner of inanities (inducing the same kind of excuses for them).

The theme so far in 2015 is that this year is not the typical “winter” mess, nor what we have come to expect of having economists apologize by midyear every year, as Stanley Fischer pointed out some time ago. This one has taken on new urgency that defies orthodox tendencies and has already started to shake loose all of last year’s “definitive” optimism about 5% GDP. In other words, even the economists have started to take note.

The latest figures add “to a growing list of disappointing U.S. economic indicators, suggesting that the economy ended the quarter on a very weak footing,” said TD Securities analyst Millan Mulraine. “Moreover, there is little indication of an impending rebound” to start the second quarter.

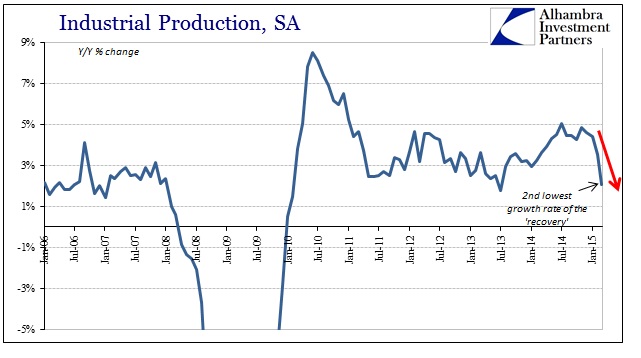

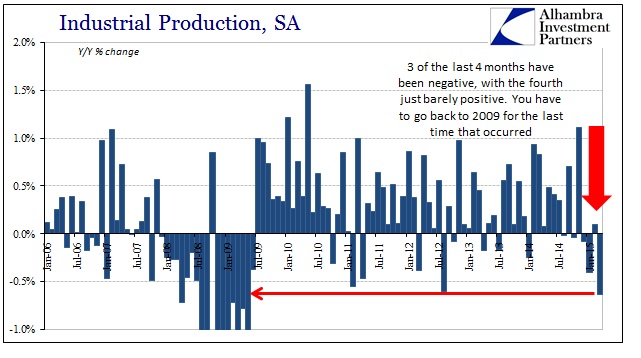

They have not yet connected the dots but there is certainly useful symmetry in having US industrial production severely underperform on the same day as China. In the adjusted series, US IP in March fell by the largest amount since May 2009. The index has declined in three out of the last four months (with the fourth month at just +0.1%), a run of deceleration not seen since, again, 2009.

It is not just the speed of the deceleration that is most concerning, it is the fact that it appears to be durable to the downside. That is the difference in the interpretations, regardless of what last year or the year before looked like in comparison. This “one” doesn’t want to go away and it is forcing even the fervent monetary believers off the “booming” perch.

US industrial production fell by 0.6% in March, a worse figure than Wall Street had been expecting even after allowances were made for a harsh winter.

Chris Williamson, chief economist at financial data provider Markit, said America was going through its softest growth patch since early 2009 when the economy was in the midst of its worst downturn since the Great Depression of the 1930s.

“It’s becoming increasingly clear that US economic growth slowed sharply in the opening quarter of the year,” Williamson said.

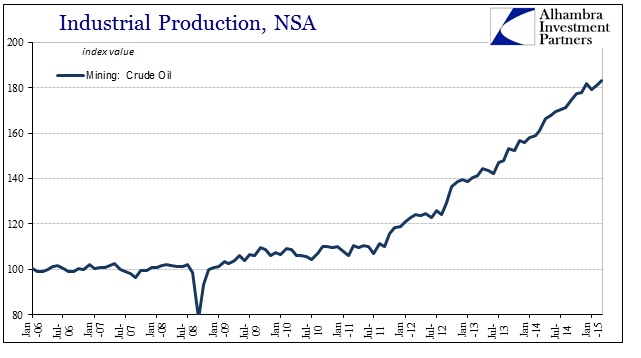

What dots do get connected for it don’t yet even apply – you can’t blame oil for the slump in industrial production, at least not yet. In terms of IP anyway to March, the energy sector continues to expand at a pretty robust clip (though the rate has slowed), meaning that this decline is more deeply economic and not just the inevitable end of artificial intrusions.

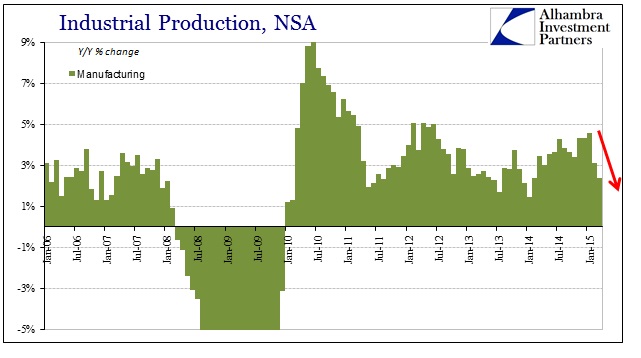

Even US manufacturing, which had a relatively decent run of late, has been severely strained so far in 2015.

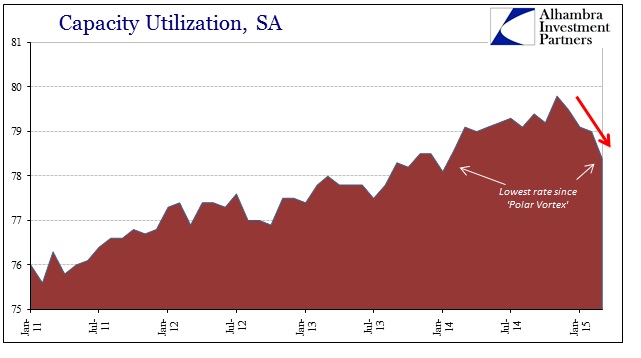

So not only is there a looming rundown in crude and mining activity at some point, particularly given the almost complete halt in exploration activity, there is another reason to be seriously concerned about the next stage in whatever process is afoot. Capacity utilization has dropped sharply since November, raising serious doubts about how businesses, already laden with inventory, might be “forced” to respond.

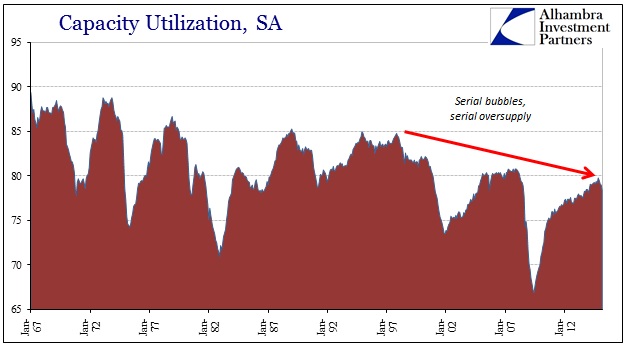

That will both reduce forward expectations for activity but also any “need” for increasing capital expenditures. In an economy already drowning in oversupply, that is the worst sort of outcome. US industry has been taking on increased inefficiency since right around the time the serial bubbles showed up in the late 1990’s. That may be coincidence, or it might just be another distortion of inefficient resource allocation.

That is the largest worry, that whatever “recovery” has occurred has been so inorganic and inefficient that it might become amplified in reverse – as these types of economic imbalances typically do. To economists, the unimaginable is taking shape – a recognizable “slump.” No longer is this just another aberration in a string of them, to which the next suggestions should be geared toward determining its magnitude. The worst case would be a fusion of economic digression with so many financial imbalances starting to “correct.” In that respect, the oil sector might offer in the not-too-distant future some valuable insight into this dynamic, as leverage is heightened there as is this “slump.”

Stay In Touch