The question was never about what Chinese GDP would amount to, as that is as much an intentional projection as it is a measure of economic performance. That is true everywhere, but the Chinese have become masters of hitting their marks. They “predicted” 7% GDP and that is exactly what they got. It is more difficult, however, to do the same in further economic accounts more closely tied to the “action”, or “inaction” as it may be now.

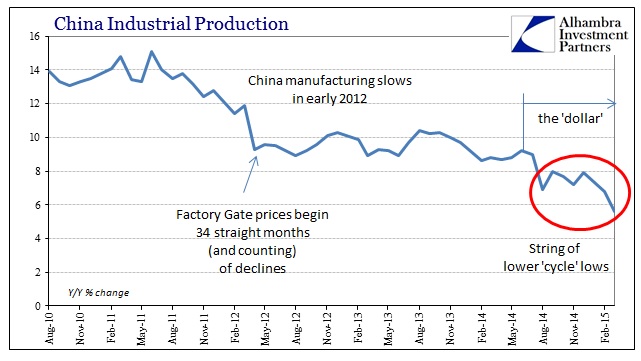

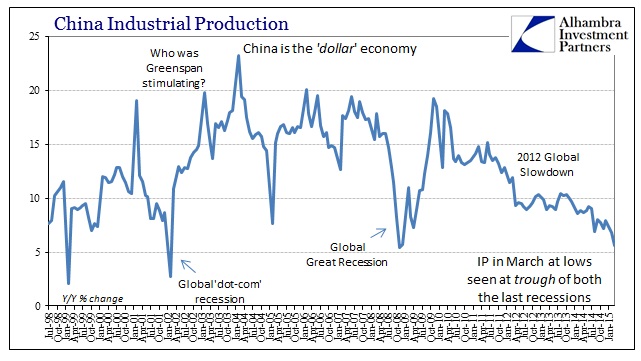

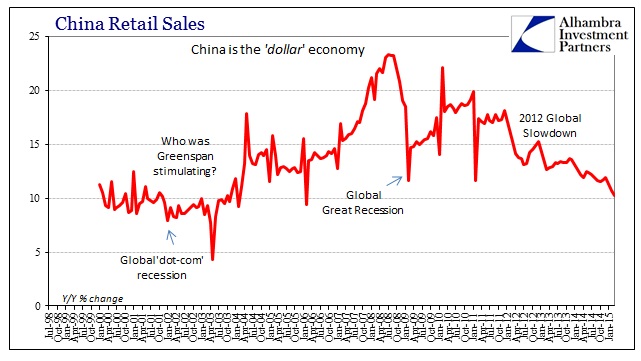

The roundup of Chinese figures are as ugly as the US, if their growth rates sound very different nominally. Industrial production, a key component, was the worst since November 2008, meaning that industrial production right now, as of March, in China matches the lowest point of the Great Recession! It was not any better elsewhere, as retail sales fell to 10.2%, which is actually below the entire Great Recession and the weakest growth since February 2006 (and the lowest non-February figure since November 2003; the Chinese New Year causes great distortion in these numbers, which is why the NBS in China stopped reporting separate January and February estimates in 2012 for retail sales).

Coming to terms with all of this is exceedingly difficult for the world’s economists as they are all united in singular attention. That includes not just orthodox tendencies, but an apparently innate inability to incorporate and interpret the modern context.

China grew at its slowest pace in six years at the start of 2015 and weakness in key sectors suggested the world’s second-largest economy was still losing momentum, intensifying Beijing’s struggle to find the right policy mix to shore up activity.

Measures to support the property sector and a series of cuts in interest rates and bank reserve requirements look to have delivered less support to the economy than hoped, apart from feeding a stock market surge, raising expectations of more stimulus soon. [emphasis added]

The only way the highlighted portion above makes sense is if you assume a baseline of orthodox monetary policy. The “measures to support the property sector and a series of cuts in interest rates and bank reserve requirements” were never intended by the PBOC to be that. In that sense, these monetary means delivered almost exactly what was intended; which was never much for the economy. The PBOC is not “stimulating” but rather trying to manage the decline so as it doesn’t gain “too much” disorder. If these rate cuts and such didn’t create the growth panacea that economists are desperately hoping for it is because they were never meant to.

But that is too difficult for the economics mainstream to grasp as it essentially invalidates, very tangibly, the idea that monetary policy anywhere has worked. China and its economy are uniquely situated as a barometer of the global economy, caught, now, between end market growth that just has never been delivered and the realization that it is actually now reversing. To be under the projection of massive bubbles is perhaps the worst case situation – except for one case, which is to keep following the orthodox textbook and building even greater bubbles while time has run out.

The enormity of the Chinese task is actually being played out by the Shanghai and Hong Kong exchanges. Bubble “money” dies hard, and having been turned away from the usual bubble channels (the proper interpretation of “a series of cuts in interest rates and bank reserve requirements” with the added and needed context of everything else, the actual ends of “reform”, the PBOC has done in the past year plus) overwrought speculation has sought out any available means of expression. Like wind or water, massive speculative forces will find a “weak spot” and exploit it. The PBOC is stuck because the economy grows weaker, as it expected, but their actual ability to control bubbles is quite limited (which should have been expected, and maybe it was).

The very fact that the PBOC and a good deal of the Communist machinery entered this very dangerous course says a lot about how desperate they were to avoid the alternative – the very scenario that economists all over the world continue to call for. With the Chinese economy teetering, we are about to find out the limits of all of this, especially the margin for error surrounding a disorderly breakout.

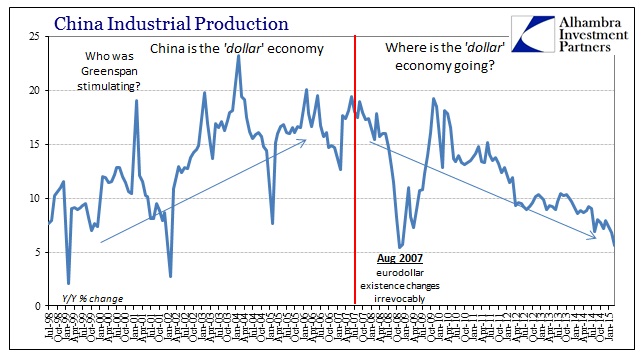

The first factor to note in any of this is how the Chinese economy isn’t just representative of global economic affairs, it is perhaps the perfect expression of the “dollar” itself as a global standard. When Greenspan intended to avoid repercussions of his management in the dot-coms and the rising eurodollars in the 1990’s, who exactly was he “stimulating?” Ultra-low interest rates were projected to aid the US economy, but not much really ever got there. Of course, there was the housing bubble in the US but that was financial and certainly his intention was to use that as a tool for real economic function (though economists still don’t get the complexity of finance and how there is no direct route through it to the real economy). There was minor leakage in the form of consumers using home equity as ATM’s, but overall what Greenspan did was purely financial.

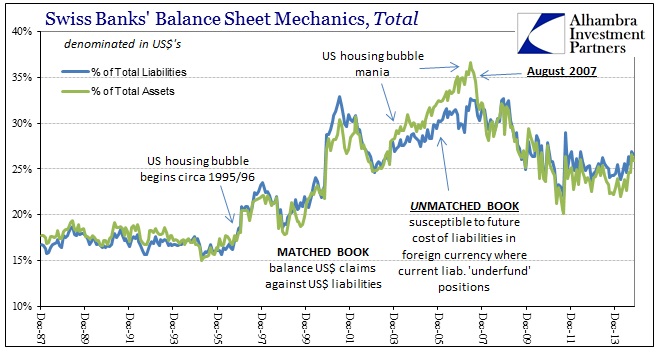

It certainly escaped his grasp in how being purely financial wasn’t strictly a domestic parameter, as he stumbled aloud muttering about some “global savings glut.” The monetary policy of the United States and its central bank was to create a massive and synthetic “dollar” short that covered the entire globe. As such, that expansion in the financial was never limited to the US, though it primarily directed there if only in the form of mortgage debt, instead being unleashed throughout the world, and especially China.

Again, if there is economic function that best defines the modern, 21st century “dollar”, especially as it relates to the tendency toward serial bubbles, it is the Chinese economy. The entire system in China was oriented toward the eurodollar standard and being the manufacturing engine where it would actually express real economic function.

The problem that the PBOC has reckoned, particularly of the 2012 slowdown, is as I noted some time ago about what actually happened in August 2007. The eurodollar system as it existed prior to that point was no longer feasible, meaning the bubble system that had fed this global arrangement was fatally wounded – but that did not stop the world’s central banks from trying to heal and recreate it. After all, they were convinced of a “global savings glut” and the munificence of Greenspan and then Bernanke.

What the global slowdown in 2012 really revealed is that systemic divide dating back to the middle of 2007, as there is “something” irreparable here where the “dollar” engine or framework is still in a state of criticality and disorder – the next global arrangement has not yet been revealed, nor can it, I contend, be predicted. Apart from a short “recovery” in 2010 and even into 2011, the direction of the “dollar” economy all over the world is unbelievably (to economists) uniform. They cannot see it because it is much more ambiguous in the US and Europe (and even Japan, to a certain degree) but it is unmistakable in the pristine “dollar” provisions of the Chinese economy:

For that general pattern to be duplicated by something as seemingly unrelated as Swiss banking “attention” to the US$ is not random coincidence, it is the nexus of all this eurodollar evolution, both up and now down.

With the economic and “dollar” arrow pointing decidedly and persistently down you can begin to understand the Chinese predicament. They only, however, get full marks for actually waking up out of the orthodox dreamland and recognizing their eventual fate under that spell. Their biggest problem is whether or not they did so entirely too late, as the followed far too closely the global monetary standards up to that point.

It may never dawn on economists this situation because that would require a comprehensive repudiation of all mainstream monetarism – from top to bottom, sparing nothing. The world’s combined central banks built this “dollar” and ascribed to themselves almost magic about the way it went up; and now blame you and me and everyone else around the world for the inevitable gravity of it all. There is something very wrong in this world where the definitive expression of “money” in Communist/communist China is more aware of markets and market tendencies than all the rest of the “free world” combined. You don’t have to admire the PBOC, but it makes sense to actually pay attention to them.

Stay In Touch