A look at relative value for the 2 major asset classes.

A look at relative value for the 2 major asset classes.

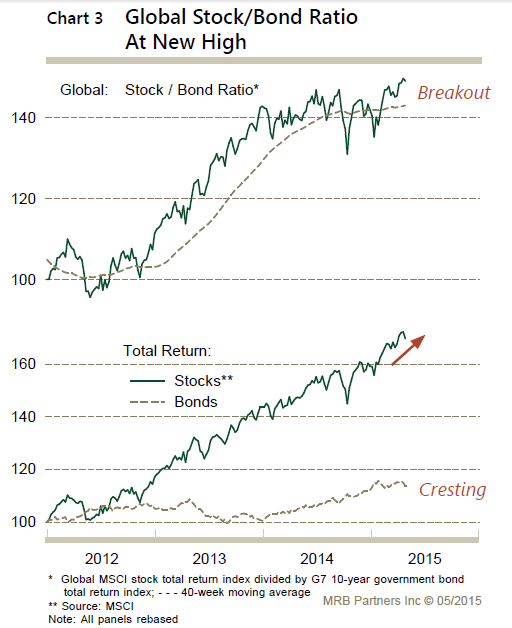

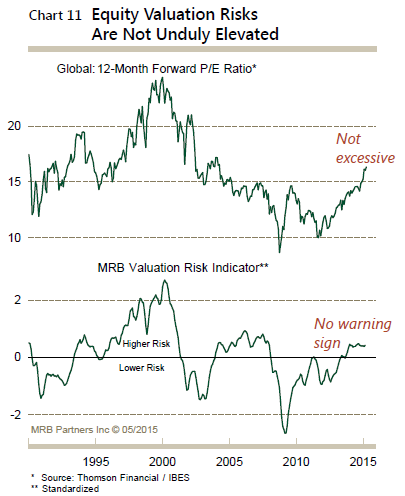

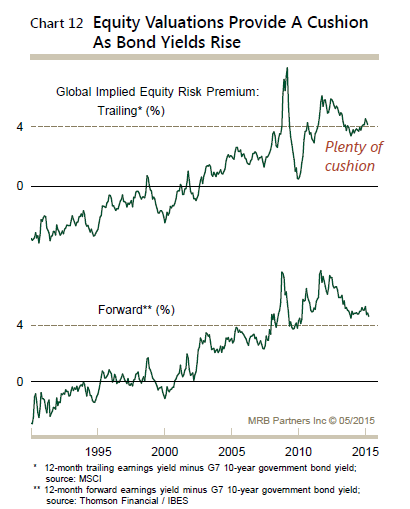

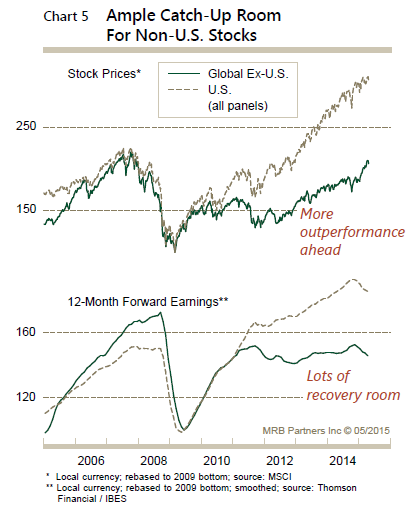

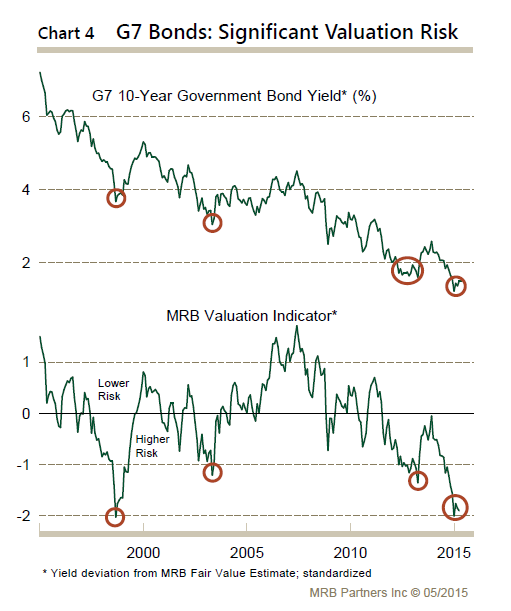

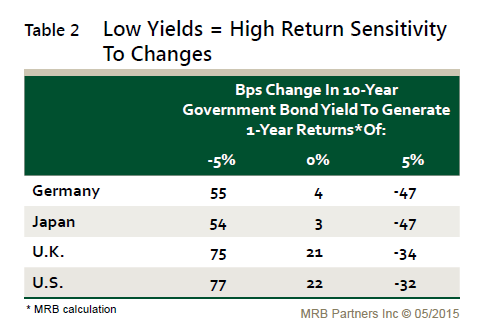

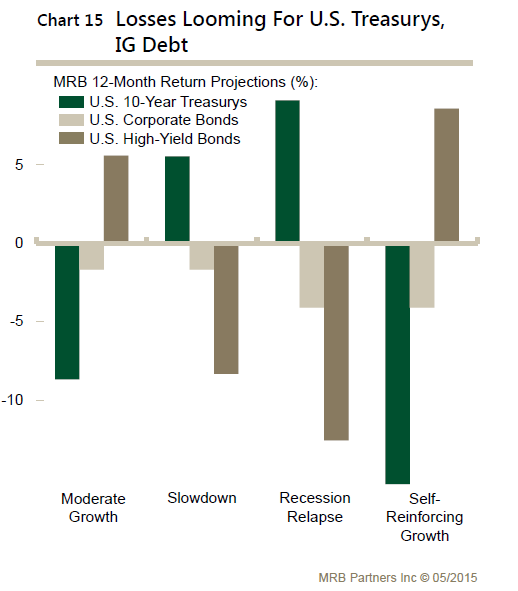

Historic valuation measures indicate more risk currently in bonds than stocks. Momentum favors equities over bonds. The macro economic backdrop is likely to be more favorable for equities than bonds. The macro economic backdrop suggests that one should look for yield by taking on more credit risk as opposed to duration risk. The macro economic backdrop, relative value measures and momentum signal a preference for International Equities over Domestic Equities.

- Favor Equities over Bonds

- Favor International Equities over US Equities

- Favor Short Duration Debt over Longer Duration

- Favor High Yield Debt over Government and High Grade Corporate

Equity Momentum

Equity Risk

International Equity v. US Equity: Momentum and Relative Value

Bond Risk

Treasuries, High Grade and High-Yield Corporates:

Projected 12-month returns given 4 economic scenarios

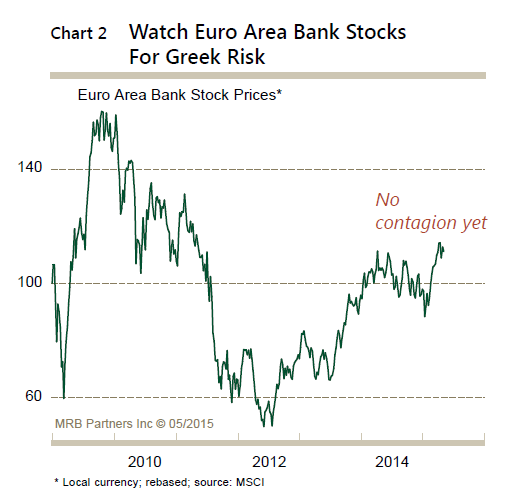

Geopolitical Risks

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Past investing and economic performance is not indicative of future performance.

Stay In Touch