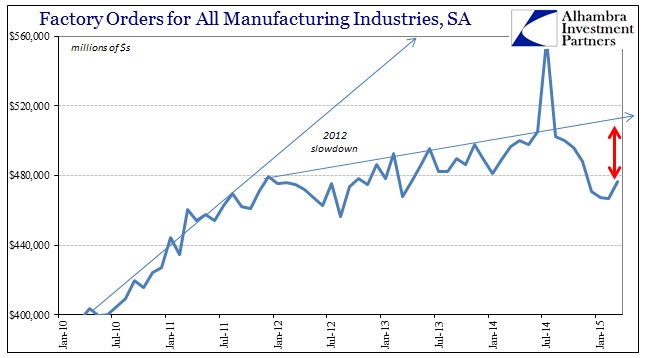

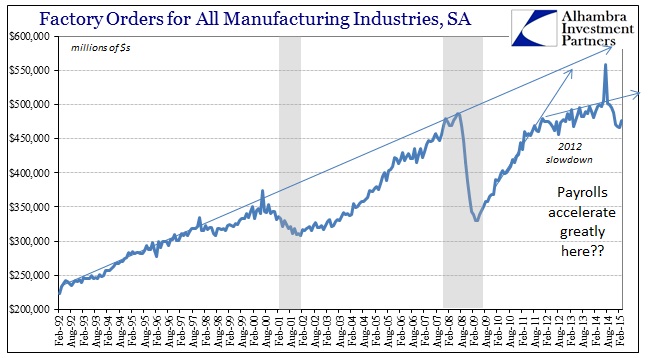

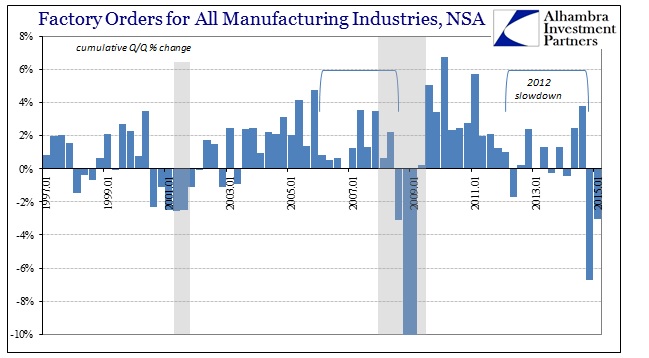

Factory orders rebounded in March, though that term increasingly does not apply to the situation at hand. In seasonally-adjusted terms, March factory orders were about $10 billion more than February, a little over 2% month-over-month, but that doesn’t adequately describe the relevant context and trend. An actual rebound would suggest a quick and pain-free rejoining of a temporary deviation back again to the prior trajectory. That is not what occurred in March factory orders, as it is increasingly clear the slump is adding another durable alteration to what would actually look like a recovery.

In other words, despite March not being as bad as February, the variation off that trend is gaining. The further it goes the more likely businesses will take more drastic or deep measures to deal with it; a temporary drop will be ignored or even papered over easily, a more stubborn deviance will trigger an expanded response.

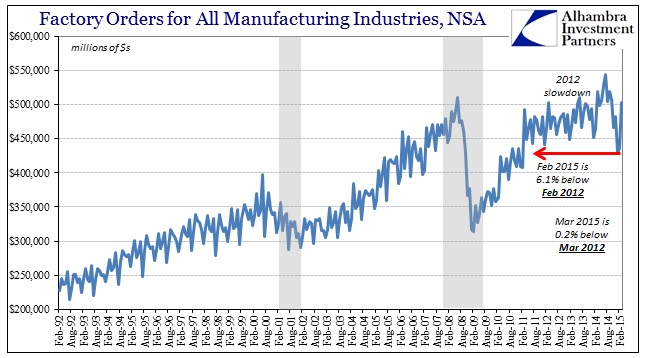

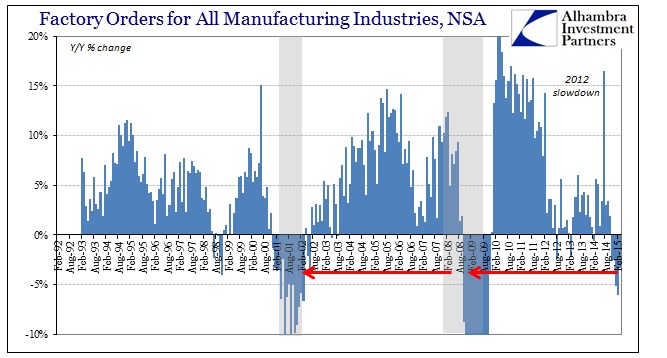

The unadjusted figures show the March incline but it isn’t as clear just how far off trend that is. Year-over-year, factory orders are down 3.3% following a downwardly revised -6% in February and -5.2% in January. In other words, no rebound at all, just a little less bad.

It is, again, the accumulation of these negative aspects that works its way into something like a recession. Economists will continue to say that this is temporary and there is no cause for concern, but the longer it goes the less likely businesses will be able to ignore it in favor of nothing but that academic hope. This is particularly true as the size of the “slump” makes plain. This is far worse than last year’s wintry winter and shows no signs, even with March, of abating off the downslope.

The 2012 slowdown was already problematic as it suggested an end to the actual recovery that took place in 2009-11, but so far under the “rising dollar” there is an inflection building. As you can see above, March’s “rebound” doesn’t much qualify as the level of factory orders remains some $25-$30 billion off the pace of last summer.

Again, it is the accumulation of negative results that is of highest concern. In terms of total depth, the past two quarters are worse than anything seen in the dot-com recession and far worse than the first half of the Great Recession. Two-consecutive quarters of negative “growth” are not unheard of outside of recession (1998’s Asian flu being the obvious example) but two consecutive quarters -3% and worse is exclusive territory.

Six months is an unbelievably long time under great duress no matter what Janet Yellen says about oil prices, inflation and how great it will be tomorrow. Factories need to see unqualified increases in orders or they will be forced to reckon their cost structure far greater than they have so far under the 2012 slowdown condition.

Estimates for April and May will be very important in ultimately suggesting the direction further on. While the case for “anomalies” is weak, it is not totally discounted, but from here on the probabilities of “anomalies” is practically zero. If there are lingering effects from exogenous and “transitory” factors in January and February affecting March, they will surely dissipate in April and be completely absent in May. Again, the issue is not positive numbers but an actual rebound to rejoin the prior trend; the accumulative deviation so far is not inspiring.

Stay In Touch