The conventional wisdom last year as it related to the “dollar” was that its ascent had to be confirmation of the divergence between US economic fortune and the continued and even growth misfortune of the rest of the world. That is pretty much standard orthodoxy as it seeks to align financialism with a generic view of the economy. On its face, such assumptions are already weakened by the idea that the “dollar” is both the domestic currency of the United States and the world’s “reserve.”

In the 1950’s and the 1960’s this contradiction was already proving difficult by what was labeled, by orthodox economists struggling to come to terms with rising financial factors, Triffen’s Dilemma or Paradox. The irreconcilable position, allegedly, then was how the US could effect a neutral enough monetary policy domestically while still allowing enough monetary growth overseas to placate trade expansion. Under the gold standard as it was determined by the Bretton Woods framework, this seemed to be unworkable – and became increasingly so throughout the 1960’s (though for reasons that still escape econometrics).

Thus, that meant that an increase in “money printing” was necessary in order to finance the global economic expansion, which very much complicates any idea about what the dollar may say about the financial relation of the US economy to the rest of the world. But no such complexity had been acknowledged last year, as there was indeed a rush to use the “rising dollar” as confirmation of every backward-looking interpretation that could be unleashed.

In October, JP Morgan Funds issued exactly that (an edu-tisement to be sure) checking almost every single box about how the “dollar’s” movement could not be anything other than a huge positive for everyone on the planet.

First, compared to other major economies, the U.S. is currently displaying the best momentum relative to its trend growth pace. Following a 4.6% real GDP surge in the second quarter, the U.S. appears to have grown by a healthy 3% in the third. This is in contrast to the eurozone, China and Japan which, while not in recession, have shown signs of relative stagnation over the summer. Traditionally, fast-growing economies have rising currencies due to capital inflows.

The author of this article was no doubt further intrigued by the 5% growth in US GDP that came out only a few weeks after its publication. It certainly does not hold up so well at the moment, especially the idea about “momentum” here, but it was this suggestion that is completely out of place (more so than even the above):

Most importantly, however, a higher dollar effectively transfers demand from the U.S. economy to economies around the world. At this stage of the global business cycle, this is a welcome development. The U.S. unemployment rate is now below its 50-year average and falling fast, highlighting the limited remaining capacity for the U.S. economy to absorb extra demand without generating inflation. By contrast, other economies such as Japan, emerging Asia and Europe could do with a boost to their exports, which should be the result of a higher dollar. In the long run this should lead to a healthier, more balanced global economy.

There isn’t anything particularly controversial about writing something like this, but it should be. It exactly conforms to every idea orthodox economics has about currency and global trade as the rising dollar purportedly means cheaper imports for US buyers. In the most important respects, this is exactly the same as the idea that the rising dollar is great for US consumers as it introduces a “windfall” to consumers via lower prices, especially energy. Both of these are but conventions that confuse cause and effect, and thus interpret only effects without as much as a minor examination into their cause.

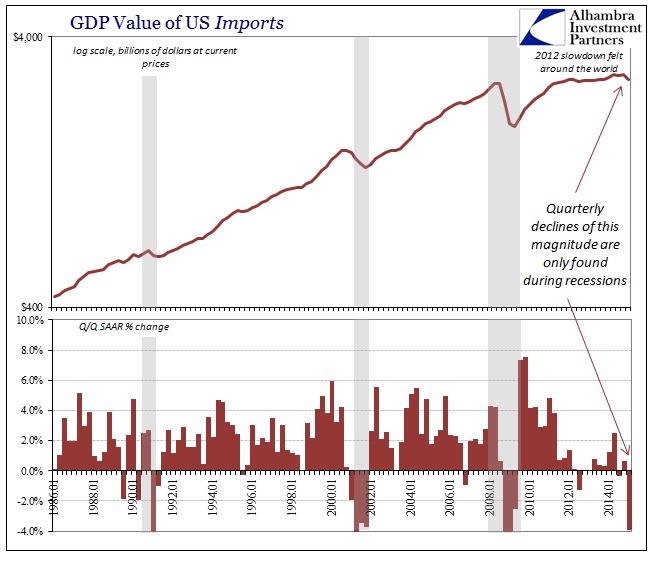

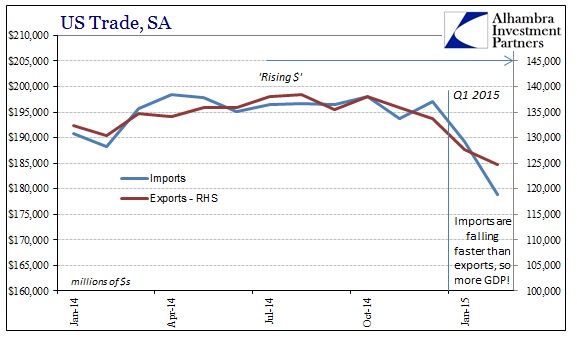

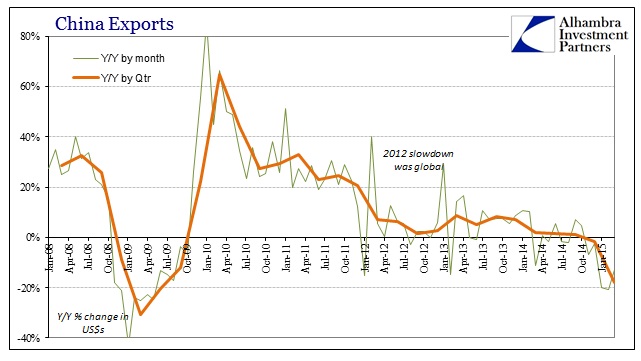

As the Chinese will fully attest, there has been no “demand transfer” to anywhere, a fact repeated by Japanese and Europeans. Import activity into the US has been declining, and precipitously, throughout the “rising dollar” period. The past three quarters in the GDP figures have been adamant about no “demand transfer” except in reverse (especially Q1).

Again, this is not a surprise to most import-oriented economies around the world, as they have become more conditioned by the 2012 slowdown that most economists aren’t aware took place. First among those are the Chinese, and they continue to suggest that the “rising dollar” has been a marker of ill omen.

The latest indication of deepening factory woes raises the risk that second-quarter economic growth may dip below 7 percent for the first time since the depths of the global crisis, adding to official fears of job losses and local-level debt defaults.

The HSBC/Markit Purchasing Managers’ Index (PMI) fell to 48.9 in April – the lowest level since April 2014 – from 49.6 in March, as demand faltered and deflationary pressures persisted…

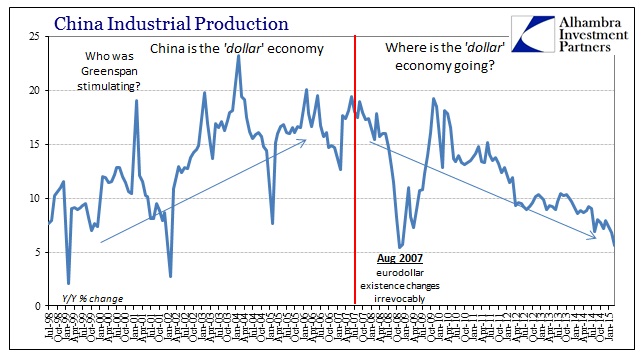

Both input and output prices declined for a ninth month, while manufacturers shed jobs for an 18th month, auguring poorly for an economy that grew at its weakest rate for six years in the first quarter.

These were PMI figures (for the HSBC version as opposed to the official government PMI released last week), so take them for whatever they may be worth, but they are at least consistent with a broad survey of the Chinese economy apart from GDP. China’s economy was built as the ablest expression of the modern “dollar”, freed from, supposedly, Triffin’s Dilemma, only to capture China within the modern adaptation of the activist central banking globally. It is there that all this confusion about finance and economy is generated, as central banks act and pronounce as if it were still the 1960’s; as if the “dollar” were still somehow the dollar.

Such lack of recognition about the bypass of the financial “economy” leads to contradictions such as this (from the same article about China’s PMI):

Millions of workers lost their jobs when China’s growth tumbled to 6.6 percent in early 2009. A massive stimulus package pulled the economy out of the slump, but at the cost of saddling local governments with a mountain of debt.

It is hard to define “stimulus” where the “solution” creates a greater problem. In that sense, what the PBOC did in 2009 was simply transfer the direct existence of the prior problem but leaving it pure and undeterred overall. That is the “dollar”, where finance and bubbles seem to be a cure in the same respect as a “strong dollar” once was; but the difference between them is enormous and even dangerous. To view the rising “dollar” as something stable, just as the Chinese (and every other monetarist textbook) once viewed a new bubble as a stable solution to the growing recession, misses the idea about so much fungible currency because it applies anachronistic views upon 21st century function.

Stability is not something that can be conjured by monetary activism, though it is all taken as the same thing in mainstream interpretations. That is especially true when central bank activism is the greatest and most visible agent of instability itself. That helps to explain why not only do economists continue to be far too optimistic about the “recovery” but also why they can’t even figure out currency.

Stay In Touch