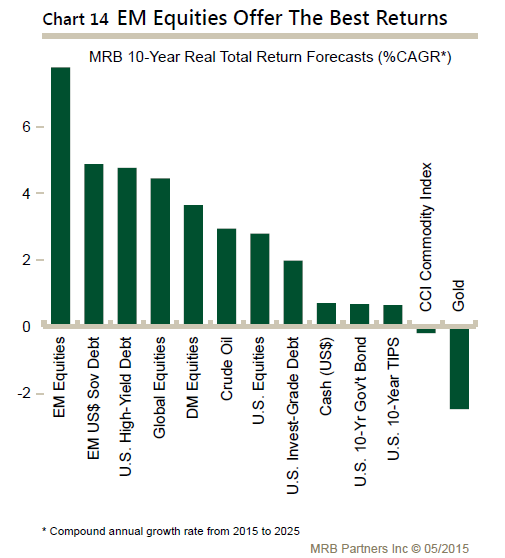

After 3 decades of disinflation and 15 years of very aggressive monetary policy, asset prices are high. Returns are expected to be below average for the next decade. Given the hyper-aggressive monetary policy of the last 6 years, the historically low yields on bonds means multi-asset class portfolios will be hampered by low returns on fixed income.

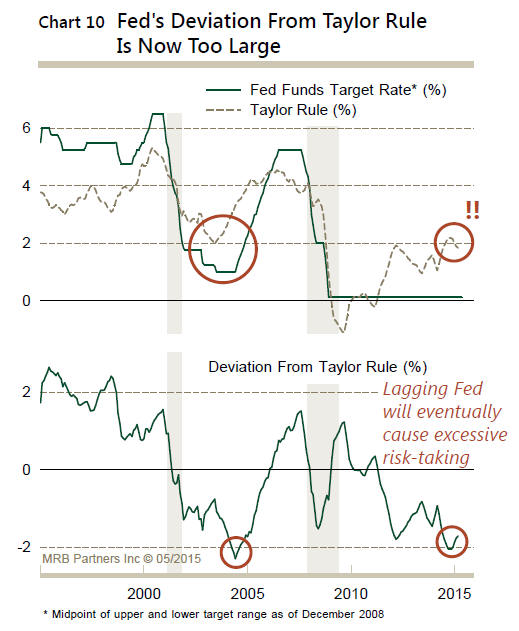

Will the Fed raise rates or not? The following chart shows that their deviation from the Taylor Rule is the largest since 2004. Based on this information, expect the Fed to hike.

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Past investing and economic performance is not indicative of future performance.

Stay In Touch