If there were an economic recovery in the US then we would certainly find it on the fiscal budgets of the various states. You cannot spend or even generate income anymore without taking incidence of a taxable transaction. So if the US economy has been doing what the FOMC says it has, then the taxman will tell us.

Even here we still have a problem defining a recovery, as it is either intentional misdirection or just plain laziness that seeks out the highest point in 2007 as the measure to achieve. In other words, there is no accounting for lost time, as the goal in the economy now eight years later is not to match that long ago high water mark but to return to the growth trend that created it. If there has been a true and full recovery in the US, tax levels would be not equal to 2007 but by now some 20-30% above them (eight years of compounding is quite powerful).

Yet, we know that many states are still struggling and surely as still somewhat of a matter of the great housing bubble of the last decade. But any lingering effects should be muted by now and further the great monetary promise of ZIRP and QE’s was to not only blunt that downside but to fully and completely overcome it. It clearly hasn’t, as the best that can be described of the US economy now is lumpy and unstable, and even unstably lumpy.

Six years after the recession ended, many U.S. states are hard pressed to balance budgets because of a sluggish recovery and their own policy decisions. The fiscal fragility raises questions about how they will weather the next economic downturn.

A majority of states are making cuts, tapping reserves or facing shortfalls despite an improving national economy and stock markets at record levels, according to Standard & Poors and the Nelson A. Rockefeller Institute of Government. State revenue hasn’t rebounded to a prerecession peak adjusted for inflation, and other factors are putting pressure on budgets.

All the things that make up the constituent parts of an “improving national economy” are still missing, including fiscal health in the states, yet it continues to be described as such because mainline economists have been insistent upon that opinion for years now. Throwing in with the stock market used to be an impressive bit of background confirmation, but after two bubble collapses and even Janet Yellen’s admission for a third it doesn’t quite add up.

So it was interesting in yesterday’s embarrassing FOMC “policy” statement that the orthodox economists there were left to, among a couple other molehills, consumer sentiment as an intellectual bulwark against once again economic deviation. There is a plethora of faith-based components in this one concept, including the “wealth effect” plainly derived from that stock bubble to begin with. If consumers are happy and they have growing brokerage accounts and even 401(k)’s it is simply assumed that is meaningful in economic terms.

But, like tax collections, it hasn’t much turned out that way. As it is, the last two decades in consumer sentiment reveals a great deal about why – and maybe even suggests the “power” of bubbles as waning.

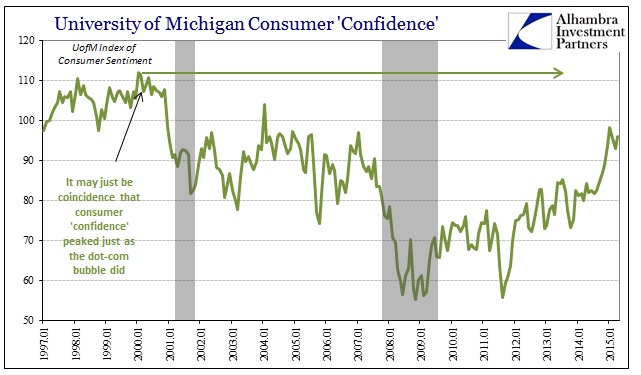

As you can see above, consumer sentiment absolutely surged starting in August last year, as if the “rising dollar” was itself taking part in that wealth effect formation. That is the part that the FOMC wishes to isolate and emphasize, but the overall track is far more interesting. The highest level of consumer “confidence”, as measured by the University of Michigan but also echoed by the various other sentiment surveys, was a sprightly 112 in January 2000. It was the highest level in the entire series, dating back to the reformed index starting in 1978. I suppose it could be just coincidence that such sentiment would nearly match the very peak in the dot-com bubble, but the behavior thereafter is more assured.

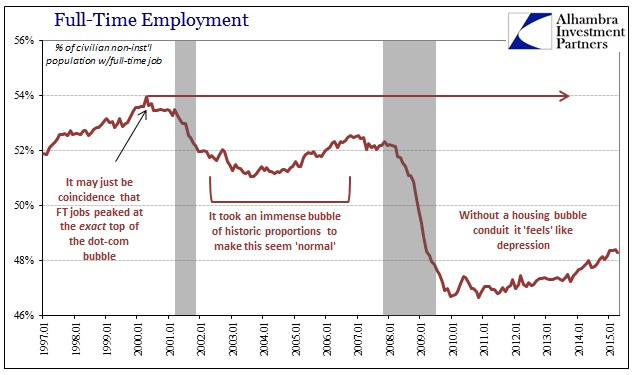

This overall pattern should look very familiar, with an apex at the dot-coms, and a ratcheting downward of cyclical progression from there. It is remarkable, actually, how similar consumer sentiment and the level of full-time jobs turned out to be.

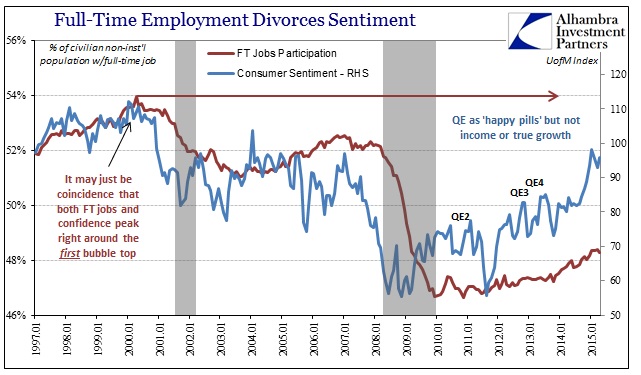

Upon closer comparison, though, while the overall similarities remain there emerges a more recent deviation that is relevant to both state tax collections and the idea of an “improved national economy”, the myth whose desperation for continuation is now plumbing these depths of desperation.

What is immediately apparent is how consumer sentiment has become almost completely unhinged from true employment gains (what little of them without acknowledging how even that may be greatly overstated). Consumers are much more happy, equal now to even the halcyon days of the greater housing bubble in the last cycle. Yet 4% of the population is without full-time employment by direct comparison, an absolutely enormous gap that was not opened by Baby Boomer retirement but clearly by the Great Recession itself.

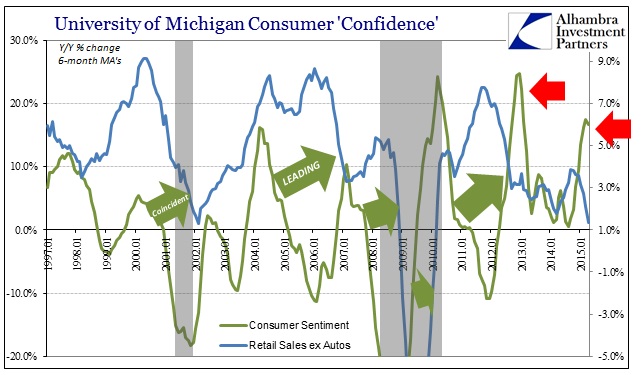

The transition between happy emotions and jobs is supposed to be in the course of more “aggregate demand”, in other words consumer spending. But here the gap between sentiment and spending is not just wide but moving sharply in opposite directions. Sentiment is shooting upward while spending has sunk to some of the worst results in the last quarter century.

In cycles past, there was some rough correlation between changes in sentiment and changes in consumer spending (translating into and through employment). Entering the dot-com recession, for instance, sentiment fell sharply coincident to sales imploding into contraction (in real terms; nominally it is very rare to see a negative number which is why 2015’s appearance of them is so outstanding). The beginning of the housing bust presaged the initial slowdown of the elongated cycle preceding the Great Recession. And the surge in confidence out of the extreme trough led the same in the economy which followed about half a year later.

Changes in confidence even predated the 2012 slowdown, but the surge thereafter had no imprint upon spending; just as the current surge in confidence has not on gone unnoticed but has become completely unhinged. What has changed post-2012? There were two extra incidences of QE to “aid” the economy as it seemed to have prior, but to obvious effect at all now.

I think it is clear that there is still some great belief in monetarism or sentiment wouldn’t be rising so especially after 2012. But happiness is not a job and it doesn’t do much at all for wage growth. If people aren’t spending then it is because people aren’t earning, and that would suggest a problem of businesses. In that case, QE might have worked all too well, in the constant appeal of the stock bubble, with so many corporate resources shuffled to unproductive financial investments. Further, there is, in this broad bubble period, an immense projection of corporate liquidity to so many inefficient businesses that should have failed at some point in the past few years but have held on in the enormous appetite of syndicated leveraged loans and junk bonds.

In other words, the gap between consumer believability and economic efficiency has grown to enormous proportions, and so consumers may be happy but that doesn’t spend. In forcing nothing but a monetary recovery, they got exactly that; again. For the FOMC to rely on pure emotion to “save us” as the forces of dislocation expand into broad penetration is pure desperation. Maybe that is why Yellen has become more vocal about the stock bubble; maybe she finally admits that if she can get corporate CEO’s instead to hate it there is at least a chance the old economy might in time reappear and sentiment and spending and wages would grow back again. Somehow I doubt that is the case, but that is probably the only real way to actual recovery at this point.

Stay In Touch