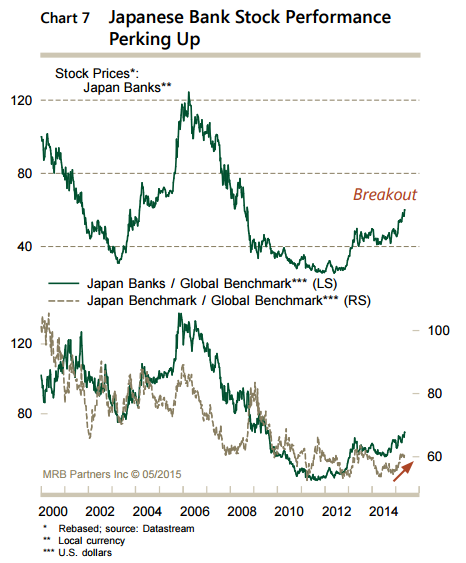

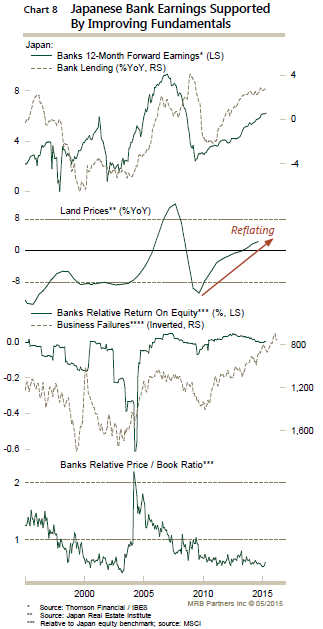

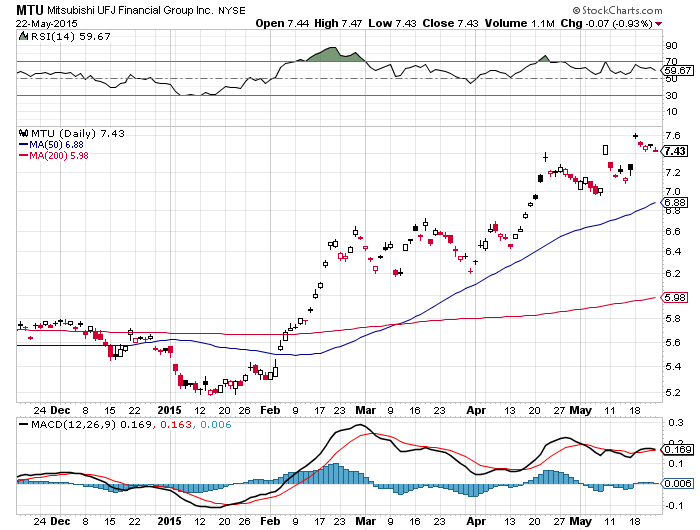

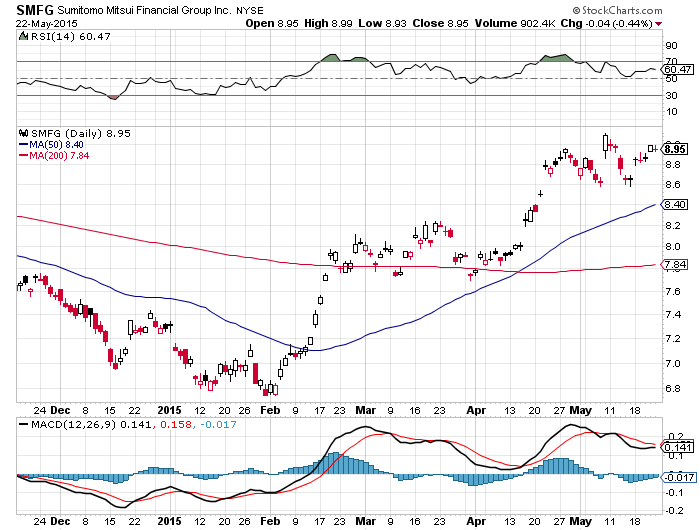

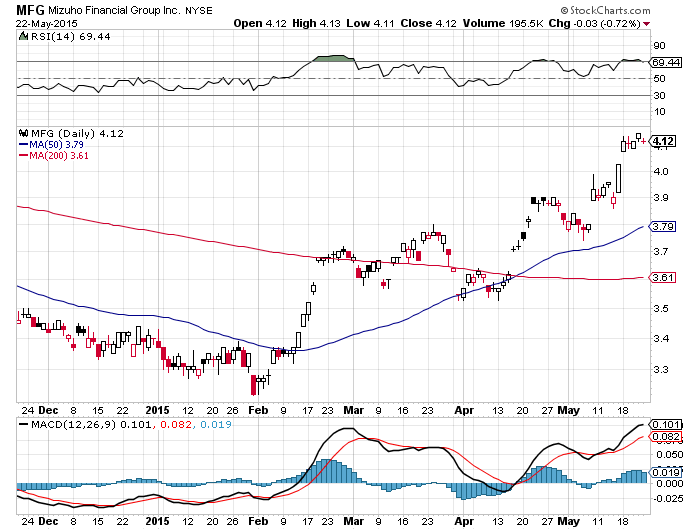

Japanese bank stocks surged over 50% from December 2012 through the first half of 2013. Since, they have been in what one might call a consolidation phase. The initial surge coincided with expectations of the effects of Abenomics. The consolidation was a 1.5 – 2 year wait and see period, somewhat of a battle between believers and doubters. Now, there has been a renewed surge in Japanese bank stocks in the first part of 2015. One can debate whether this is directly attributable to quantitative easing or just an improving economy that has healed some old wounds. The 30+% gains ytd are noteworthy and one wonders if this is just the dawn of a new rising sun.

Fundamentals are supportive of growth and valuation based on P/B levels are historically low.

Disclosure: Alhambra has long positions in MTU and MFG.

As always, please feel free to contact me with any questions or concerns.

Find out about your personal risk profile and working with Alhambra

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Past investing and economic performance is not indicative of future performance.

Stay In Touch