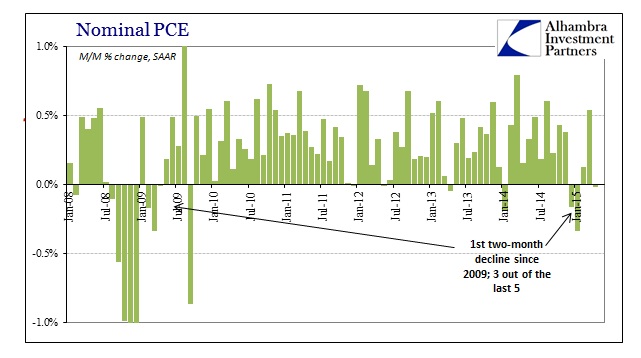

Personal spending fell slightly in April, making three of the last five months for declines. Such a sustained slump is actually quite rare, and you have to go back to the Great Recession to find anything like it in recent history. There are a few reasons for this now-accumulated downtrend, but it always starts with income. While personal income has been growing, it has not done so fast enough and in a manner that would support sustained economic activity. The consumer end of the economy, under the attrition of just positive numbers, is therefore highly susceptible to further negative factors (including GDP-positive healthcare).

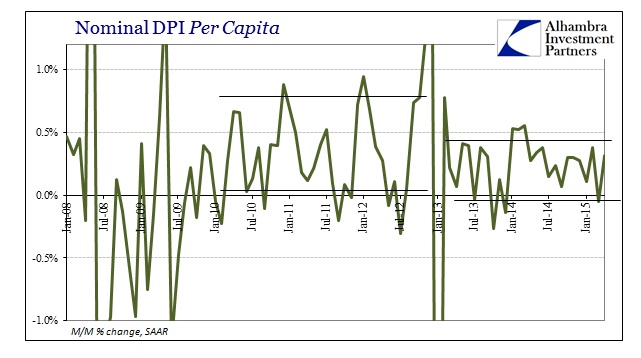

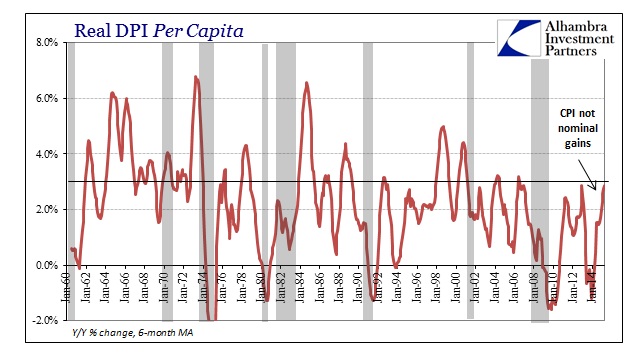

Real incomes have gained but only as the CPI has faded, meaning that paychecks overall are not expanding no matter how much economists think that is equivalent. For all the talk last year about this about massive payroll expansion, it is clearly not feeding into incomes and certainly not at historical-type gains. If anything, incomes sustained a blow in late 2012 and have never caught up, almost as if US companies have gained a cash flow problem separate from accounting versions and visions of profits.

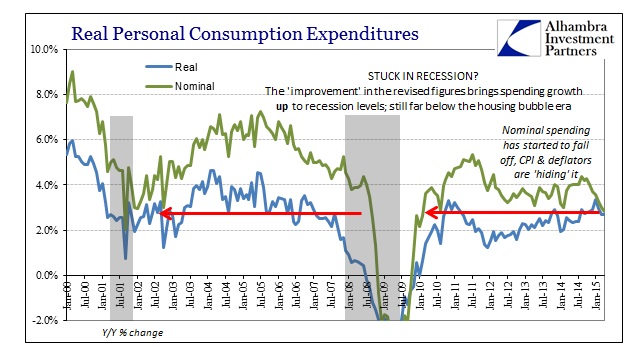

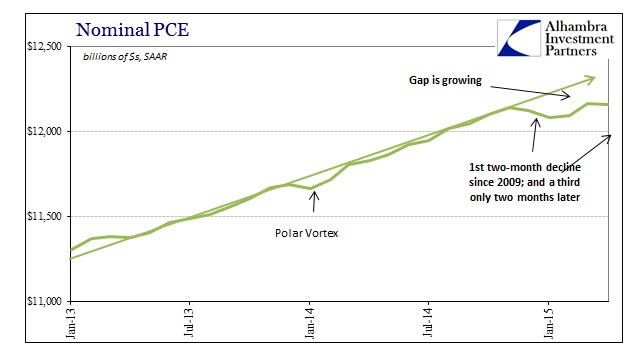

The same CPI “problem” is clouding the idea about the spending side. Nominal spending, like incomes, has clearly turned down but the near-zero “inflation” measures have made “real” spending figures less of a threat to the recovery narrative. While gains like this can be a net positive for consumers and households under certain circumstances, context matters and in this case nominal paychecks and spending are the primary motivators of what is truly shaping up as economic dislocation.

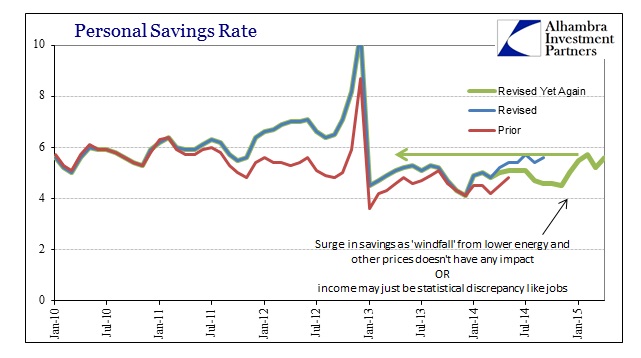

Nominally, PCE spending year-over-year is at a “cycle” low but real spending looks to be steady, if still insufficient, upward. If consumers were indeed being rewarded with lower actual inflation then they would not be reacting as they are. One glance at the personal savings rate (as it is currently estimated, who knows what it may look like tomorrow) disabuses any idea that “real” spending is the real path here.

The personal savings rate jumped up in December as the slump “unexpectedly” began and has remained there for the balance of 2015 so far – now into April with these latest estimates. The hallmark of any recession is the consumer “bunker”, typically one of a mindset which grows highly cautious for reasons that escape orthodox economists and monetary policy (economists as a general rule believe this is irrational fear, so they irrationally talk about how great consumer inflation is particularly when they abuse monetary policy to try to get more of it in the near future). The problem is that people cannot spend what they don’t have no matter what monetary policy tries to do about prices.

For the most part, the trend in PCE is quite established and usually invariant. That might be a statistical fingerprint but since it is consistent throughout the data going back to 1959 we can at least be somewhat assured that the comparisons then are consistent too. That is why a run of three declines in a condensed five-month period is unusual, and more than suggests an unusual (read: significant) break in the economic trend.

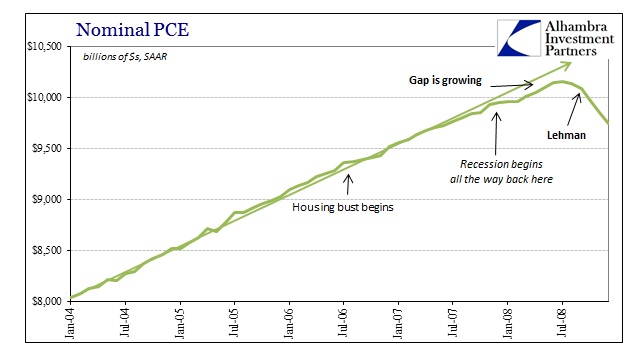

Recessions are not always negative numbers, instead a recession, especially in nominal terms, is actually more so a sustained deviation from the prior trend regardless of the sign in front of the growth rate. That is what the current track of PCE spending shows dating back to November 2014. Despite the fact that the current SAAR for nominal PCE is above that of November, the real standard of comparison is where it “should” be on the sustained trendline that covers the whole cycle so far (or did). The longer and wider the deviation, regardless of whether there are more negative months or not, the more likely that there is serious economic trouble both causing that trend abnormality in the first place as well as leading toward self-feeding declines across a broader economic front in the near future.

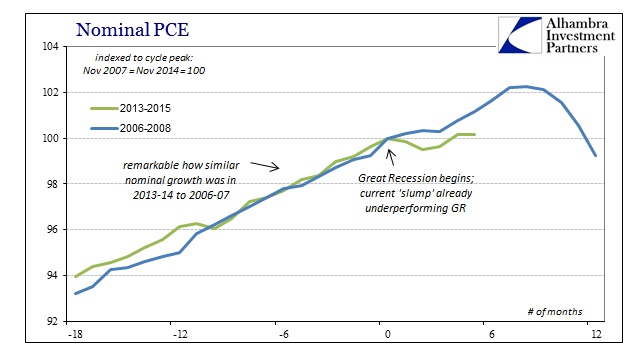

In fact, by historical comparison, the current five-month slump is not much different than that which preceded and consisted within the Great Recession itself.

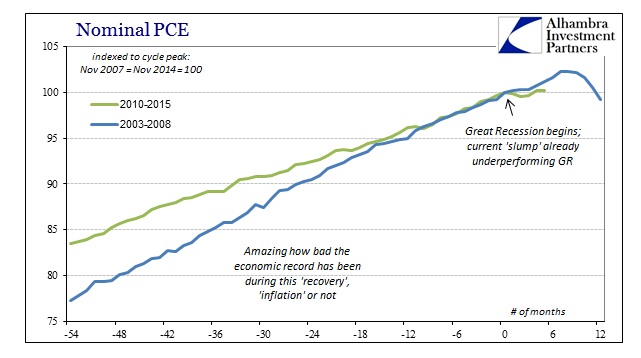

Again, the stability of the PCE trend is evident as is the fact that nominally PCE continues to expand despite recession. Thus, recession is again not outright contraction in negative numbers but rather sustained underperformance relative to the cyclical trend. When comparing the two periods, the current slump is by all accounts already below the Great Recession, inflation or not.

That becomes obvious when you compare the two periods directly (above), as is the utter failure of all “aggregate demand” stimulus to conjure actual demand; the slow growth in PCE in the current “recovery” is painfully obvious when compared even to the deficient period during the housing boom. The only equivalence is, oddly enough, growth just prior to the slumps in both periods:

If the Fed wants to “explain” that through seasonality in GDP they are looking, once again, in the wrong direction. However, I don’t believe even the FOMC’s policymakers are that obtuse and that the intention in that respect is more so to give even weak outward assurance because they realize how serious a turn this has taken. No longer are there ridiculous statements about how great the “strong” dollar is for everyone, nor even the mention of the “dollar” under any positive format. Rational expectations theory demands that they be positive no matter what, lest the economy take those worries to heart and act them out into a contraction. The problem for 2015 is that the contraction may already be taking place, and thus the “rational” optimism that is being thrown about comes across as desperate and increasingly incredulous.

Given that retail sales figures are already pretty dark, and that retail sales are more of marginal economic shifts than broader PCE which includes services and various imputations (some of the reasons for the straight-line nature here), this isn’t altogether surprising except perhaps the degree to which it has so far been carried. There may not be much left holding the US economy closer to its necessary trend, bad as that was, and the longer this lingers the less likely a QE5 would have any significant impact apart from finally signaling that even the Fed has finally and, as always, belatedly given in to the same bunker where consumers and households are already hiding.

Stay In Touch