The unifying element of the prospect for recession in 2015 is how it will reveal the hugely mistaken assumptions that were taken on faith alone. Entering 2008, for example, the FOMC kept some plausibility because of the housing debacle. A convenient scapegoat, the Fed proclaimed that recession was a danger on housing alone, and so its mistakes were met as mistakes in kind rather than of category where they belonged. In 2015, there is no such “hiding place” as the FOMC has been proclaiming relentlessly QE worked and the economy is (not “was”) robust without any qualifications.

If that turns out not to be so, and even the opposite as recession would have it, then monetary policy is disabused from the core outward. The prospects of such a reckoning were largely going to be inferred from another economic carcass, a survey of wreckage that will only for so long be titled “unexpected.” Thankfully, in this endeavor, the Wall Street Journal has performed no small favor in actually spelling out the cluelessness and corruption that passes for expertise on affairs of the economy.

The sun shined in April and you didn’t spend much money. The Commerce Department here in Washington says your spending didn’t increase at all adjusted for inflation last month compared to March. You appear to have mostly stayed home and watched television in December, January and February as well. We thought you would be out of your winter doldrums by now, but we don’t see much evidence that this is the case.

You have been saving more too. You socked away 5.6% of your income in April after taxes, even more than in March. This saving is not like you. What’s up?

The only way this “is not like you” is if you accept, from the beginning without admitting possible deviation, that the Fed and monetary policy, most especially QE, has created a blooming and booming economy. If you step outside that bubble, one walled off with and by financial bubbles of “necessity”, there isn’t really much mystery.

The Federal Reserve is counting on you too. Fed officials want to start raising the cost of your borrowing because they worry they’ve been giving you a free ride for too long with zero interest rates. We listen to Fed officials all of the time here at The Wall Street Journal, and they just can’t figure you out.

That last sentence is almost redundant at this point, as more and more people will accept that the Fed “can’t figure you out” is shorthand for “flawed theory in practice for decades.” To see that confirmed, you only need to recognize what passes for sanity in terms of economic deciphering among officials these days. Fed Governor Lael Brainard voiced what sounds like, though only in relation to typical assessments, actual common sense:

“No doubt, bad weather, port disruptions, and statistical issues are responsible for some of the softness in first-quarter indicators of aggregate spending,” she said at the Center for Strategic and International Studies in Washington, D.C. “But there may be reasons not to ignore the recent readings entirely.”

“My own reading is that earlier, more optimistic growth projections may have placed too much weight on the boost to spending from lower energy prices and too little weight on the negative implications for aggregate demand of the significant increase in the foreign exchange value of the dollar and large decline in the price of crude oil,” she said.

You know orthodox and mainstream theory and economic ability has strayed so far from center when the highest degree of rationality expressed is the one Fed official who only starts to doubt blindly following orthodox interpretation. These are not economic experts or scientists taking observations where they rightfully lead, these are ideologues utterly incapable of finding originality or even accepting deviation from their math-based view of the world. It matters not how many shortcuts it took to gain even reasonable workability in those regressions, they are nice and elegant and economists treat them as their own offspring rather than fallible tools.

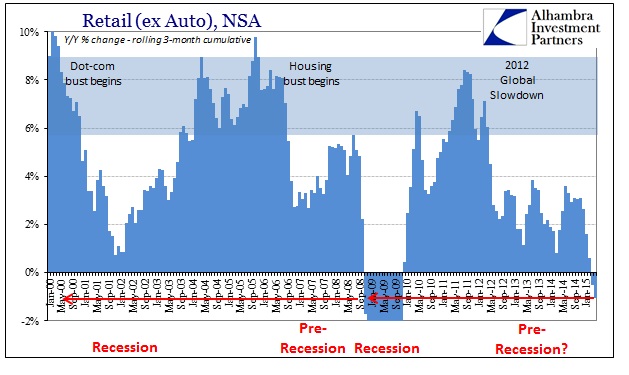

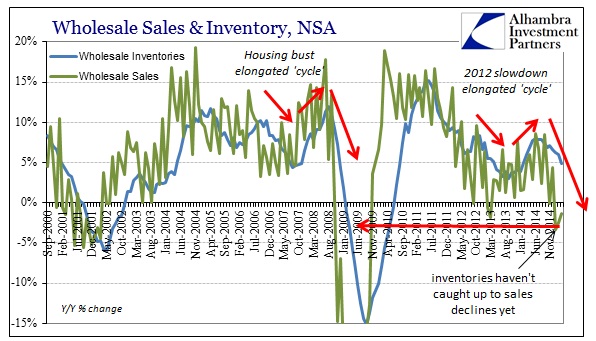

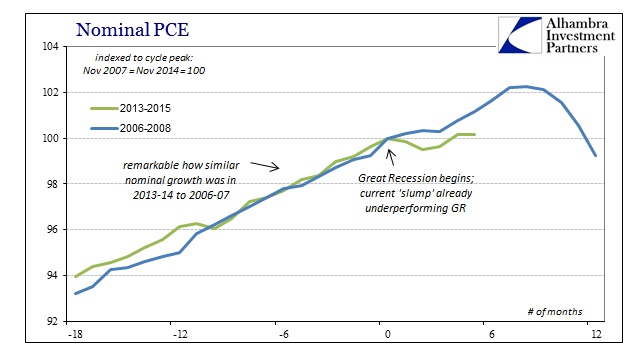

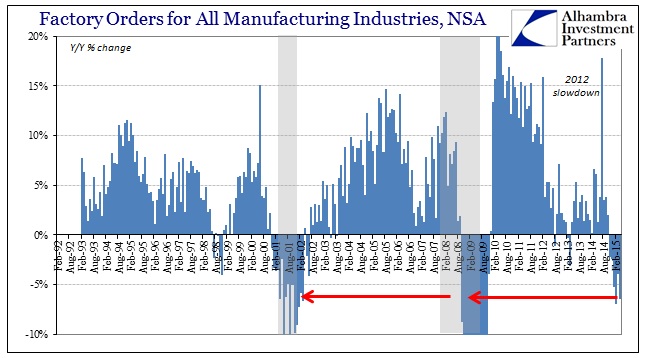

By any fair measure of recovery or economic health, the US economy, and the globe with it, took a severe turn in 2012 and has remained very sickly ever since. It was only a matter of time before such a weakened state took enough of a toll on consumers (and businesses, to a lesser extent “thanks” to QE and the corporate debt version of the bubble) to foster the heretofore unthinkable.

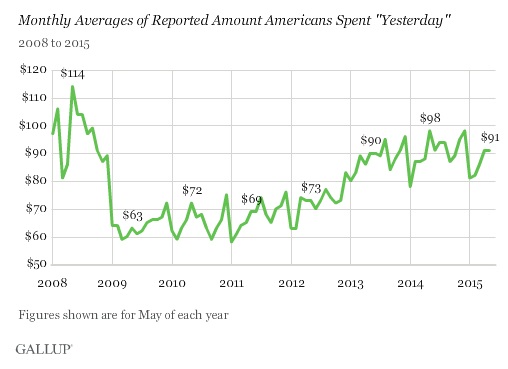

The roll call of ugly and downright atrocious indications is deep and growing deeper. We can add to that even private estimates of the consumer economy, with Gallup’s Daily Spending tracking poll coming in at only $91 in May (well past the winter or “seasonality” of Q1). That was only equal with April and $7 below May 2014. What is clear in Gallup’s figures is not just the most recent “slump” but how that has been forming for more than two years; there is no growth really since early 2013.

By these estimates alone it is plainly obvious that whatever recovery there was ended back then, and rather than gaining as the FOMC would have it (along with all their orthodox parrots) the economy has, at best, been in a holding pattern ever since. That sideways trend, however, understates the degree to which households in particular have been experiencing attrition and corrosion from the bottom up.

The intentions of all “aggregate demand” theory start with the top down, especially when involved with asset inflation. If the “rich” (for lack of a better, less static term) “feel” better about the world then it is expected, not suggested or hoped, that they will spend on those feelings alone – which they largely have. That is supposed to kick off a virtuous cycle of more production related first to that spending, and thus more income broadening the base of spending into still more production and income. That simply never happened, though it continues to be the dominant expectation.

Instead, “aggregate demand”, not only being generic nonsense, comes with very real costs that are born out in the very large majority with no active connection to that “wealth effect.” What we are seeing in 2015 is that eventual revelation, that over time the costs of “aggregate demand” far outweigh any redistribution benefits – a position that is far more reasonable since financial redistribution takes place not from merit but from arbitrary garbage. In other words, you cannot build an economy from a preponderance of negative and arbitrary factors; transactions for the sake of transactions do not lead to anything other than further attrition.

A recovery is built upon real wealth which is activity created and sustained with an actual purpose, transactions that serve other and deeper means governed not by “free money” and debt above all else but by meaningful profit. It is obvious that is never accounted by orthodox economics, which is why “can’t figure you out” has a very, very good chance of becoming the motto for this entire era. We can only hope it sticks this time.

Stay In Touch