It makes a very interesting contrast, to start the week under cloud of suspicion only to end it with its reverse. Economic data was routinely awful earlier, though for the most part financial markets are moved more by how that might make Janet Yellen feel than anything of a fundamental basis for all those prices. Typically, the ISM surveys are given serious consideration, so when their economists sound alarming it is widely noted:

Slowing service sector growth adds to signs that the US economy has lost some momentum after an initial bounce-back from weather-related weakness at the start of the year.

May’s PMI data showed service sector activity rising to a slightly smaller degree than signaled by the flash reading. Alongside the slowdown in manufacturing, the services PMI points to the weakest pace of US economic growth since January.

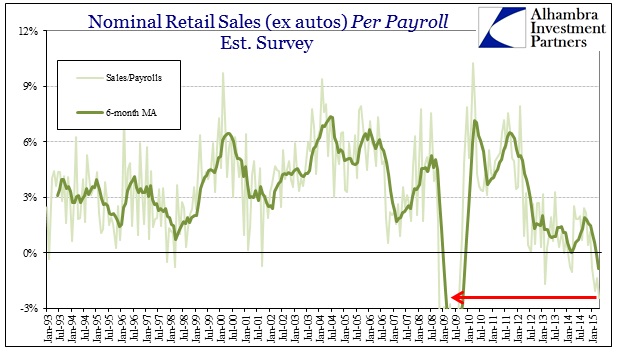

That view has been echoed throughout numerous other data points, in particular retail sales and PCE. There was the sharp slowdown that started not in Q1 but back in November (October 15 play a role?), then a small bounce in March as expected (in terms of timing not degree) and then nothing. If the ISM and other sentiment surveys are picking up that second derivative a second time, that would seem to be rather widespread unification.

None of that matters anymore, apparently, because the headline jobs figures wash away all economic sins. Like January this year, this payroll report was just about perfect: high headline, jump in full-time and labor force, and at least a close read on the Household. All of that adds up to very little outside of what seems to pass for conventional “wisdom” about the economy. I’m not sure when it happened, but the payroll figures seem to have surpassed everything else in terms of the economy’s weight in at least setting mainstream media perceptions, likely because bubble rationalizations do not like to be disturbed – and the payroll report is about the only account that obliges.

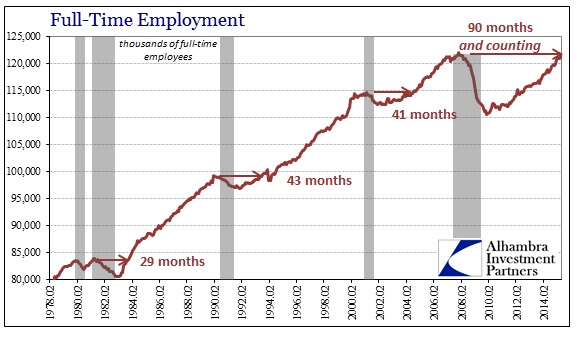

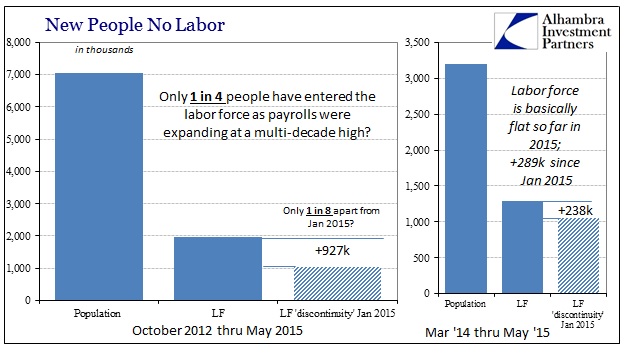

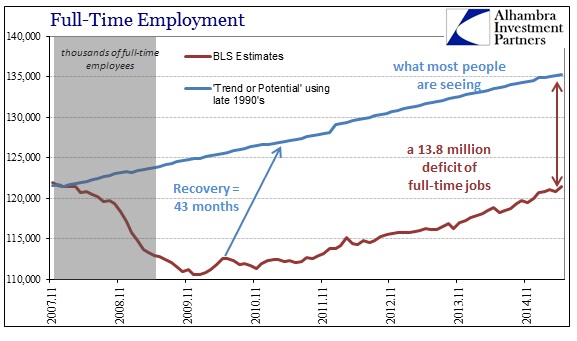

Despite a jump in full-time payrolls, the overall recovery trend remains as it has for years now. The run of below-peak employment now stretches an unbelievable 90 months (longer than even most car payment terms now) meaning that month-to-month variation is like splitting hairs. The labor force improvement in context is a drop in the bucket, as there still is little incentive for those not in the labor force to change their status (in official counting).

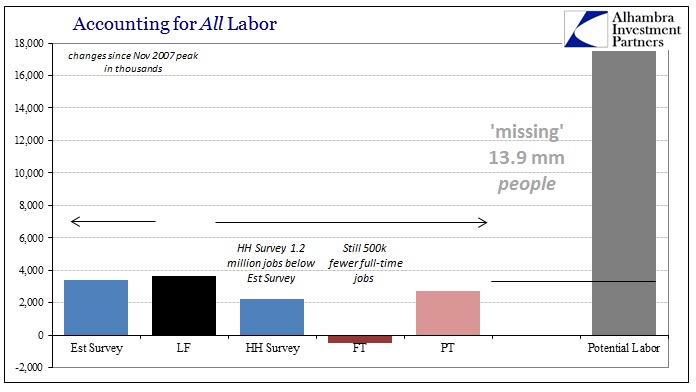

The numbers just don’t much change overall. Where last month there were 14.1 million “missing” people in the official stats, this month there are “only” 13.9 million. What is most curious and important for my analysis is the fact that no matter the job count actual spending is contracting. The retail sales figures only tally through April, which means given the nearly 300k addition in the Establishment Survey in May that retail sales will have to surge by an enormous amount just to get back to something positive. No matter your view on the BLS’ work overall, that is the true problem and the source of all statistical discontent (tracing back to wages).

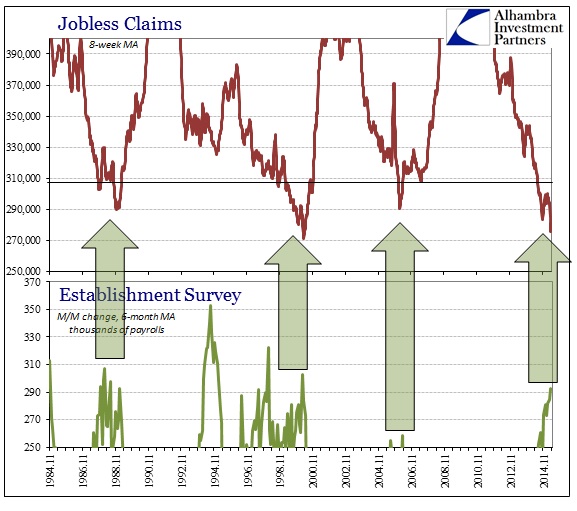

The spending figures alone cast serious doubt on the payroll reports, a case that I have made repeatedly. From my view, the only factor that matters to the BLS is not actual economic growth but instead jobless claims. That is the only durable correlation that survives especially in 2014 and now 2015, and may even be redundant.

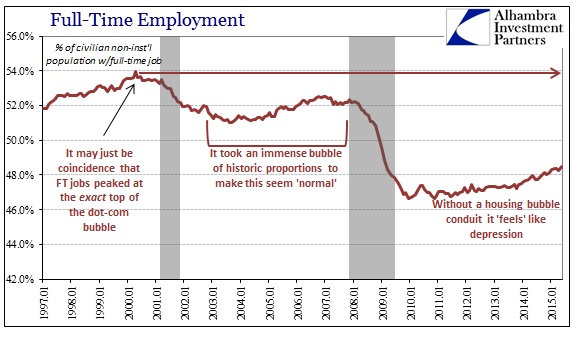

As you can see above, the average gain in the Establishment Survey is about where it was in 1999, as is the reduced count in jobless claims. Clearly, however, the economy at the moment is nothing like 1999, even when considering the “progress” of serial asset bubbles.

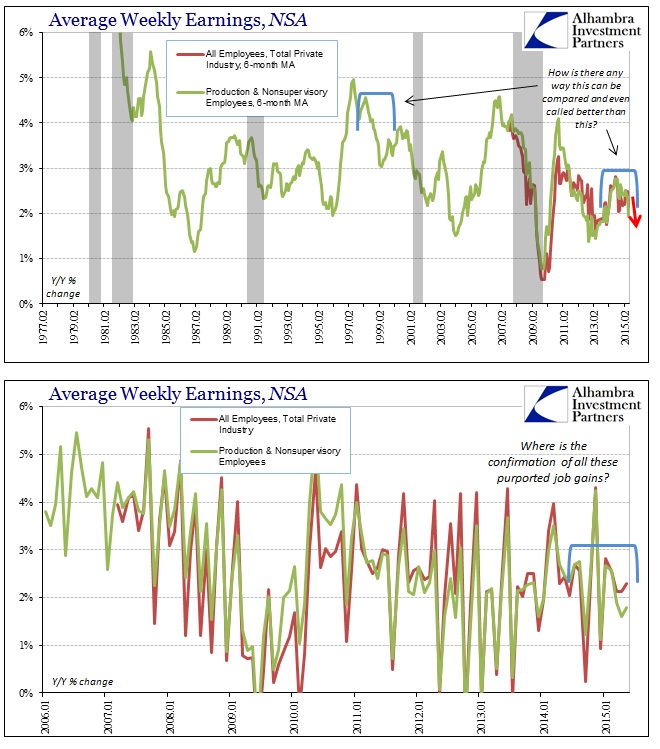

There are no wage gains to accompany these “perfect” payroll numbers, just chained monthly variations set considerably upward; in fact, for the increase in supposed payrolls in May, average weekly pay of production and nonsupervisory employees grew less than 2% for the third consecutive month. The 6-month average is now down under 2% for the first time since 2013. In other words, not only do wages not confirm the robust headlines, they are also heading in the wrong direction like spending (imagine that).

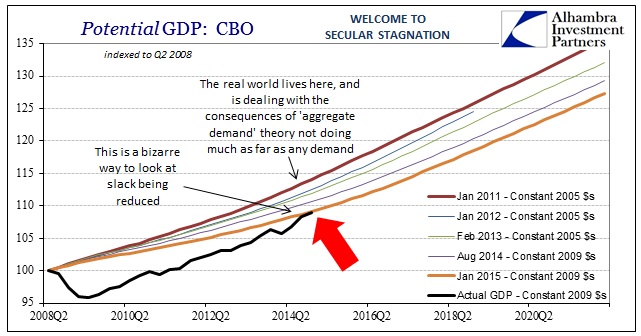

This has perplexed economists, especially those at the Wall Street Journal yet again (at least they acknowledge that “Americans aren’t getting a raise”), simply because payroll expansion does not conform to anything else. Real experience is highly different than what the BLS says it is, meaning that “slack” as an economic concept is misaligned to the pitiful nature of this economic expansion. Secular stagnation blames the economy for this situation, so various orthodox economic outlets and models can mark down “potential” in a manner that is meaningful only to those same models and economists.

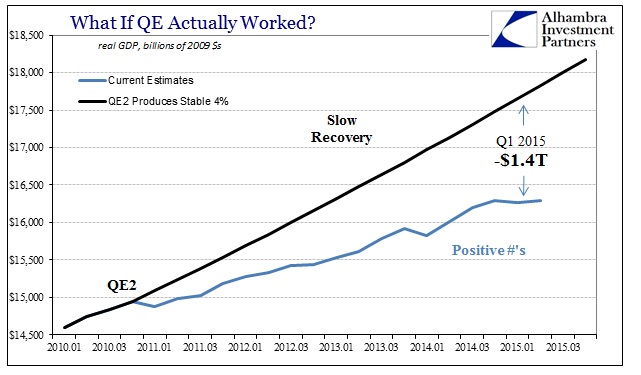

In short, the amount of “slack” is enormous still because there has been no recovery; a fact made plain even setting aside all the very reasonable and compelling reservations about these perfect payroll reports. The only way to view QE as having been successful is to so degrade economic potential that it now amounts only to whatever GDP is today. In the real economy, that reduction doesn’t stand; the real economy suffers from the opportunity cost of not attaining meaningful progress no matter how much economists (and statisticians) convince themselves that monetary policy could not possibly fail so spectacularly.

Americans aren’t getting a raise because the economy is gone not because economists can’t find the “right” calculation for slack. The payroll reports cloud that issue immensely, when they should be providing clarity.

The point of monetary policy these past almost-eight years now has been to stimulate “aggregate demand” rather than the count of the Establishment Survey alone. It was simply assumed that one would follow the other. In terms of peak-to-peak, it has failed on both accounts. I think it is pretty well established (pardon the pun) now that the payroll report is going to be good no matter what, meaning that this analysis is, as it has been for quite some time, redundant month after month. The true economic insight is to figure out why the divergence; economists blame you and me, I blame the BLS for at least allowing them some cover in doing so. Put the payroll reports on something less of a trend-cycle basis and the entire monetary/QE narrative falls apart, with nothing left.

Stay In Touch