There was a reason FDR’s administration in its first 100 days took the order it did. Contrary to some assertions, Executive Order 6102 was not a lawless expansion of executive privilege and prerogative. It had a very lawful basis, underwritten by the Emergency Banking Act of 1933 which itself was based on (and no part of this fact should be underappreciated) the Trading With The Enemy Act of 1917. The whole affair was perfectly consistent throughout, from 1917 to 1933 and on, as the US government through took to treating gold “hoarders” as the entire enemy of economic circulation, and simply stroked them into illegality with the whole legal apparatus.

Hoarding had to be outlawed otherwise the next step in economic revival would have been totally moot – devaluation. It is always dangerous to think in terms of a counterfactual, but here there isn’t so much controversy. Had the Congress and FDR not outlawed private gold it is very reasonable to assume that it would have flowed outside the US in massive quantities when they defaulted on the dollar (the true death of the strong dollar). What was done then was not just devaluation but in reality redefinition; the purpose of which was to exercise more complete control since it was judged that the people were not to be trusted with their own wishes and prudence on purely economic affairs (in its most basic and consistent format, not what passes for economics today).

I don’t want to rewrite or rehash what I have already written but there is a certain tediousness to the obvious repetition. What is at issue here is inflation, not in the CPI exactly but one far more devious and corrosive. I started with this issue last week in examining the widening chasm between reported profits, other definitions of profits and finally cash flow. This is far more than an accounting issue, having much to do with debasement of benchmarks and standards – the proper definition of inflation.

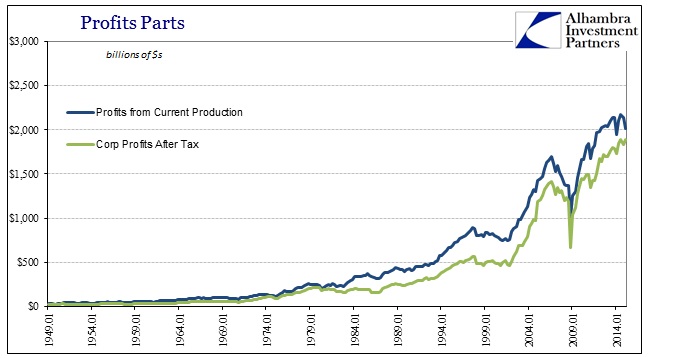

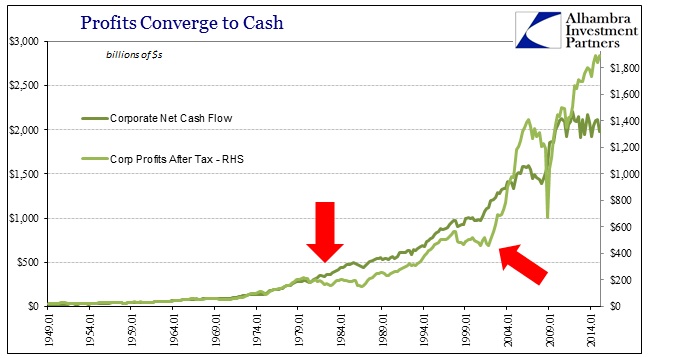

The idea about corporate profits is easy enough to see, as the BEA in part of its GDP estimates (GDI, more specifically) breaks out profits according to several components. You can read here for my specific critique on that mark, but needless to say this divergence has become extreme more so in this age of constant and rolling asset bubbles.

The further you get into pliable measures, the greater this disparity. By the time you factor in all the fiscal “stimulus” through tax cutting (and even add profits gained through nothing more than interest cost reduction; or, a stable interest payment “supporting” a huge increase in debt on the balance sheet) all that seems to be increasing of corporate profits is everything but actual production.

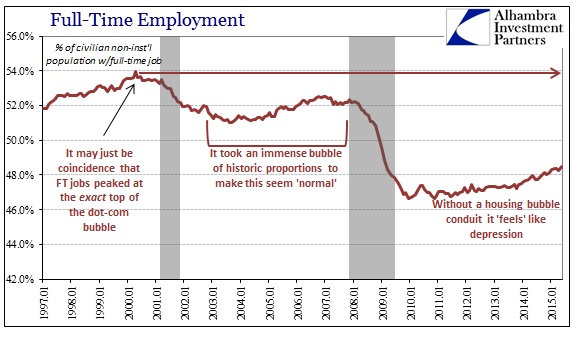

From this you can begin to understand why US companies, particularly in the upper tiers according to size, can be so profitable yet have little impulse to do much productive with it. In cycles past, growing profitability has been the near-universal component in fostering an actual recovery. If recession is the end of profitability, leading to a quick and devastating cost-cutting that shows up as a spike in unemployment (since labor is the biggest cost component and the easiest, overall, to use as a plugline for cash flow), then profitability is its welcome inverse. This is why productivity figures are important, as they provide some good insight into this very cycle mechanic.

As I mentioned last week, if a business is confronted with growing profits from its actual business it should tend to respond by seeking to continue and expand that actual business. If, however, profits are growing instead through other factors, such as tax cuts or the aforementioned interest rate “stimulus”, then needless to say the direct effects on business activity are a bit murkier. Businesses might be tempted to expand existing business, if there were a financial limitation to them doing so prior, but if all financial appetites are satiated then this listlessness in the face of growing profits is quite reasonable.

Unfortunately, that is not the full extent of the cyclical reworking as there has been a now-noticeable divergence not just of profits from cash flow but also in the very idea of profits in the first place.

What’s worse, the financial analysts who are supposed to fight corporate spin are often playing along. Instead of challenging the companies, they’re largely passing along the rosy numbers in reports recommending stocks to investors.

“Companies are tilting the results,” says fund manager Tom Brown of Second Curve Capital, “and the analysts are buying it.”

An analysis of results from 500 major companies by The Associated Press, based on data provided by S&P Capital IQ, a research firm, found that the gap between the “adjusted” profits that analysts cite and bottom-line earnings figures that companies are legally obliged to report, or net income, has widened dramatically over the past five years.

None of this should be “unexpected” since we have been down this road before; twice. Bubbles have a great tendency to not want reality to interject, leading to an inverse dynamic that is decidedly unhealthy – the greater the financial imbalance the more this kind of revisionism is taken as real by those who do not want to let go of the bubble in the first place. That includes, indirectly at least, the Federal Reserve whose policies have underwritten, often explicitly if indirectly, this entire point.

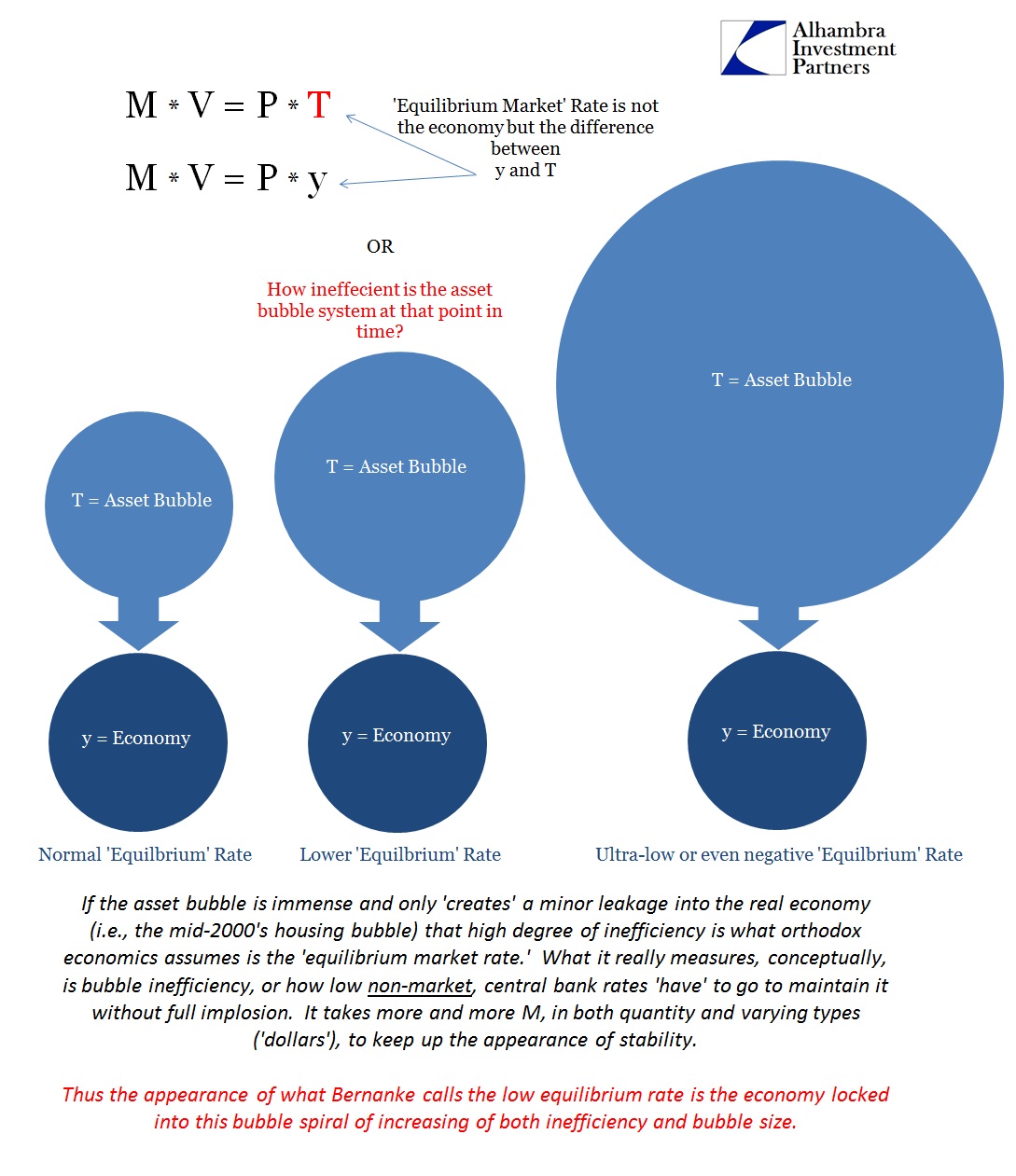

The Fed, in its bubble embrace, cannot “permit” anything that might seriously endanger the price structure it seeks as a means to coax “demand.” In its initial stages, the asset price bubble must be permitted by whatever means necessary if only in the expectation that the robust economy that is supposed to result will allow a more natural reversion to more normal operation. In other words, the bubbles come with costs that are to be born out later when robust growth makes it much easier to do so.

I have called this the Yellen Doctrine as Janet Yellen often speaks as if she recognizes that there are bubbles but only insofar as they are tools for economic management fostering greater control (in theory). Thus, bubbles aren’t really bubbles as commonly understood, and only become so if and when their basis (like expectations of future robust economy) is revealed as illusory and rationalized.

At one of every five companies, these “adjusted” profits were higher than net income by 50 percent or more. Many more companies are in that category now than there were five years ago. And some companies that seem profitable on an adjusted basis are actually losing money.

It wasn’t supposed to be this way. After the dot-com crash of 2000, companies and analysts vowed to clean up their act and avoid highlighting alternative versions of earnings in a way that could mislead investors.

But Lynn Turner, chief accountant at the Securities and Exchange Commission at the time, says companies are still touting “made-up, phony numbers” as much as they did 15 years ago, perhaps more, and few experts are calling them out on it.

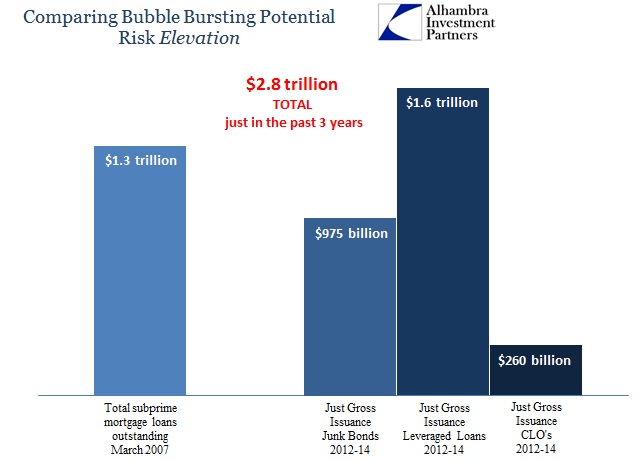

This deflection upon earnings and profits is bad enough of its own accord, but it is combined with a reflexive trend that is perhaps the most dangerous piece of all of this – the corporate bond bubble. In that respect, it seems, these “fake” profits are used as a form of financialism “currency” in order to gain more volume. Just as NINJA loans were taken without question during the subprime buildup, there is very little actual intermediation taking place in corporate bonds right now. Artificial profitability, among other sins, makes bond issuance “look” that much more realistic than it should be.

A dark shadow is lurking behind the happy façade of rising stock prices.

U.S. companies are borrowing money faster than they’re earning it — and they’re doing it at the quickest pace since the aftermath of the financial crisis.

Instead of deploying the debt to build factories, hire new workers or expand product lines, companies are funneling more of their money to shareholders or using it to fund deals. Stock buybacks reached an all-time high last year and the volume of global mergers and acquisitions announced so far this year would make it the second-busiest ever, according to data compiled by Bloomberg.

And so the two trends proceed in tandem; the more accounting profits are sown regardless of actual cash flow the more corporate debt that can be harvested not for the real economy and true investment but to keep and attain more asset inflation. The very means by which monetary policy attempts to control marginal economic changes, low interest rates and stimulating borrowing, become locked into a struggle to get ever higher lest it all fall apart. The Fed can do very little at this point other than recognize the obvious.

Traditional economics does not want to see any inflation in this because that would mean slowing down or, perish the thought, reversing. Just like in the 1930’s, inflation is not just consumer prices going up or down but rather in the total redefinition of our financial existence. That was what economists were seeking after all, greater economic control through more command flexibility. That means to be able to not just influence the behavior of certain inputs intermittently, as it started out, but rather to be able to completely rewrite definitions. That it has happened in these asset bubbles, to an exponential degree as we go further into the third, really should not be unexpected.

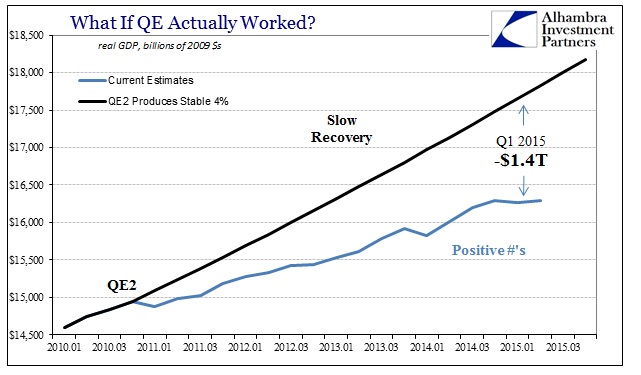

As noted before, the stasis of bubbles takes up so much “energy” just to keep them from collapsing that little is left over for even artificial economic gains.

The entire governing dynamics of finance and economy have been abused and expanded (and reduced) so much that what used to define value just a generation ago no longer applies to anything – this includes comfort with debt above all else and especially asset bubbles.

Some will strenuously object, but this is the very definition of inflation. The standards and benchmarks have all been rearranged with only one object in mind, to allow the top-down structure to not just dominate but do so to the total exclusion of all else. Those that protest call all this progress, to which the rest of the world asks, “where is it?” We have an enormous corporate risk and debt bubble at the same time as no recovery and a global economy close to, if not already in, recession. Monetary theory wholeheartedly and enthusiastically embraces the former to all exclusion about the latter. How is that not debasement?

There is a tremendous amount of inflation, including asset bubbles, that does not fit into the orthodox treatment of it because it was the orthodoxy itself that wrote the intentionally narrow definitions that are supposed to apply here. If you think the CPI is the full extent of inflation, then everything that has been done since 2009 is consistent with that idea – including the utter confusion engendered by all the “stimulus” with no tangible economic result. If, however, you see inflation properly defined you cannot go anywhere without experiencing its destabilizing effects; “dollar” included.

If “anything goes” so long as it helps with the asset price channel for some intended “wealth effect”, there should be no surprise that in the end “anything goes.” Monetary policy went all in on this very point expecting to get a recovery years ago, let alone 2014 with all that purported job expansion. That is another parallel between the 1930’s and today, as FDR’s monetary efforts bore little other than temporary artificial reprieve. The re-depression in 1937 was proof of that, and we may be getting a taste of the same once again. History does rhyme, which is a terrifying prospect if central banks keep expanding their fingerprints on total redefinition.

Stay In Touch