The ISM Manufacturing PMI for June was up to 53.5 which was the best monthly showing this year. That has been taken as inarguable insistence that the US factory sector is doing what economists expect, even though 53.5 is significantly below both June 2014 and the 12-month average (which includes four months beginning February below 53) of 54.7. As usual, the PMI is abused as to what it may actually mean:

U.S. manufacturers ended the second quarter on stable footing, reporting a strong flow of orders that could help support the overall economy in coming months.

The Institute for Supply Management on Wednesday said its purchasing managers’ index edged up to 53.5 in June from 52.8 in May. The index, based on a survey of supply-chain executives, is back up to its January reading after stalling in the early spring. A reading above 50 denotes expansion in the sector.

“Manufacturing is over its winter hump,” said Ward McCarthy, chief financial economist at Jefferies, pointing to first-quarter drags from the bad weather and shipping delays caused by the West Coast port slowdown.

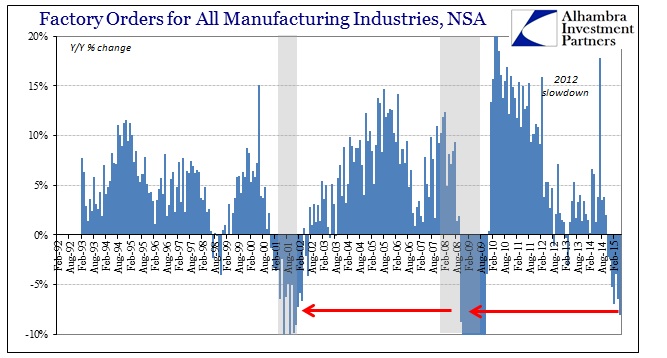

That proclamation from the credentialed economist looks strikingly overwrought in light of highly contradictory and contractionary information about factory orders, which sank 8% in May. Even if the ISM PMI is correct about June being better it isn’t appearing so significant in its inflection as to erase all 8% to just get back to zero.

On the other hand, several other PMI’s are taking the opposite direction. In fact, the ISM’s version is isolated in suggesting a pickup in activity, as the rest of the highly pliable PMI’s are quite clear in the contrary interpretation. Markit’s Manufacturing PMI, for instance, fell to its lowest level since October 2013, leading its chief economist to note of “seeing a loss of momentum heading into the third quarter.” Even Markit’s Services PMI fell and largely corroborated the manufacturing version (as much as PMI’s might be able to). About the services version, Markit’s chief economist was rather blunt:

The latest flash PMI surveys showed the smallest rise in service sector activity since January and the slowest growth of factory output for over a year and a half, linked to the strong dollar.

With the exceptions of the weather-related slowdown at the turn of the year and the 2013 government shutdown, June saw the weakest pace of economic growth since May 2013.

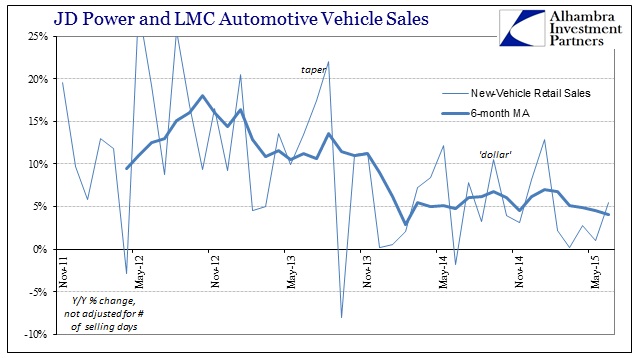

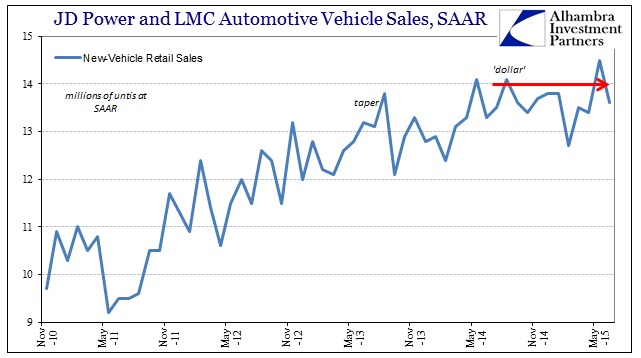

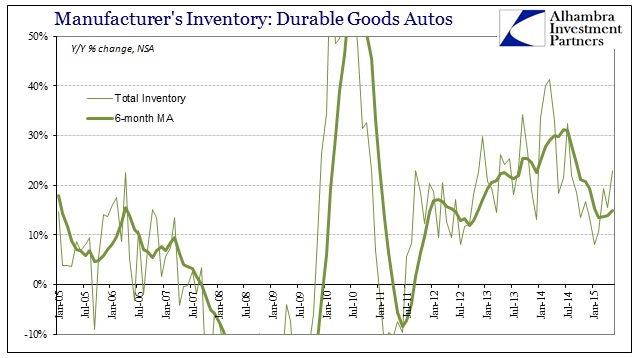

It isn’t just the lack of sales growth at end sales points that is the problem here, as certainly inventory is so far out of alignment (from, likely, listening to economists talk with such certainty about how PMI’s near 60 last year were the definitive measures). But what might be taking 2015’s slump into that recessionary level, PMI’s or not, may be the auto sector. Auto sales are still projected to be at or near all-time and cycle highs, but that view is quite misleading as there has been a clear slowdown in the pace of sales expansion. You can make the same statement about any cycle peak, as all-time highs shortly become something altogether different if the growth of actual sales slows too precipitously while still making those new highs.

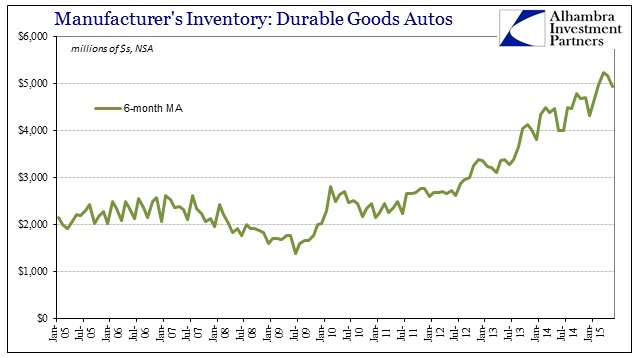

Depending on the measure of auto sales, the speed has at least crawled to nearly a halt dating back to last summer. According to JD Power’s estimates, domestic new vehicle auto sales jumped above 14 million in May 2014 and have rarely been at or above that pace since. While sales were at an estimated 14.7 million last month (May 2015), the accumulation of lagging sales over the past year has been in clear divergence from, what else, inventory.

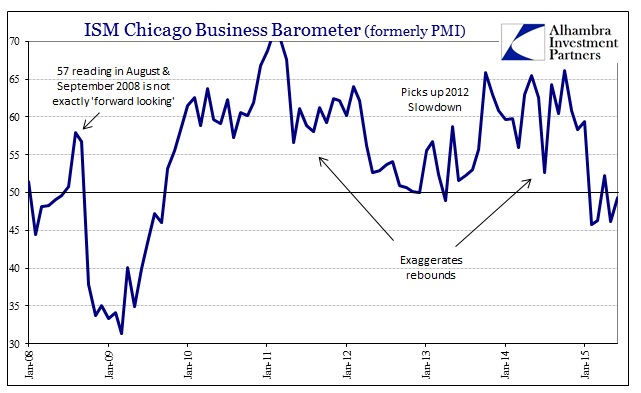

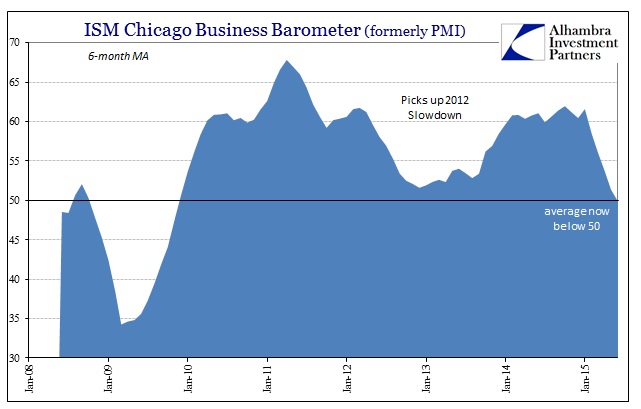

That would seem to form the basis of another depressing PMI, the Chicago Business Barometer. The Chicago BB has historically been associated with the auto sector, and the potential for serious declines in production due to flagging sales would at least start to explain its rather uncomfortable results.

While the calculated index rose more than 3 points in June, it was only to 49.4 indicating how big the likely manufacturing hole so far has been. That left the BB below 50 for fourth month out of the last five; the 6-month average is now below 50 for the first time since the Great Recession.

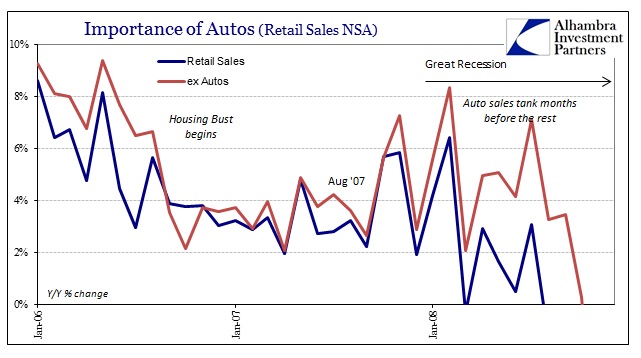

The danger of an auto sector taking in a reduced production pace is, again, recession itself. It was autos that led the first phase of the Great Recession where the rest of consumer spending and sales were still somewhat enthralled by rising prices if little else. In other words, it was the serious decline in autos right out of the gate of the financial implosion that set the recessionary tone, and even the broader decay in production levels.

The script, so to speak, has been flipped especially since the 2012 slowdown. In other words, without auto sales now the appearance of recession would be much less arguable than it already is, and would have shown up much, much sooner. There is little doubt that autos have been moving based almost purely upon credit, often subprime, through leasing (almost exclusively these days), which is really another damning point against monetary theory (which expects such credit-based spending to lead to much better and broader economic fortunes rather than be left as the one artificial positive note in an otherwise deficient and sinking system). In other words, spending for the sake of spending, even on autos, didn’t produce the recovery in “aggregate demand” as was expected.

The opposite case, however, is quite and dangerously asymmetric. Whereas the artificial support of high auto sales and therefore production didn’t have much economic effect, a decline, potentially, due to inventory and falling production surely will. That may be why US factories are, apart from the somehow “lovely” ISM, seemingly heading quite seriously in the wrong direction regardless of how Q2 GDP or anything else works out in the statistics. Factory orders are already heavily contracting and the best any of the PMI’s, in fact the only one, only hints at a minor improvement; the balance are far less reassuring if not suggesting outright quite the opposite.

Stay In Touch