The FOMC policy statement released last month wasn’t improved by the “minutes” publicized today. If you believe the committee is “hawkish” then there is plenty for you to find agreement; the opposing equally so. From what I see, they spend an inordinate amount of time and words on the labor market, but after repeated emphasis that instead of fashioning confidence actually begins toward confusion. The labor market is clearly great and getting better, but…

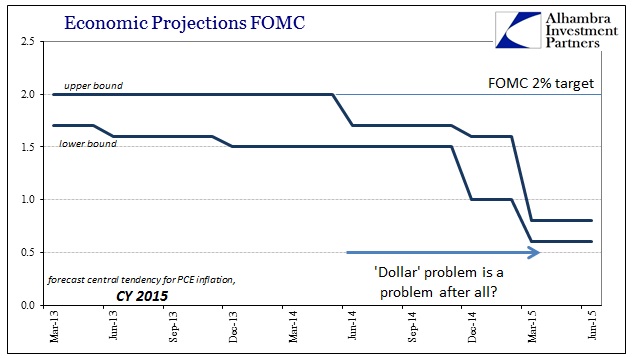

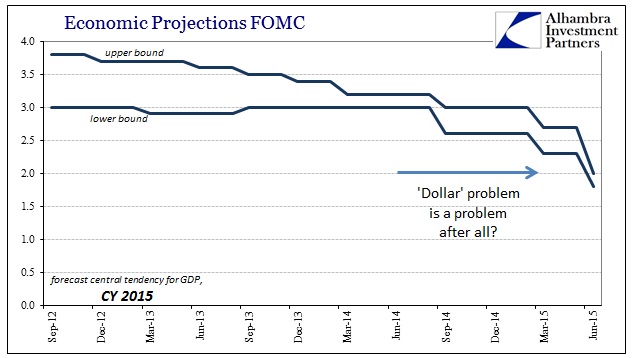

If that were the case, there would be no qualification necessary; and they know it. Right at the outset is the Fed’s first official mandate which has been twisted by mathematical trickery into somehow finding 2% inflation as an intended target which creates price “stability.” Yet, for all their conjuring and QE’s, the PCE deflator has remained underneath that target for going on now three full years. In the orthodox understanding, that is a major problem and indicates more than something amiss.

While the FOMC was encouraged that oil prices had at least stabilized up to the middle of June, that isn’t the case now as once more (without another “dollar” inflection) energy will be dragging down inflation.

Total U.S. consumer prices, as measured by the PCE price index, only edged up over the 12 months ending in April, held down primarily by earlier large declines in energy prices. Core PCE inflation, which excludes food and energy prices, was 1¼ percent over the same 12-month period, restrained in part by declines in the prices of non-energy imports.

Core PCE at 1.25% is far, far from the 2% target. Since orthodox thinking links “inflation” directly to wages, the primary mandate straight away almost dismisses all the talk about how grand the labor market is getting along. In other words, even the Fed’s own view of inflation, and its role in it, is defying their preferred interpretation and has only become much worse in 2015. The most the FOMC could manage about wages were some hopeful-sounding anecdotes:

According to business contacts in a number of Districts, many firms looking for new workers said they had been raising wages selectively to attract them; some had also begun to raise wages more generally. However, several participants pointed out that, even with the recent upturn, wage increases remain subdued.

If that’s the best they can find, it simply isn’t there. They as much admitted that fact when finally getting around to their own idea of “data dependent” rate policy:

During their discussion of economic conditions and monetary policy, participants commented on a number of considerations associated with the timing and pace of policy normalization. Most participants judged that the conditions for policy firming had not yet been achieved; a number of them cautioned against a premature decision. Many participants emphasized that, in order to determine that the criteria for beginning policy normalization had been met, they would need additional information indicating that economic growth was strengthening, that labor market conditions were continuing to improve, and that inflation was moving back toward the Committee’s objective.

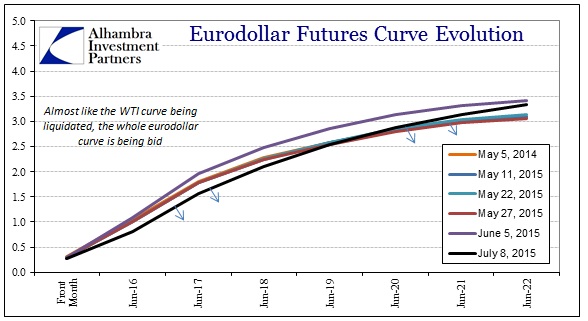

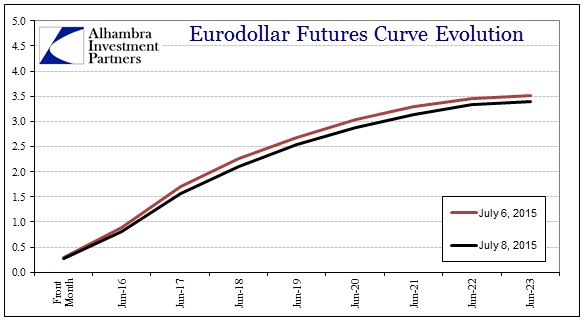

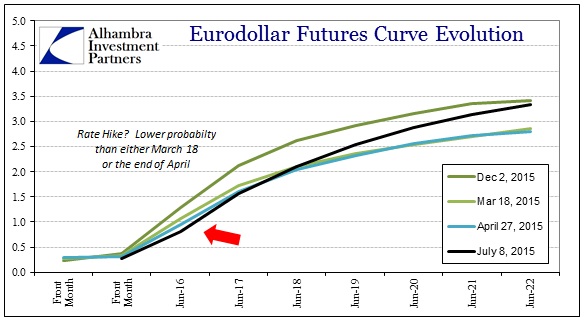

Since conditions have changed since the June meeting, especially with the “dollar” and oil, it is little wonder that money markets have moved against a rate hike in the near term. The eurodollar market, in particular, has been heavily bid the past few days, maybe as an acknowledgement of the combination of disparate (intentional?) attitudes in policymaking tending toward confusion again out of a rather muddled, aggregate viewpoint. If the FOMC cannot point to anything tangible about this recovery, even now after spending more than a year talking it up incessantly, they may never get to that point as accumulated weakness is actually asymmetric the further it drags on.

The futures curve in eurodollars has flattened out somewhat, but the near-term is where it is most directly related, I think, to any potential policy interpretations.

Of course, the money markets may not care at all, or at least much, about what the FOMC is thinking; paying much closer attention to the world as it has changed in the past week or two. In other words, the eurodollar curve is bid right now much as the WTI curve has been uniformly sold, as acknowledging that the state of the world isn’t again conforming after only briefly hinting it might. While that may, eventually, translate into the Fed never getting to actually raise rates, the market view would have that as reactive rather than setting the course as the committee surely intends (rational expectations and all that).

I doubt that was what the FOMC had in mind in perpetually referring to “data dependent.” So far of that supposed standard consists of them talking about, again, the Establishment Survey and why the economy continues to underperform anyway. What is likely most important, if you understand how the Fed sees itself and its own operations, is why the Fed is so intent on making everyone think it sees recovery. The worst case for monetary policy is to be fully engaged, or nearly so, when the next downturn occurs:

Other concerns that were mentioned were the potential erosion of the Committee’s credibility if inflation were to persist below 2 percent and the limited ability of monetary policy to offset downside shocks to inflation and economic activity when the federal funds rate was at its effective lower bound. [emphasis added]

Maybe that is “hawkish” in a more general sense that they will raise rates just to do so, but in reality it is a huge constraint – if there were some “shock” in the near term they would do serious damage to their all-important credibility by raising rates only to “have” to undo that in short order. In my view, there is palpable fear of just that scenario spread across the 25 pages or so of sanitized material, which is what all this “data dependent” noise is really about. They see markets under far less illusion than they would like, and worry that without unambiguous recovery they will end up doing more damage than by actually doing nothing.

I think that is the proper interpretation of the whole wadded mess of words, though, as mentioned at the outset, there is nothing really conclusive here. That seems to be why money markets are so little swayed by the do’s and don’ts of each of these policy meetings thereafter the sharp change in March. That March meeting set this course as it was an acknowledgement, with an unusual degree of clarity, that the recovery wasn’t; everything so far afterward has been really about groping to estimate some limitations on the downside, no matter all the happy labor talk stuffed in between. While in June there may have been a slightly better outlook in the orthodox pieces, that has now been superseded and/or erased.

Stay In Touch