When US retail sales jumped in May on seasonal adjustments alone, economists and mainstream commentary lost all composure as they were certain that meant the “slump” was over and the dominant narrative would continue. The same occurred in Europe over a slight pickup in overall lending, not even in the household or business sectors, which was proclaimed as nothing but the beneficence of QE already working. Neither of those “certainties” lasted more than a month, as US retail sales in June were “shocking” and lending in Europe quickly fell back to its normal flatline (which the ECB has really not been able to affect through its entire five years of deep experimentation).

This is nothing new, of course, as every uptrend is extrapolated into the recovery while at the same time every bit of weakness is qualified “temporary” or “anomalous.” The result over time is the regular saw-toothed monthly variation steadily sinking on that “unexpected” but somehow persisting downtrend. If you don’t observe the overall context beyond those shortest variations you might actually expect a domestic or global recovery intact.

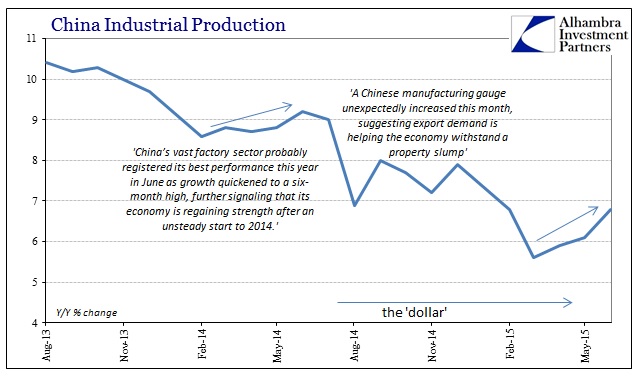

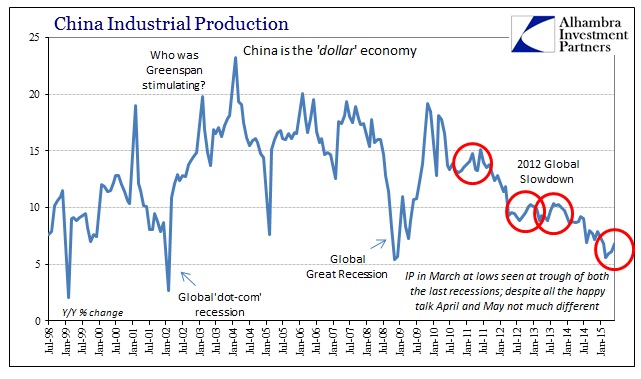

Such is the case now with China, as conditions there haven’t gotten worse in the past few months. That immediately is declared the absolute proof that all is right again and “stimulus” has finally, finally found its magic once more. Chinese industrial production in June was 6.8%, having risen for three straight months from a multi-year low of 5.6%. Retail sales there were up to 10.6%, the second consecutive month of acceleration. GDP held steady at 7%, which is taken as a positive that it wasn’t worse.

Such commentary is not just short-sighted, it is downright short of attention span. In industrial production alone, the same exact pattern played out just one year ago with all the same projections and extrapolations assuring everyone the “slump” was then over and that global growth was ready to pick up – and do so with gusto and unusual fervor. After falling to a “shocking” 8.6% in March 2014, Chinese industrial production increased over the next five months (with one statistical setback in May 201) but in the end that meant nothing about the future.

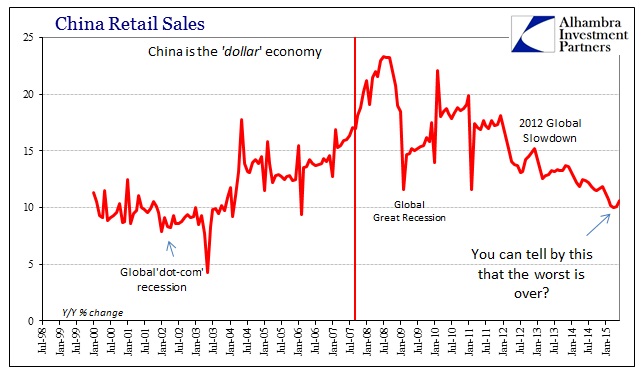

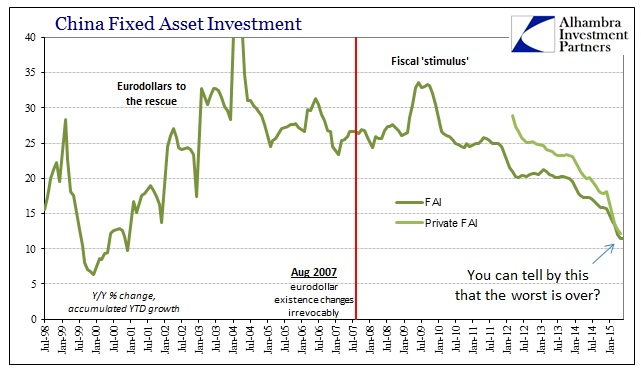

The same is true about retail sales and any of the other Chinese figures (or American, or European) where every positive sign or acceleration is, again, supposed to be definitive but none of them are. Instead, you can plainly see these serial recovery narratives subsumed time and again by trends that are supposed to be impossible, all along the downside axis of the general global economy clearly and steadily depressing.

Retail sales in China fell from 15.2% in December 2012 all the way to 12.6% in March 2013 (taking January and February into that calculation due to the Chinese New Year). That, too, was declared “transitory” and even appeared to be so as retail sales continued to accelerate all through 2013 and reaching 13.7% that November; to obviously no avail beyond that.

The three-month run of industrial production may turn out to be meaningful over the intermediate and even long terms, but context here more than suggests that is far more likely to not be the case. Economic trends are not found in monthly or even multi-month variation but rather in complete and comprehensive (as much as possible) analysis. In other words, even in the Chinese data itself, there isn’t much positive about potentially arresting the multi-year downtrend. That interpretation is strengthened by both the eurodollar system’s decay and how that has turned into a global downward trend, bordering on global recession in 2015 (if not already so).

We can gain a better understanding of where China is heading by what it is doing “to” other related economies. I have in the past used Brazil as a proxy for China’s growth path, as new orders from any expected strength (real, not statistical variation) will show up in the resource economies first. Brazil is in recession right now and is on track for -1.5% GDP for the full year of 2015, which would be the worst economic result in decades.

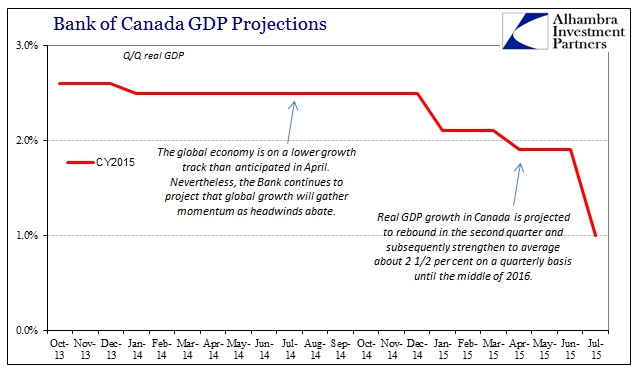

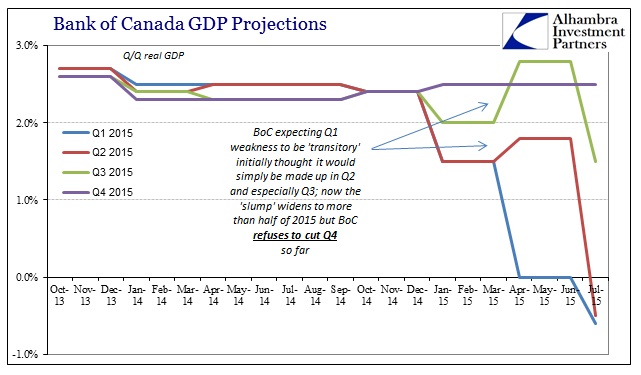

It isn’t just Brazil, however, as even Canada find itself in a likewise “unexpected” recession at this moment. The Bank of Canada, coincidentally today, just cut its economic growth projections for 2015 from 1.9% all the way to just 1.0% – and that is as likely to be overly optimistic too. Like the FOMC and ECB, the BoC find itself in a “slump” it never saw coming and one now that has lingered beyond all transitory descriptions of it being transitory.

Just last year, in July, BoC noticed the same slowdown attributed to as much snow in the US (but, curiously, not winter in Canada?) but was defiantly confident that such global weakness could not be anything but an aberration.

Running into 2015 and the “dollar” and petroleum, you can see plainly above that BoC treated it as the FOMC and every other central bank and orthodox concoction. Q1 turned “shockingly” weak but that was supposedly not meaningful – BoC even upgraded Q2 expectations in April because of it! Instead of finding that quick, sharp rebound, Q2 GDP, which was forecast just three months ago at 1.8%, is now -0.5%. Q3 which was then predicted to be the turn, estimated at 2.8% in April, is now doused by the growing disaster; with the July updates cutting Q3 by 1.3%, down to just 1.5%.

Even with that reality crashing into now more than a half year of what really looks like recession, BoC still maintains that it will simply end and that Q4 now will be the restart of global growth, continuing into 2016.

As if to assure how little assurance the Bank has provided, along with all these economic reductions, BoC also today cut its main O/N rate by 25 bps to 0.5%, declaring, essentially, that it doesn’t really understand what is taking place:

The Bank of Canada is cutting its key interest rate for the second time this year, citing a larger-than-expected first half contraction and a “puzzling” stall in non-energy exports. [emphasis added]

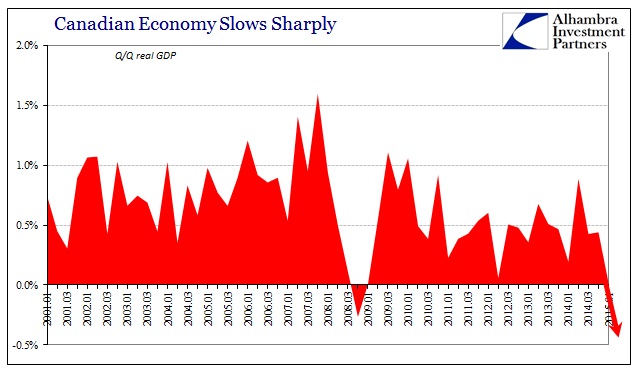

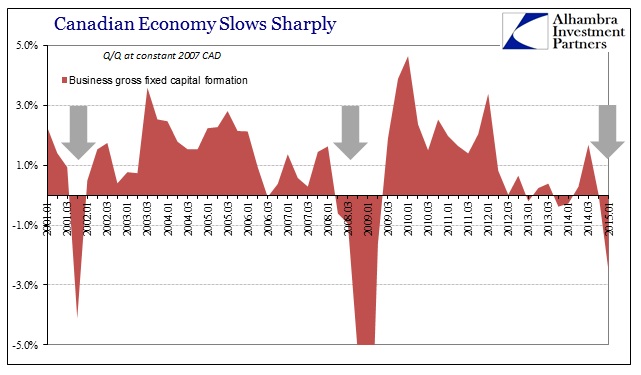

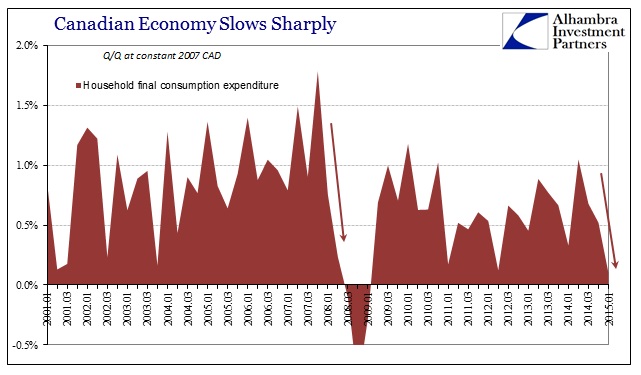

The formed recession in Canada has been typically blamed exclusively on the energy sector. That simply is not the case, as what is happening to the Canadian economy, like the US economy relatedly, is widespread. Not only is GDP sinking it is doing so at a rate like Canada’s experience of the Great Recession. Business investment (capex) is dropping in a clear recession signal, while even household expenditures have slumped quickly, so much so that it is a sign of full economic retrenchment indicative of, again, full-blown recession.

It was easy to blame oil and the “dollar” for everything a few months ago, but this has taken beyond all that. The US is supposed to be the cleanest dirty shirt in all this, but imports were down 7% in May which starts to pull all these disparate economic systems into that context. China sells a lot of marginal economic production to the US, as does Canada (which also sells a great deal to China). Global recession does not occur in a straight line, nor does it parcel itself in individual economies in perfect synchronization of monthly directions. But the arrows in all these economies are still pointed down, and decidedly so now, which is far more important than any of the shorter descriptions that are taken as the recovery.

The global economy is in serious trouble, and it is not just now starting to spread it is already widespread. There is little comfort in seasonal adjustments to US retail sales, any minor uptick in European lending nor much of any of the most minor improvements in Chinese economic stats; the full, global picture is already mostly filled in, just as the “dollar” had begun painting it a little over a year ago.

Stay In Touch