Wow what a recovery. The S&P 500 Cap-Weighted Index ((IVV)) held support at the 200-day moving average and bounced right back to the top end of the range it has been trading within since February. The index has been straddling the 50-day moving average for some time now. If it can’t blast through the 2120 level, look for the index to retest the 50-day moving average yet again. The S&P 500 is up 4.42% for the year.

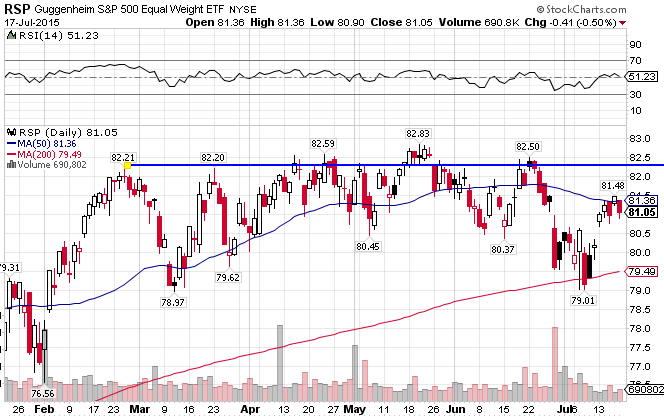

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the out-performance versus the cap-weighted index in the last decade. The index is up 2.05% year-to-date, slightly underperforming the cap-weighted index, despite a stronger year for small caps. Very peculiar.

One of the themes of the past decade has been growth-oriented, smaller cap stocks outperforming high quality, blue chip stocks. The trend for 2015 has followed that closely, as the Russell 2000 index ((IWM)) is outperforming the large cap index by a significant margin (5.91%).

The S&P 500 versus the Russell 2000 Index, Weekly Chart. The large cap index has underperformed since the last quarter of 2014, and currently finds itself just above support at the 200-day MA. Expect a big move soon, as the trend lines are merging.

The MSCI EAFE Index ((EFA)) seems to have turned the corner this year, despite the troubles in Greece and a weakening Chinese economy coupled with a deflated stock market. The index is up 9.16% since the beginning of the year, significantly better than its US counterpart.

The MSCI EAFE Small Cap ((SCZ)) has performed significantly better, with an impressive gain of 11.79% for the first part of the year. Like the US markets, international small caps are outperforming the large cap index.

EAFE Large Cap Index vs EAFE Small Cap Index, Weekly View. It’s been a steady small cap outperformance since October of last year.

Stay In Touch