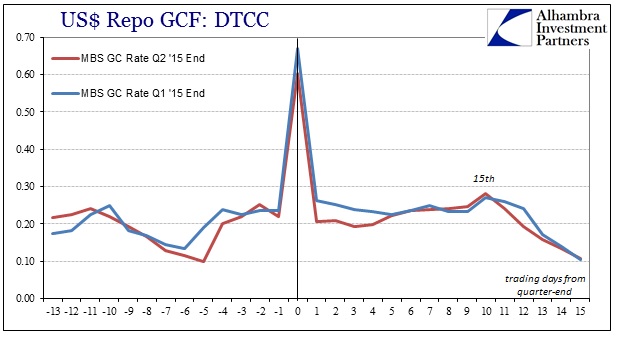

Having past the fifteenth of the month, the first month in the new quarter, the repo “cycle” for the quarter end has completed. Repo rates have followed almost exactly the same pattern as three months earlier, pivoting on both the quarter end and the 15th each time. This is not just unusual, it shouldn’t happen.

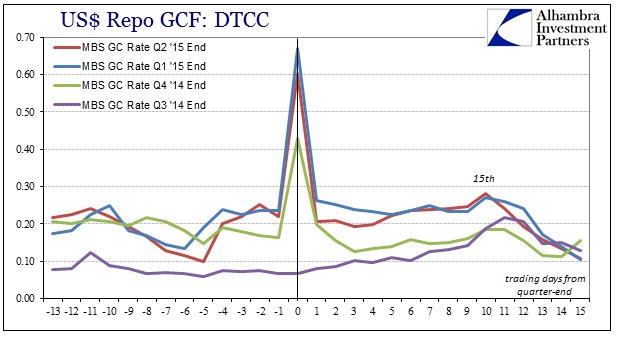

Compared with other quarter-end periods, the volatile nature that is supposed to exist of “markets” shows up.

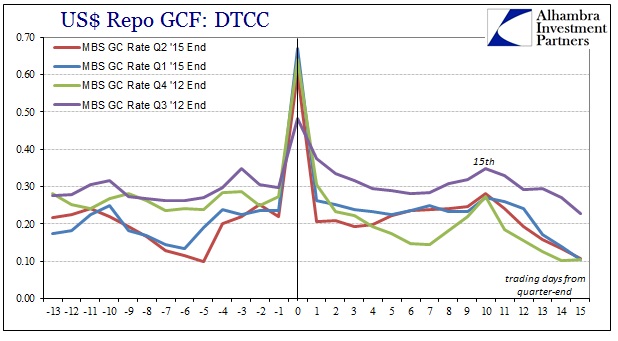

That is also true when you compare the recent quarter ends with similar circumstances in 2012; at the end of Q3 ’12 and Q4 ’12.

What is noteworthy about the noise of quarter-end patterns above is how the middle of the following month is prominent across all these periods. I would consider each of them to be circumstances of a higher degree of stress, and so I think that the repetition even where it is only the contours is significant; there is no fundamental reason that the 15th would keep on showing up so prominently other than an inherent, systemic factor. There is a systemic bottleneck here that remains unappreciated, one that has gained so much in 2015 that the repo market itself repeats now almost exactly.

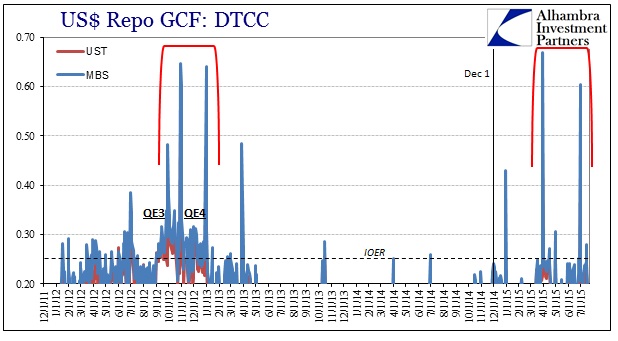

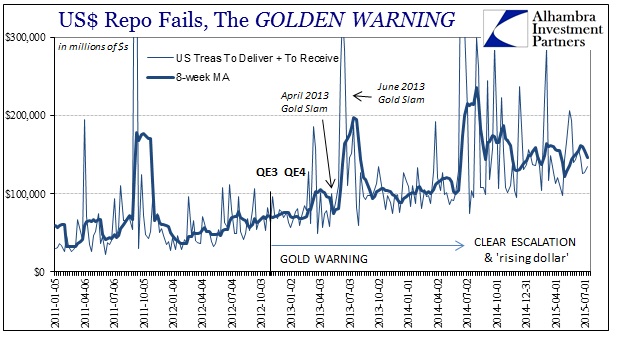

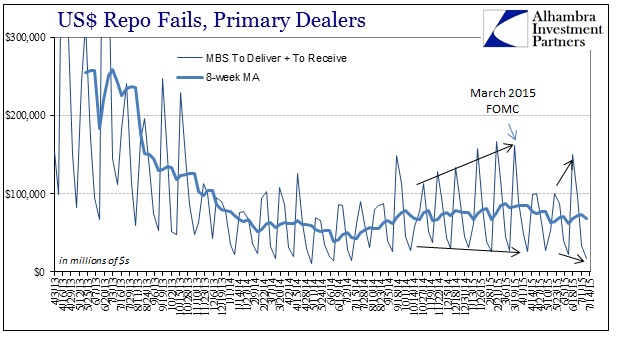

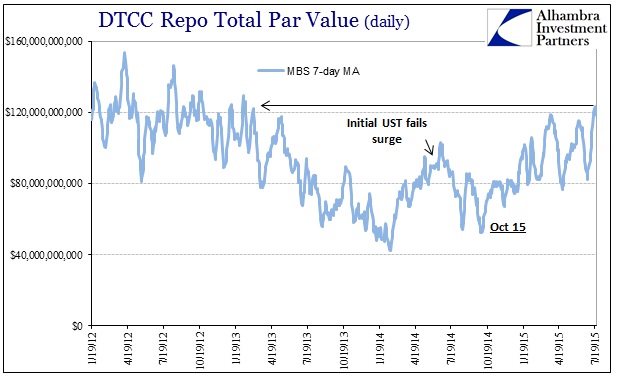

Other stress indications, such as fails, show no acceleration of transaction problems but remain in an elevated state. With gold getting hammered once again, I wouldn’t be surprised if the next update for fails was different. In any case, none of this is suggestive of a healthy, vibrant wholesale money market; just the opposite. Even volume might be more indicative of stress rather than natural and positive growth.

Stay In Touch