Top News Headlines

- Chinese stocks plunge, then stabilize

- Linn Energy shows shale bust isn’t over

- Whole Foods stock hammered on earnings

- Twitter beats estimates, stock makes 52 week low

- Gold stops going down

Economic News

- Durable goods orders rebound, still down almost 3% year over year

- Dallas Fed improves but still negative

- Case-Shiller shows surprising weakness in home prices

- Richmond Fed better than expected

- Consumer confidence misses big, weakens substantially

- GDP weaker than expected, annual revisions show weaker recovery

- Employment Cost Index up only 0.2%, lowest result in 33 years

- Chicago PMI much better than expected

- Fed meets, nobody notices

Random Thought Of The Week

The New York Times reports today that Joe Biden “has begun to actively explore a possible presidential campaign”. What exactly does actively explore consist of? Is there anything more to it than dialing for dollars? Is there any chance that this buffoon could get elected President? How is it that our country has fallen to such depths that Joe Biden and Donald Trump are serious candidates for President?

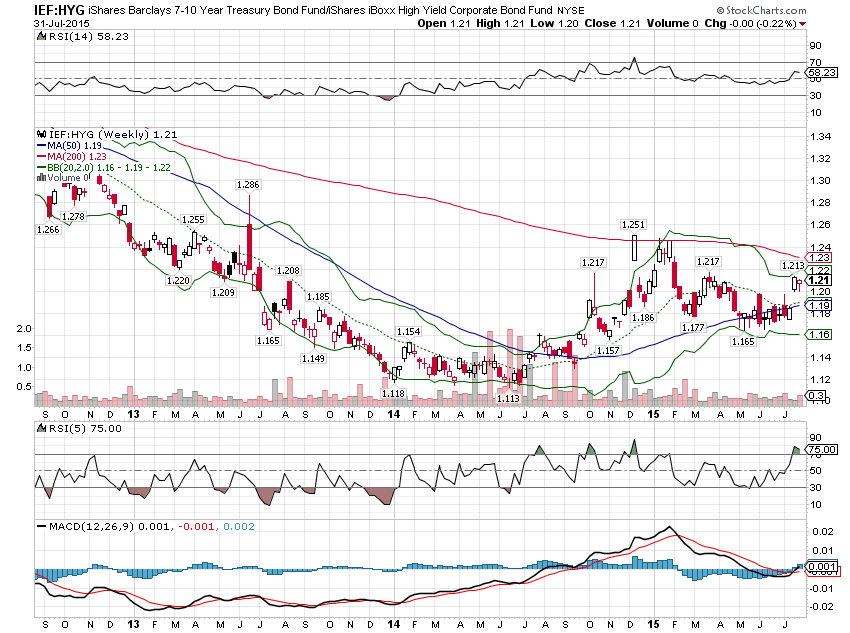

Chart of the Week

Treasuries have been outperforming high yield bonds since mid-2014. This is just another way of looking at credit spreads. Rising credit spreads are generally negative for stocks because they are negative for economic growth.

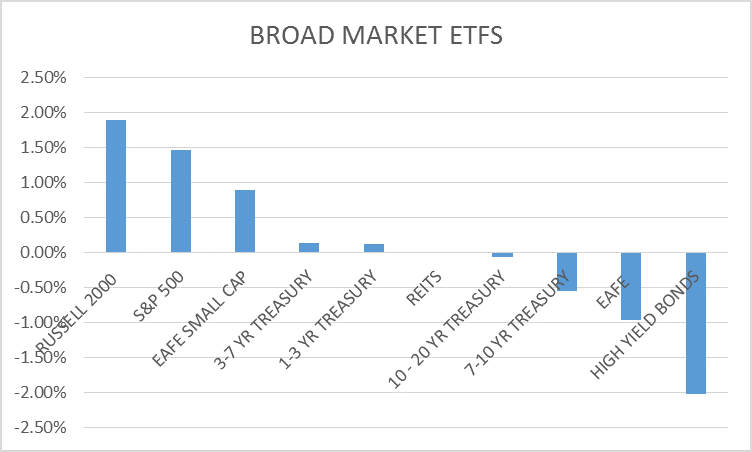

Broad Market Top 10 – 3 Month Returns

See Alhambra’s Momentum Asset Allocation Model portfolios.

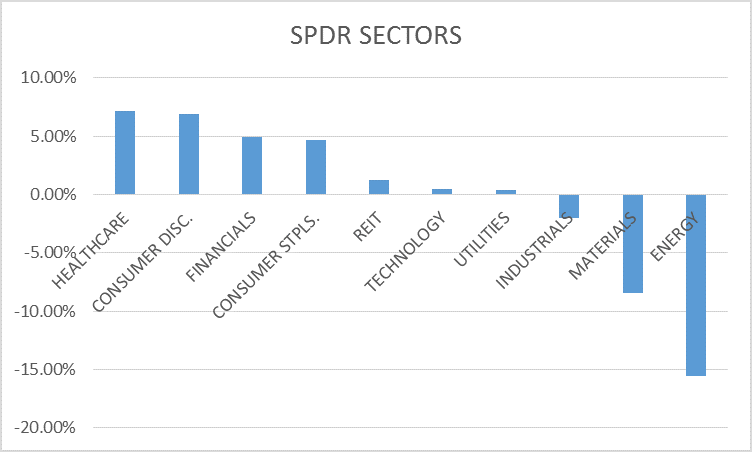

SPDR Sector Returns – 3 Month Returns

See Alhambra’s SPDR Sector Rotation Model portfolio.

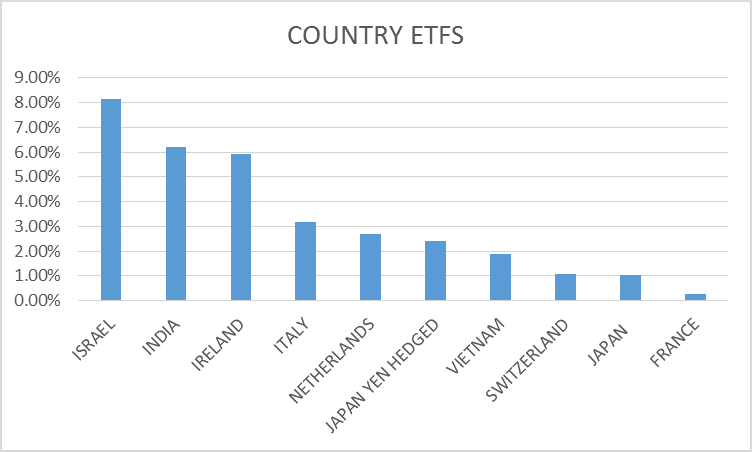

Country Returns Top 10 – 3 Month Returns

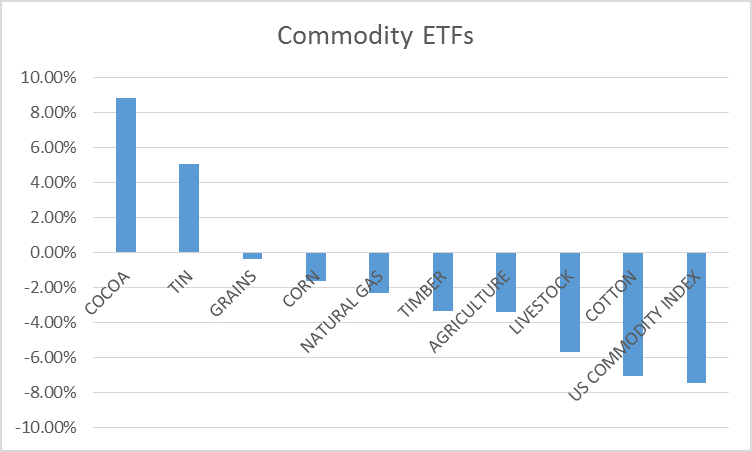

Commodity Returns Top 10 – 3 Month Returns

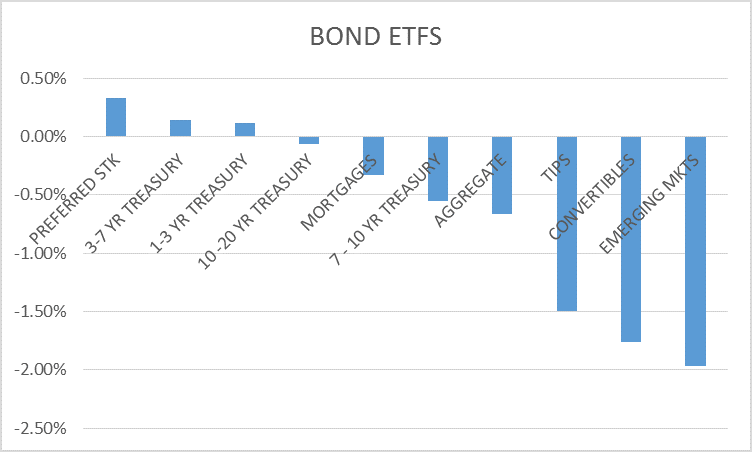

Bond Returns Top 10 – 3 Month Returns

Stay In Touch