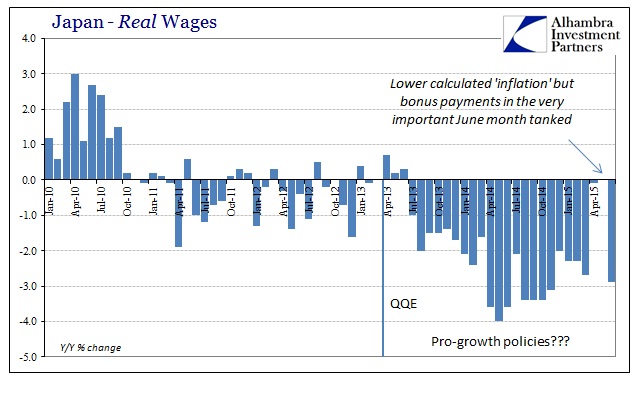

With base comparisons out of the way moving past the calendar months of Japan’s tax change last year, the continuing recession re-emerges. Real wages fell 2.9% year-over-year in June despite “inflation” remaining far below (thankfully for the Japanese) Bank of Japan’s intentions. Contractual earnings nominally were slightly higher but “special cash earnings” fell 6.5% after rising 25% in May. That may not sound like enough of an offset to create such a large monthly decline, but those percentage changes are misleading – June is, by far, more important in terms of bonuses as the second largest “pay month.”

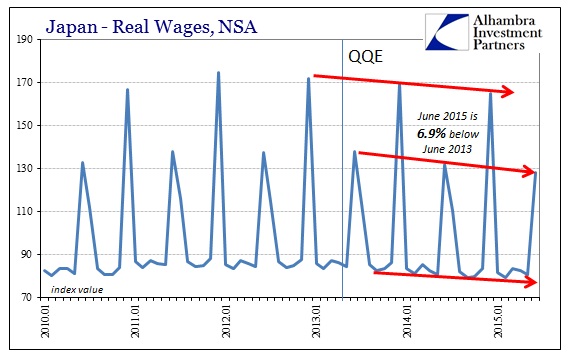

Despite the fact that nominally Japanese firms are doing, supposedly, much better profit-wise due to the yen interference it was big companies (defined as 30 or more employees) that cut back on bonuses the most. Where real wages overall declined by 2.9%, those of these large companies fell by 3.6%. In terms of June, real wages for 2015 are almost 7% below June 2013 when all this QQE “stimulus” began.

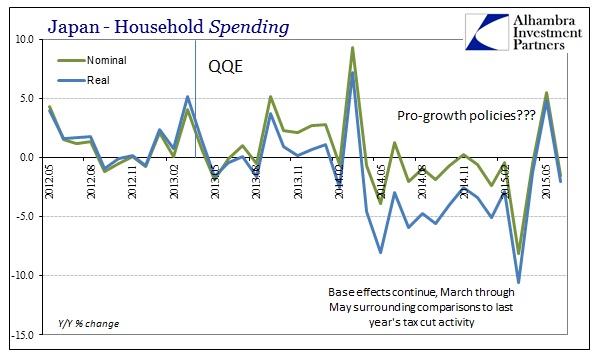

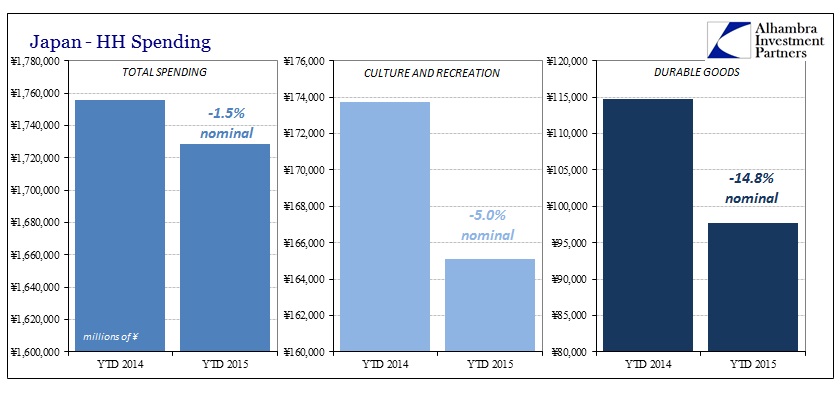

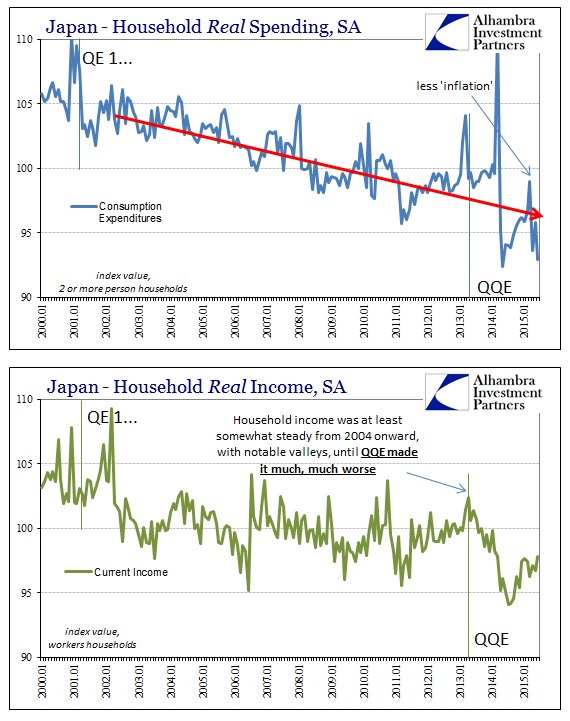

Given that contractionary wage environment it is unsurprising that household spending would renew its decline. Real spending in May was up almost 5% but that was due to a direct comparison to the darkest months immediately following the tax hike and therefore not meaningful in terms of Japan’s current economic direction. In June, household spending fell 1.5% in nominal terms and 2% in real terms (benefiting, ironically, from the low “inflation” figures).

The state of Japan in the first half of 2015 is as the state of the US – contraction all around. For Japan, that is simply the continuation from last year which was just assumed to have ended because all at once QQE is assumed to have worked at something somewhere despite the ubiquitous lack of evidence anywhere. As noted consistently when discussing Japan, the effect of QQE is actually enormous but in the “wrong” direction; making Japan quite relevant and important as an almost pure dissuasion against monetarism.

Measures of real income are showing gains in comparison only to the huge hole QQE left last year, in contrast to wages. That would more than suggest that “incomes” are measured of something less tangible to actual Japanese households who are more attuned to changes (lack of actual growth) in wages; as wages continue to fall by every view so does spending. In the end, it doesn’t matter about a positive number for incomes since either are significantly lower in comparison to the pre-QQE period.

Since the base comparison difficulties are now left behind, there can’t really be much doubt about QQE’s effects but somehow it remains the mainstream position that all this will eventually, at some unstated future date, just work. The entire Japanese economic picture, including GDP (set for renewed contraction itself), argues decisively against QQE having contributed anything positive to the economic climate. What is truly clear about QQE is the huge economic hole it ripped through Japan that is only getting bigger; yet whispers are for more “stimulus.” Having suffered the blunt end of all this redistribution, you can appreciate why spending may be declining if only in anticipation of more of it.

It has been more than 2 years since the experiment was unleashed and it hasn’t come close to meeting any expectations (which were totally “assured” by every good economist and central banker in good standing anywhere) including the very “inflation” target that was supposed to easily fall to the tremendous wave of debasement. In April 2013, BoJ said 2% in 2 years, but the CPI in June 2015 is +0.5% and wages and spending are still, still contracting worse than they ever were in the years (including the earthquake/tsunami) before QQE. As in the US, monetarism in Japan is still, somehow, described in positive and helpful terms despite all evidence and observation easily declaring it only helpful in shrinking the economy further, perhaps in permanent fashion.

That seems to be the grand correlation for the 21st century; more monetarism, more shrinking.

Stay In Touch