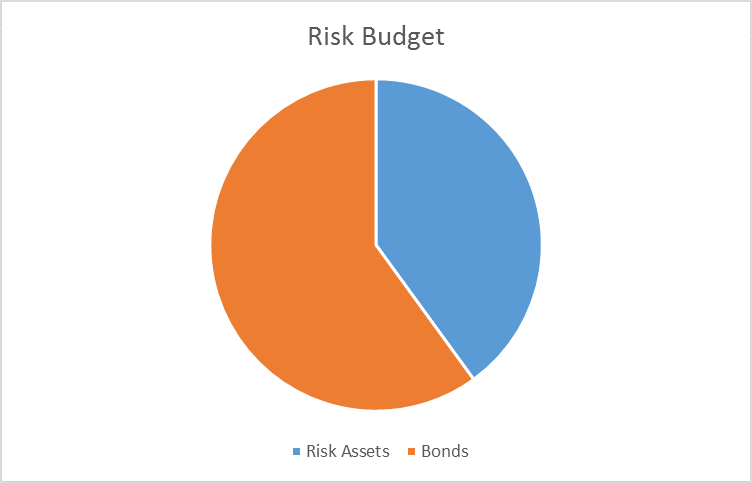

I am lowering our risk budget this month based on several factors. For the moderate risk investor, the allocation between risk assets and bonds moves to a defensive 40/60 versus the benchmark of 60/40 and last month’s 50/50.

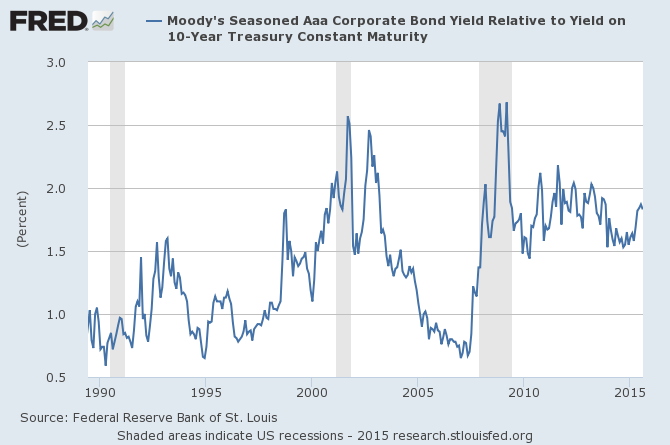

- Credit spreads have resumed widening as crude oil prices have resumed their downtrend. The downtrend in high yield credit prices may be concentrated in energy issues but it isn’t confined to that sector.

- Momentum has shifted notably over the last month to long term bonds as inflation expectations have fallen considerably.

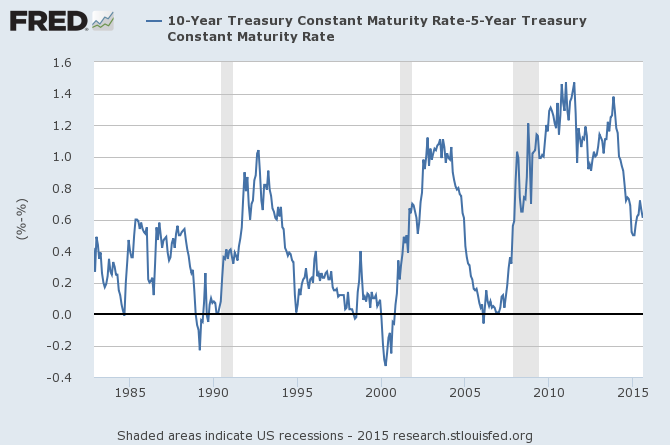

- The yield curve flattened during the month. Although the curve has not fully flattened yet – indeed sits in the middle of its historic range – I am still uncertain as to the degree of flattening we’ll see before the next recession. I am choosing to be conservative in my approach to asset allocation.

- Valuations are still high by historical standards and revenue and earnings growth is very weak.

Of the four items we monitor for asset allocation, three are flashing warnings. The change in credit spreads last month approached 10%, well above the 7.5% level we use as a warning sign. Momentum, as I’ve noted numerous times the last few months, has rolled over for the S&P 500 and now upward momentum can be observed in long term bonds. It is not as concerning as it might be though since the rally in the long end has also included high grade corporates. Lastly, reliable valuation methods continue to show a stock market near all time high valuation levels.

The only indicator not flashing a warning is the yield curve which is still far from flat, the condition most commonly associated with pre-recession.

With rates so low though an outright inversion seems highly unlikely and even getting to flat would seem a heroic feat. If that happens, I cannot imagine that stocks will not have already succumbed to altitude sickness.

Credit spreads moved wider on the month enough to trigger a sell signal for stocks. High yield spreads are not yet at levels associated with past recessions but the rate of change is concerning. Historically, rapidly widening spreads are a sign of stress and are associated with stock market corrections. Furthermore, Baa spreads are already at recession associated levels and investment grade spreads remain elevated across the credit spectrum.

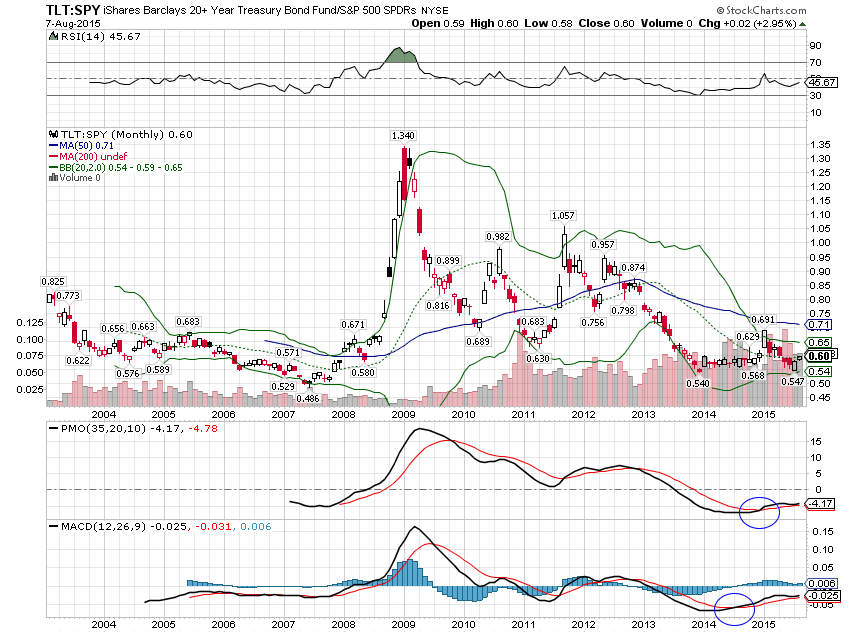

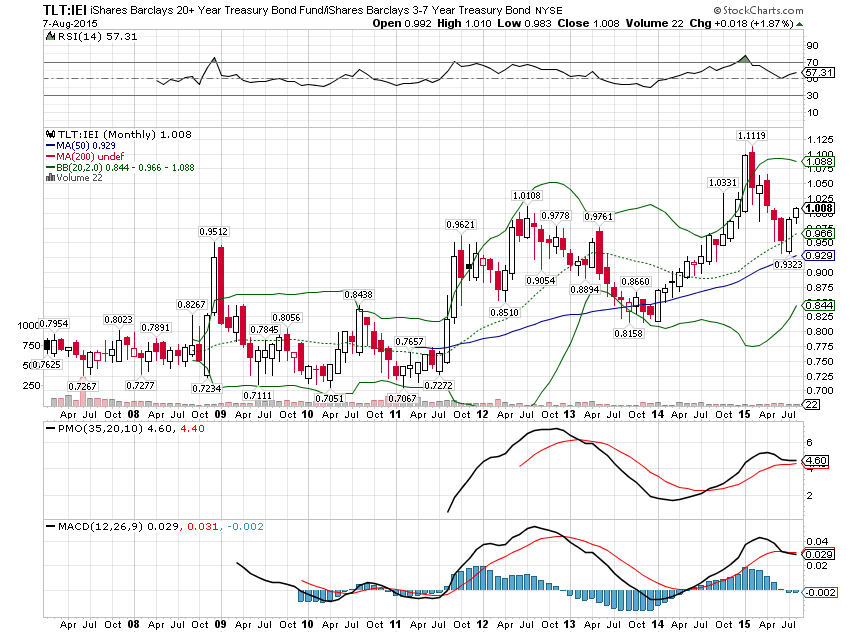

Momentum shifted during the month to bonds, a trend that is actually pretty well established although it stumbled a bit earlier this year:

Longer term bonds continue to outperform shorter maturities, exactly what we would expect with inflation and nominal growth expectations falling:

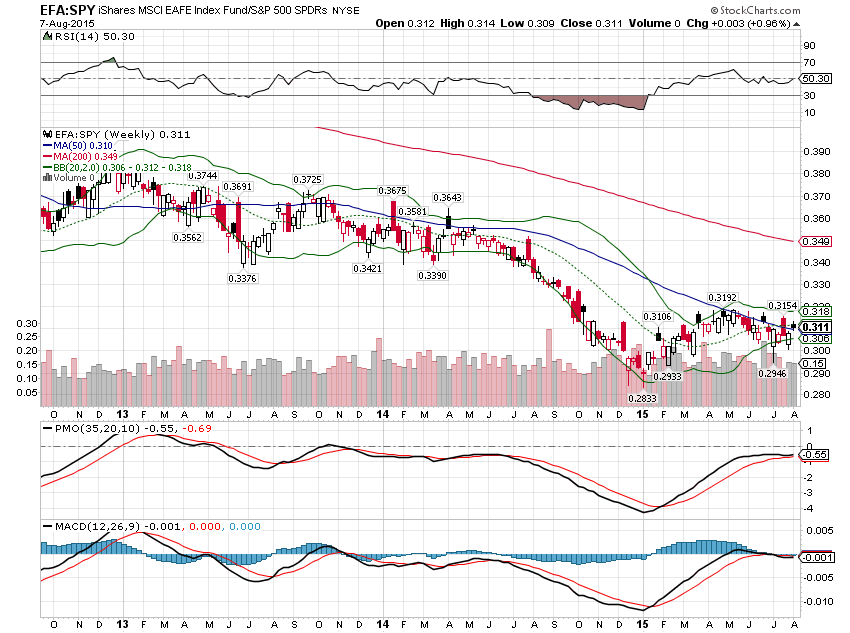

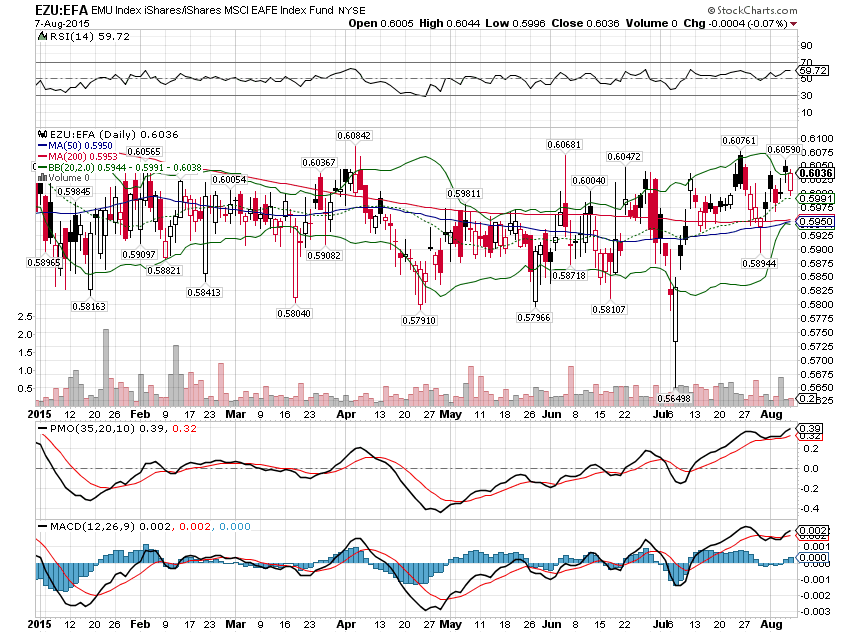

On the equity side, EAFE continues to outperform the US market this year although not by a lot:

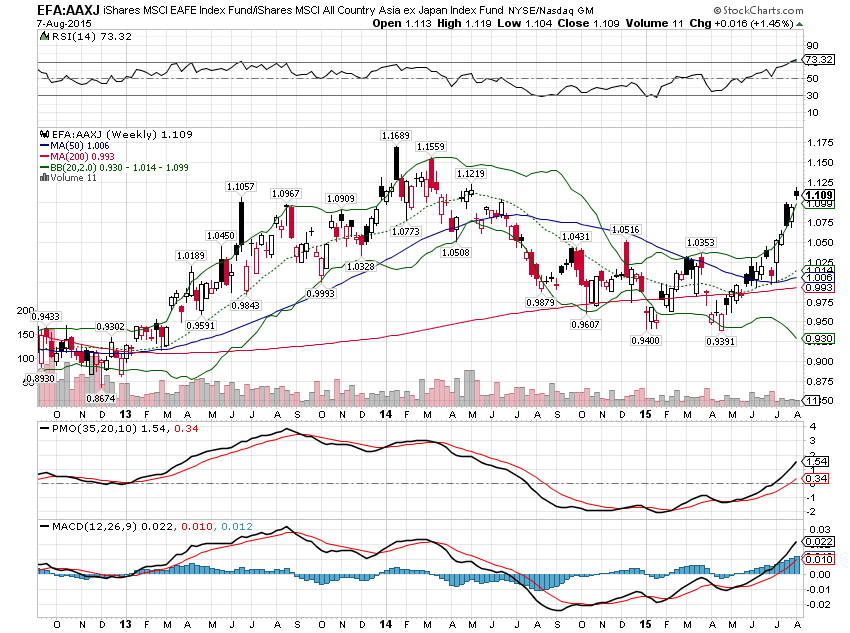

Asia, which outperformed last year and into this one has flagged badly recently and I am closing out that position:

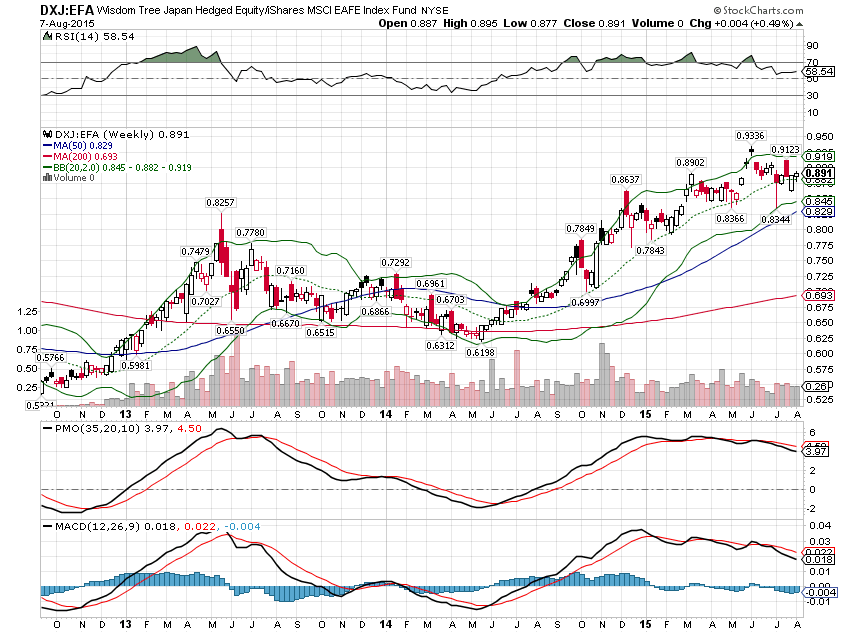

Japan, however, continues to outperform. As I’ve stated numerous times, I think Japan has entered a secular bull market:

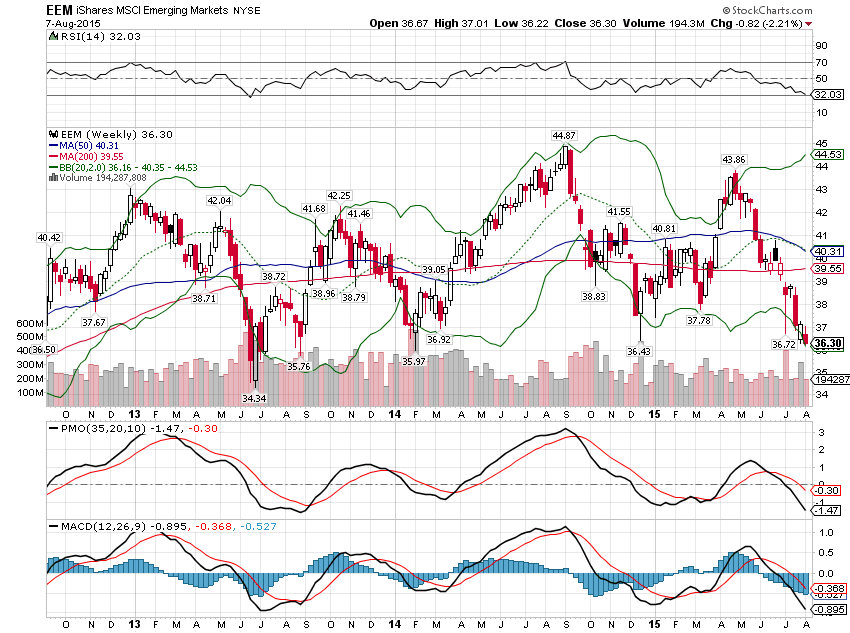

Emerging markets have not recovered and now sit at the bottom of their several year old range. As I’m moving to a more defensive posture, it does not make sense to maintain exposure to these markets. If the dollar starts to fall, I will reconsider the position:

Europe outperformed on the month and I would maintain that exposure:

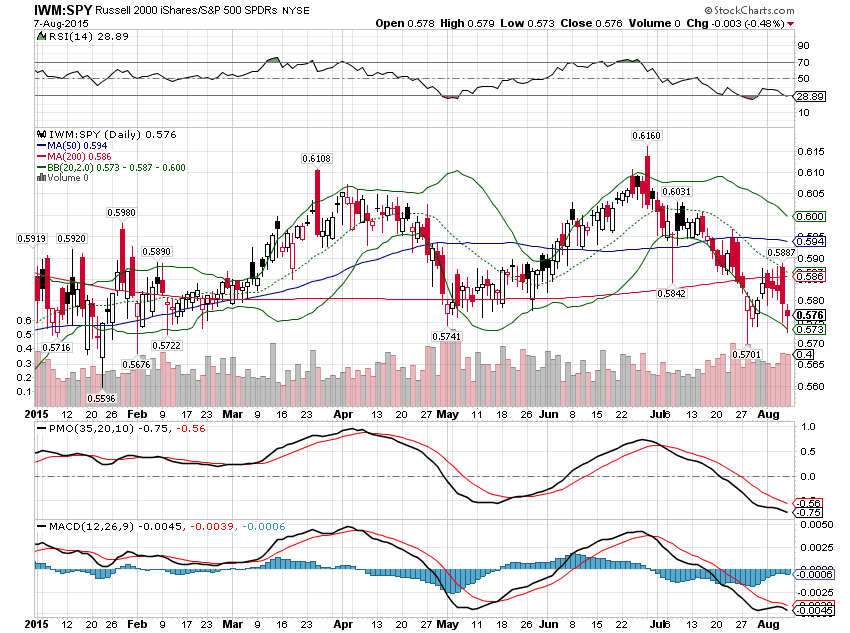

Small cap stocks underperformed badly versus large caps in July. In a defensive mode, small cap allocations should be minimized.

Lastly, I am maintaining a small position in gold as I believe the US dollar is peaking. Sentiment toward gold is extremely bearish right now so a small position makes sense from a contrarian perspective.

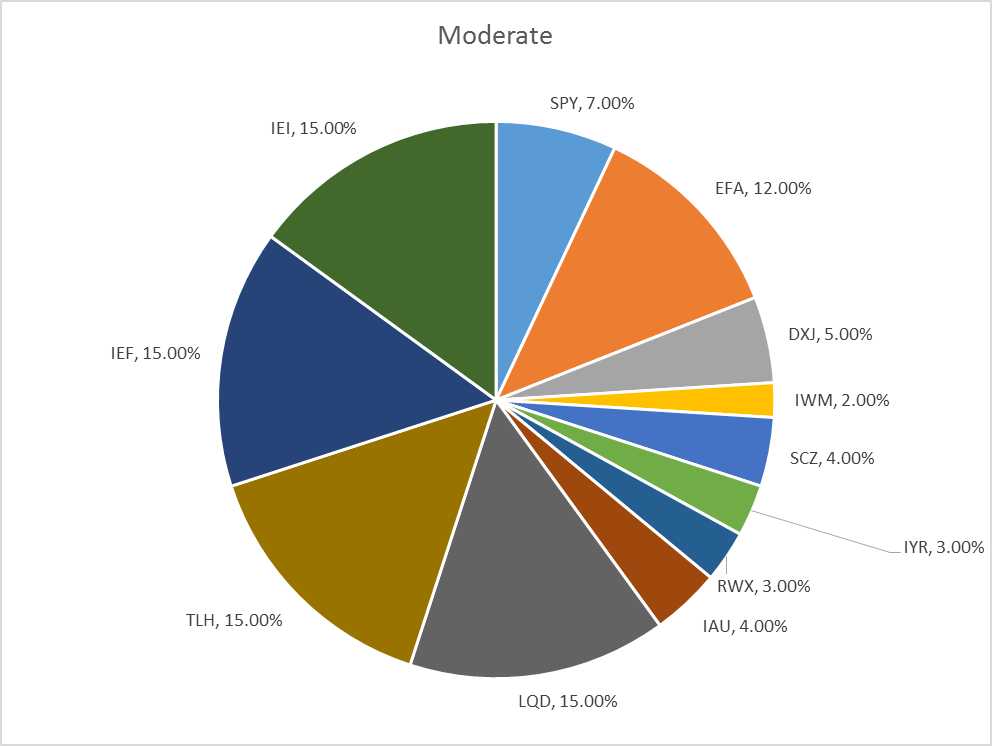

Moderate risk allocation:

If you’d like to see allocations for other risk profiles, contact me.

Momentum Asset Allocation

I also run two asset allocation models (one aggressive, one more moderate) based on momentum. These models ignore all fundamental and economic information in favor of just allocating to the asset classes that are exhibiting momentum. Here’s where those models stand at the end of the week (rebalancing is monthly):

Aggressive Version:

50% TLT

50% EWJ

Moderate Version:

25% TLT

25% TLH

25% SCZ

25% IEF

As you can see, both of these models are overweight bonds especially of the long term variety.

More information on these momentum models can be found here.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773. You can also book an appointment using our contact form.

786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch