The oft-leveled charge against politicians in DC is that they are “out of touch.” Such desultory description is often deserved, however, so it isn’t really cliché so much as connecting republican (small “r”) values through time. In the case of the 2015 economy, however, the idea that the economists sitting on the FOMC board (and their academic statisticians) aren’t in tune with the economy that the rest of the public has experienced is a literal truth. The version envisioned by elite policymakers isn’t even in the same category.

The most common complaint about last week’s GOP “debate” was that there were no questions about the economy to any of the candidates. That is surprising only in that the two most dominant topics on the minds of voters going into the event were immigration and the economy (which is in many ways a redundancy). For the media, economists say that the economy is recovered so there is no more reason to talk about it except in glowing terms.

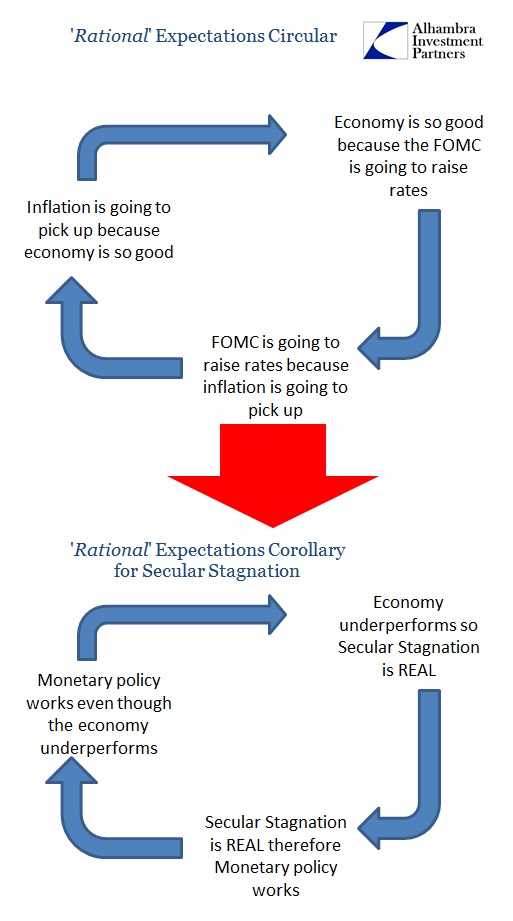

In that way, the FOMC’s flirtation with “exiting” ZIRP is meant to reinforce the narrative. How can the economy be bad or unsatisfactory when the “best and brightest” are so willing to remove all their support? That is, of course, rational expectations which actually provides one pathway toward a more sane fellowship on the part of the Federal Reserve. Because they “have” to talk as if the economy is completely healed you don’t really know if they actually mean it; which is good, because if they don’t then they end up sounding a touch too far toward unreasonable:

“I think the point of ‘liftoff’ is close,” Lockhart said in prepared remarks for an address to the Atlanta Press Club. “The economy has made great gains and is approaching an acceptable normal … conditions are no longer extraordinary.”

You have to wonder what color the sky is in the world President Lockhart is describing; until you see the word “acceptable.” Like the introduction of the word “some” in the last FOMC statement, the weasel word “acceptable” is the giveaway that this is all, indeed, just rational expectations positioning. He doesn’t specify the genesis of the qualification, but it is clear through inference that he only speaks for economists and not the rest of us (fortunately). Thus, the economy is “acceptable” to them which is why there is a huge contradiction with common perceptions.

Policymakers have convinced themselves that this is the best that can be done, and we should be grateful they had the courage to do it. Secular stagnation is about all that, namely the economy, you and me, are to blame for thwarting what under “normal” conditions would have worked vigorously well. And there, too, we see the crumble of the edifice of economics; the idea about QE and the economy was forged in the last age, the pre-crisis period where the eurodollar standard only rose and inefficiently carved out some current GDP. Monetary policy is tailored for a world that no longer exists.

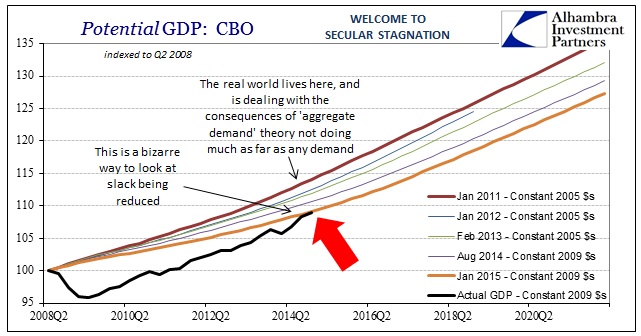

Setting aside very germane issues about whether monetarism ever truly worked, the expectations of economists and policymakers have been met solely on the downgrade. They talk about healing, especially labor, when 14 million potential laborers are still missing from the economy and full-time jobs are still less than they were just about eight years ago. By many counts, the US economy and the very linked global economy have shrunk, and the end of ZIRP is the mainstream way of simply admitting it without saying it – “acceptable.”

Federal Reserve policy anticipation has devolved into what I previously described as a chapter from Orwell’s Animal Farm. You will take the economy that the gracious monetary overseers have delivered and you will be happy for it, even when it is nothing like what they promised and further away from what economic growth used to be, is supposed to be and should be.

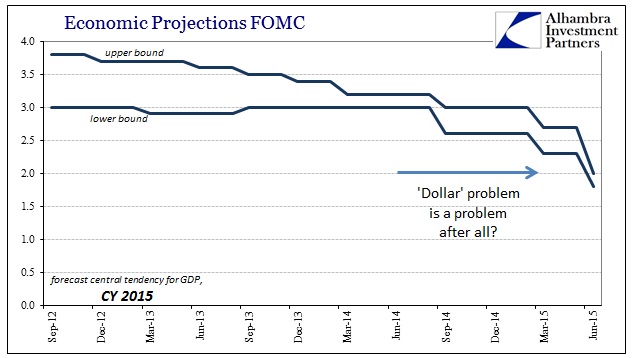

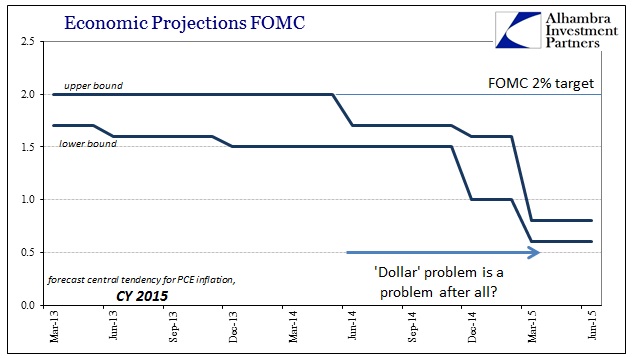

At one of these previous and ridiculous Fed meetings I wrote that there is an inverse proportionality at play, namely the further the economy strays from the intended baseline the more vociferously orthodox economists and policymakers (redundant) would protest otherwise. Everything about this FOMC meeting suggests that there is nothing to suggest a recovery; and in fact the economy in 2015 was just reduced to something worse than last year’s deficient pace despite the fact that every FOMC member up to and including Janet Yellen spent months and months last year and a good part of this year telling everyone that was completely impossible. Rather than admit the mistake, they harden toward the mistaken assumptions.

In that respect, every economic downgrade is really an upgrade; that is the only way to reconcile the upside down nature of orthodox economists as it amounts to an obvious socialism in practice if disavowed in name. They perpetually downgrade everything under their assumed purview, but that only brings them closer to secular stagnation and thus their completed task. In other words, the longer the economy underperforms the more it confirms, to economists, that secular stagnation is real and therefore the Fed has done its job up to “acceptable” standards.

In that respect, the last major benchmark revisions to GDP (downward, of course) actually are quite unhelpful as they would suggest, as wages do, remaining slack even to the gutted “potential” definitions shown above. So it’s almost a race to the bottom, getting economic growth down far enough where “slack” simply disappears enough for the FOMC to call it a day. I thought it was bad at the June FOMC meeting where the regular staff projections were downgraded across the board, “inflation” in particular, but the more they talk about the economy in the months since the more it seems there can be nothing but “rational expectations.”

The context of “inflation” recently of commodity prices flashing the “dollar’s” trajectory only offers that interpretation. All this inconsistency is balled up and contained within “acceptable.” I’ve always said that rational expectations theory leads to some very strange phenomenon, but this is getting ridiculous. The more they don’t deliver a recovery, the more they apparently have. Animal Farm was a template.

Stay In Touch