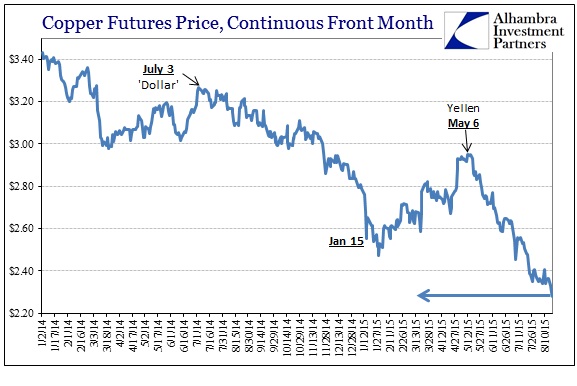

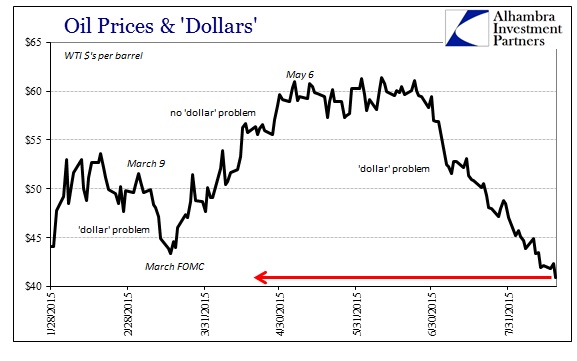

It was, apparently, just a one-day “dollar” reprieve for the crude complex as oil prices are pounded today across the board even after the FOMC statement (leak) release. Unsurprisingly, copper joined the depression as the September futures price traded as low as $2.2605 this morning ($2.273 as of this writing). That is, of course, a new cycle low in copper and a match in WTI.

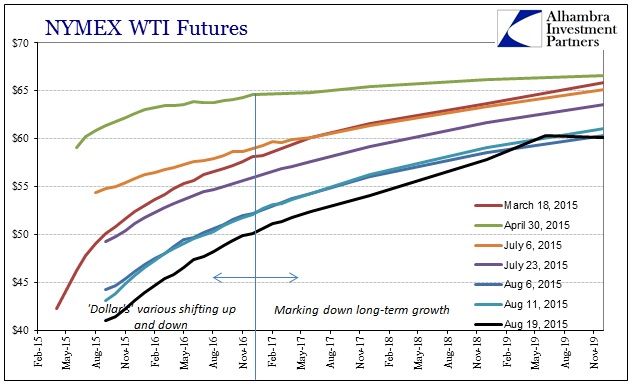

Perhaps more important, the long end of the WTI curve which had held up reasonably in the past week or so was launched into the “dollar” maelstrom. The December 2019 contract (FWIW, with little activity and volume) is only a dime from breaking into the $50’s for the first time; the entire curve is fallen enough almost to force me into rescaling my WTI charts.

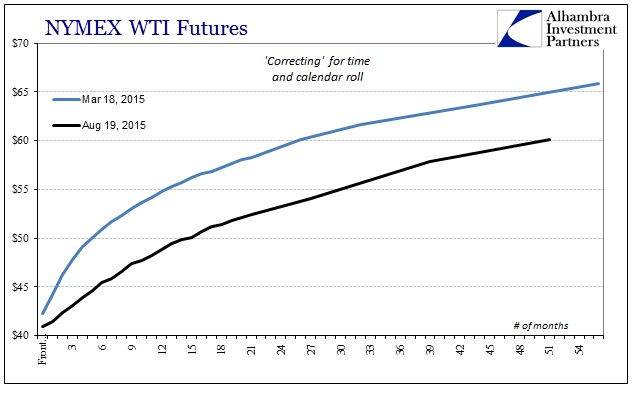

It is the same renewed story taking place as a junction between finance and economy. Try as they might, and did, economists cannot spin such a massive change in finance as anything other than an ominous take on the future economic direction. That is where the pieces of the WTI curve had been “fighting it out” for much of the past five months; the “dollar” waging on the short end while economic optimism, through contango spreads, trying to counter at the long end. This renewed “dollar” run seems to be settling that straddle once more on the “wrong” side – there is no comfort in low oil prices, at least in the intermediate term (if the Fed and ECB would stop, maybe we could finally enjoy rightfully reduced oil in a more stable economy).

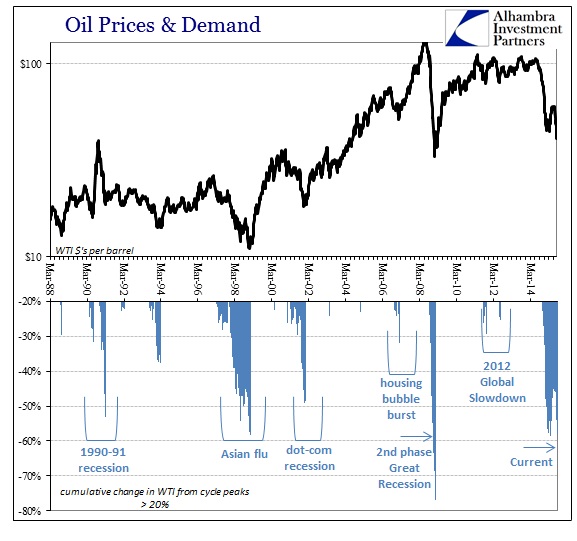

At nearly a 63% decline from the cycle peak (spot), the only comparable period in terms of oil collapse is the worst part of the Great Recession and clearly there wasn’t “enough” benefit to consumers then. That is the overriding factor to consider from this finance/economy interface, namely that low oil prices are indeed a positive economic development except that their appearance in this condition signals factors that will inevitably and forcefully overwhelm that positive offset. An oil crash inside financialism is decidedly a rupture.

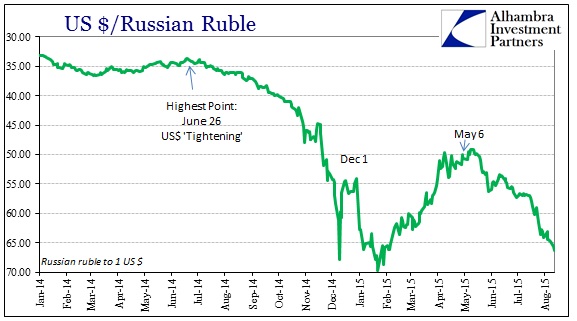

So far, that has been “contained” within the rest of the global economy as financial markets elsewhere bear the adjustment. As noted yesterday, the “dollar” run continues in certain places with more showing negatively today.

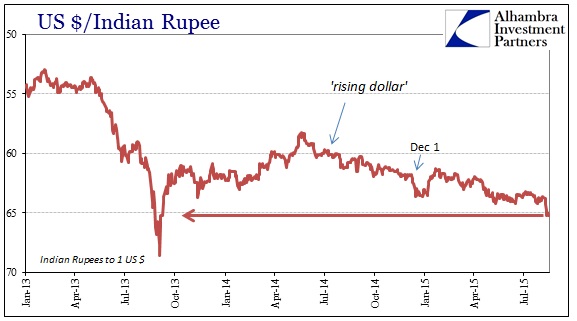

The ruble is only pips above its December crisis point, having run over the Central Bank of Russia with expected ease since early July (again, combination of “dollar” and oil). Even the Indian rupee has felt the enormity, as the currency climate once more overtakes what was previously thought to be great central bank success. Since the more dramatic decline in the middle of 2013, the Reserve Bank of India had undertaken numerous steps, monetary and otherwise, which were universally hailed for forthright adherence to the orthodox textbook.

Maybe that matters in the more placid slide in the rupee as compared to its BRIC counterparts, but the “dollar” appears to have claimed yet another central bank as this circle of deficiency widens globally.

U.S. dollar demand from importers and government-owned banks has been relentless, while the unwinding of short positions by offshore traders and domestic speculators is also causing the dollar’s sharp rise, says Anindya Banerjee, associate vice president at brokerage Kotak Securities.

As China, stripped of conventional language, that sure sounds like a “dollar” run upon the global “dollar” short.

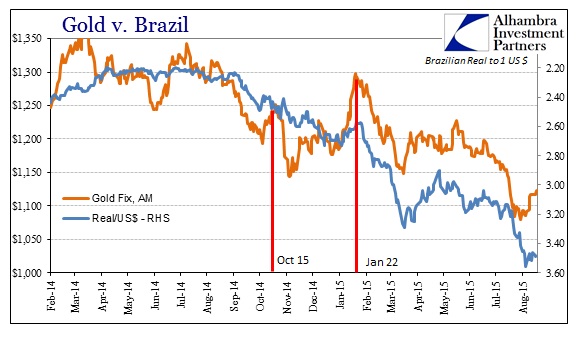

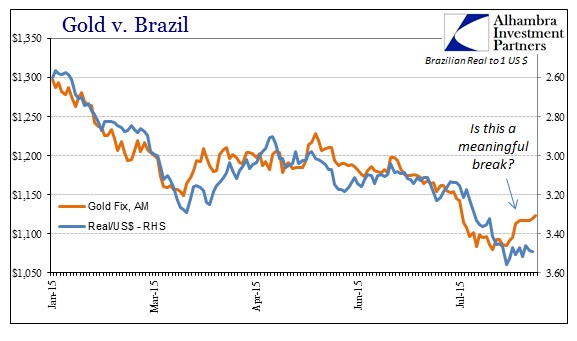

However, even with all that, my major point here is actually elsewhere. The “dollar’s” continued disruption is not news nor is the lengths it is attaining in that regard. What stands out in the past week is gold. Gold is, as always, caught between its safety attractiveness and the “dollar” as collateral of last resort. Since 2013, that balance has been no balance as the “dollar’s” negative pressure on gold has clearly taken the marginal setting. There have been only a few rare occasions where gold’s safety attraction reclaimed the primary factor, most recently up into the SNB’s peg drama.

It is, obviously, far too soon to make any hardened determination about gold. This may just be local factors taking trading mechanics, but it also may be the beginning of determined a safety bid set hard against the still-roiling “dollar” in global fashion. If that were to be the case, it would, I think, mark a significant shift in “market” perceptions about the state of the world. That may be related to how unsettled China is within that “dollar” condition, but it may also be a broad rekindling of money market hedging as darker possibilities starkly overtake previously persistent sanguinity.

Unfortunately, it will be some time before that determination can be made – hell, I have been expecting it for more than a year only to see gold smacked again and again by especially this massive “dollar” drain. In that respect, gold’s price is somewhat encouraging (discouraging from a macro standpoint) as it has held up reasonably under these extreme conditions (and all the mainstream cheering for it); falling only to just below $1,100 as compared to the massive crash in 2013 under far less “dollar” disfavor.

In short, it is noteworthy if still very far from categorical, I think, that as the “dollar” continues it hasn’t as yet pulled gold down again.

Stay In Touch