I think it is worth re-examining at this point, with a lull in the “dollar” at the moment, the effects of dark leverage upon actual bank mechanics and thus actual “dollar” supply. The idea of liquidity in the wholesale system is multi-dimensional and often confusing as it relates to what is typically believed. For example, the week the world woke up to Lehman’s demise saw repo fails rise (both “to receive” and “to deliver”) to more than $5 trillion. That meant that UST collateral was, in rehypothecation, more “valuable” than cash as repo counterparties were actively hoarding collateral and giving up cash. At that point, which is currency?

The deeper balance sheet mechanics in terms of VaR and its relation to bank “capital” is a very real pathology. Bank “desks” operating with some kind of risk metric governing its activities do so not as some public stunt to try to define suitability and overall potential losses, but as a direct link to the capital structure of the bank.

That had an effect not just on bank operations but regulatory interest. Indeed, the Basel Rules that were adopted at that time were a melding of these kinds of mathematical concepts with the “bucket” approach first introduced by the UNCR. Under the Basel II framework, a bank’s capital “charge” could be very heavily influenced by VaR provided it met a minimum set of standards: data sets needed to be updated every three months; VaR was calculated daily; 99th percentile, one-tailed confidence interval applied; 1-year minimum for historical observations; and, 10-day movement in prices were used as the form of “instant price shock.”

Because of the link between VaR and other forms of risk math and the capital structure it made the math as if it were the central focus of “dollar” liquidity. The disruption of the panic was traced in that direction first, through traded balance sheet capacity to offer hedging against irregularity insofar as past projections of volatility and expected volatility were artificially depressed by former recency bias.

That was a lesson learned the hard way beginning in August 2007 for the entire eurodollar system. What changed as a result of the adoption of VaR as more than a regulatory fashion was the very nature of banking and money. By tying quantification of risk to capital, the regulatory structure made that quantification money-like. For example, if a bank bought some specific security, it held a specific capital charge which would affect the ability of the bank to further expand and carry out operations, particularly if that security were “risky”; defined here under Markowitz reasoning as with great variance. However, if the same security was then paired with an offsetting security, some kind of hedge, that reduced the calculated fluctuation potential given the VaR horizon and specifics, that also reduced the capital charge associated with the trade and thus effectively expanded the leverage of the balance sheet. Hedging could, in theory, math and certainly practice, act the money printing press.

That is the whole point of dark leverage, to supply mathematical constructions to banks and financial firms that seem to offer a perfectly quantified risk structure. In that respect, again, offered balance sheet capacity acts as much like liquidity as bank reserves and cash (and I would argue under certain especially strained conditions far more so).

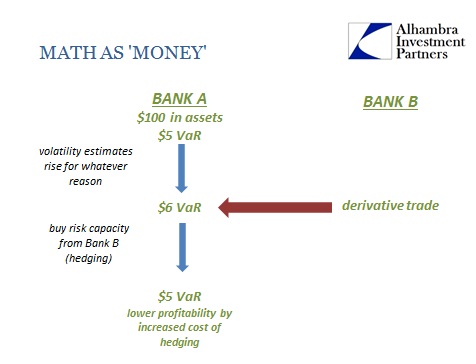

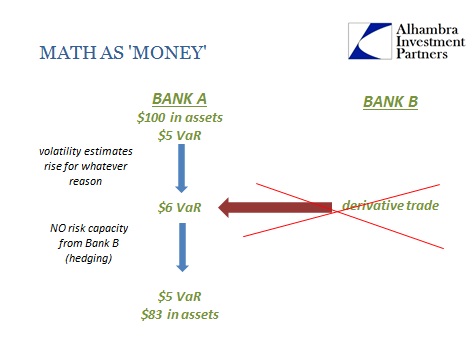

The example above is not in any way realistic, as it is a highly stylized version that seeks only to illustrate the general movements of the over-simplified conception. If, for some reason, expected volatility for a bank rises beyond some internal, black box threshold, the Bank will typically seek out a derivative transaction to re-align the risk calculations to its prior state – at the cost of lower profitability in adding the additional mathematical governance (such as an off-setting credit default swap).

If Bank B is unable to offer its balance sheet risk capacity to Bank A, in this binary model Bank A must either raise capital or sell assets to return VaR to its acceptable prior state (again, the numbers here are not realistic and simply for illustration).

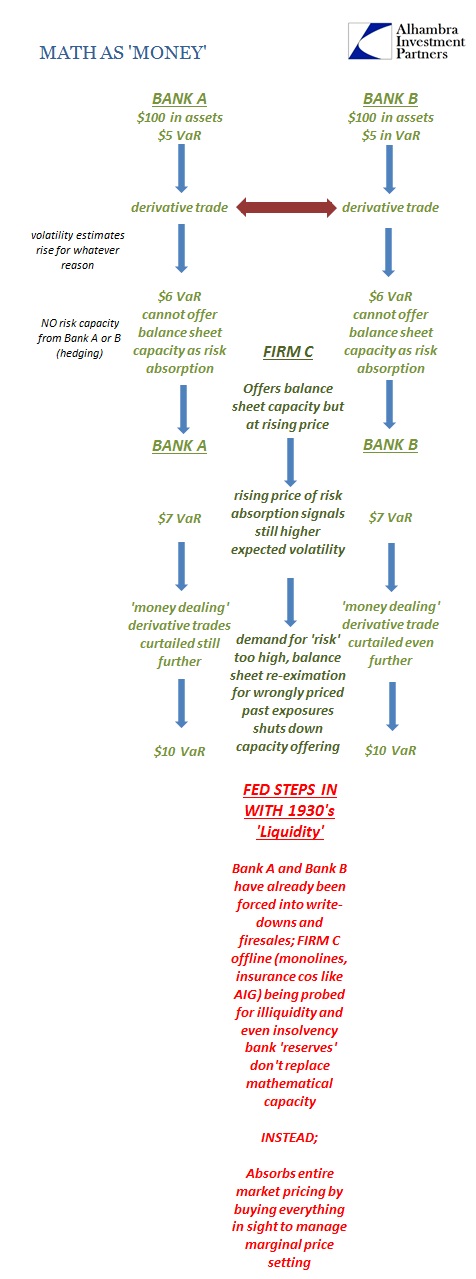

You can begin to appreciate what happened in early 2007 as ABX indices started to behave oddly. That translated as perceived increase in volatility, which caused the first systemic reset of hedging properties as they related to this dark leverage. If there were additional balance sheet capacity available to take on that sudden and increased “demand” for risk absorption, hedging prices would have remained neutral or at least within acceptable bounds (whatever that might be). That is, by its very definition, liquidity.

The problem was that the dealer setup was almost entirely an illusion, as it was an incestuous codifying of the same banks dealing to and from themselves. As Bank A experienced an increase in VaR due to the growing financial issues with ABX, so too did Bank B. Since “money dealing” and dark leverage were of the same dealers, not separate as is so often described and modeled (when anyone actually gets to looking at it), the problem is all-too-apparent.

There were alternatives to the bank-side of the dealer network, mostly insurance companies that would offer their balance sheet capacity, through CDS and IR swaps, but they were increasingly tied up in the same process through already-offered risk. That was the element of the Gaussian copula in structured finance that tied CDS prices directly to asset prices and thus volatility. It was entirely self-reinforcing, as the price of hedges grew immensely that not only reduced profitability on any bank holdings it further reduced the prices of those holdings (since correlation trading was based on derivatives themselves through spreads, largely CDS) meaning that even more hedging was necessary while straining those remaining that could offer it.

Because all this redirected back to bank capital, the math to make it try to work was paramount not just in terms of maintaining price structure of individual asset holdings (to keep them out of direct OTTI writedowns) but also as capital impairment where raising new capital was the last thing any bank could expect – at least not, absent a Warren Buffet, easily at a favorable or even workable price. Offering traditional “currency elasticity” as the Fed did was no solution at all because it did not plug any of these leaks or stop the process from spiraling again and again and again at each systemic iteration (especially after Bear Stearns). The real currency was risk absorption mathematics that were left collapsing across the entire system, fragmenting both geographically into eurodollars and by size and type of counterparties. The primary dealers could hoard whatever the Fed offered, but that didn’t compel further balance sheet offerings from those same dealers – they continued to retreat from dark leverage offerings at an increasingly rapid pace.

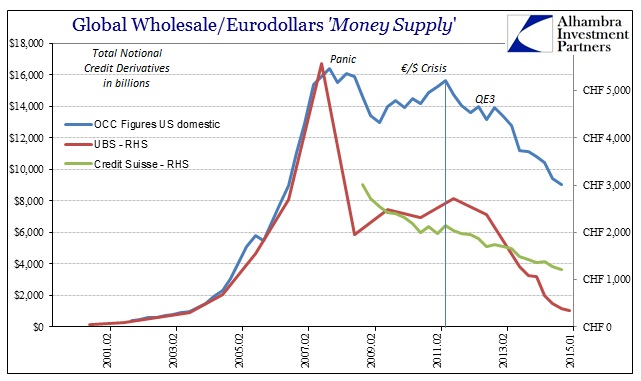

I think we are witnessing the same pathology today, certainly not on the same scales (yet) or of direct expression but the pattern is, to me, unmistakable. I have already sketched out how I believe dark leverage is reversing, using gross notional derivative levels as a rough proxy for that general, systemic capacity. When Q3 balance sheet figures come out, I suspect there is going to be another large decline in them.

What is the same is volatility; namely that for more than a year there has been rising volatility expectations that turned into, just as ABX perceptions did, self-fulfilling or justified changes in systemic condition. Rising volatility even in just “money dealing” activities alone means there is less capacity for further money dealing. Absent additional capacity from some other element the only recourse is systemic retreat. That it might be focused on China isn’t really surprising given that volatility in anything related to China has had to have been reexamined quite unfavorably; again, it becomes self-reinforcing to a breaking point, as volatility rises and curtails liquidity capacity in this manner, which has the further effect of increasing volatility in actual calculation and expectations and so on.

Also like 2007, the Fed is totally absent for much the same reasons – they have no idea about wholesale condition like the eurodollar standard. They still act as if the banking system remains in its 1960’s status; what good is the Discount Window in the face of CDS-driven implosion as a means for further systemic liquidity? You could add that the Fed has at least acknowledged the offshore portion of this system with its standing dollar swap arrangements, but that doesn’t extend to China nor does it apply to any of Asia outside of Japan, particularly in its latest, standing framework:

In response to mounting pressures in bank funding markets, the FOMC announced in December 2007 that it had authorized dollar liquidity swap lines with the European Central Bank and the Swiss National Bank to provide liquidity in U.S. dollars to overseas markets, and subsequently authorized dollar liquidity swap lines with each of the following central banks: the Reserve Bank of Australia, the Banco Central do Brasil, the Bank of Canada, Danmarks Nationalbank, the Bank of England, the European Central Bank, the Bank of Japan, the Bank of Korea, the Banco de Mexico, the Reserve Bank of New Zealand, Norges Bank, the Monetary Authority of Singapore, Sveriges Riksbank, and the Swiss National Bank. Those arrangements terminated on February 1, 2010.

In May 2010, the FOMC announced that in response to the re-emergence of strains in short-term U.S. dollar funding markets it had authorized dollar liquidity swap lines with the Bank of Canada, the Bank of England, the European Central Bank, the Bank of Japan, and the Swiss National Bank. In October 2013, the Federal Reserve and these central banks announced that their existing temporary liquidity swap arrangements–including the dollar liquidity swap lines–would be converted to standing arrangements that will remain in place until further notice. [emphasis added]

Even if those were applied to Asian counterparty central banks, I’m not sure it would be any different than the Discount Window – the first bank that signed up for a swap with its central bank would be similarly “stigmatized” and essentially “outed” as a candidate for “dollar” insolvency. Even where the swap arrangement might offer some supply it would not solve, as 2007, the retreat of the private money dealing “market” but only replace it (in theory); the same capacity issues would remain where the Fed through foreign central banks supplies not the solution but actually confirmation of the scale of the problem (what would that do to volatility calculations?). The “dollar” run remains in theory until it shows up on the Fed’s balance sheet where it becomes fact.

The takeaway for systemic “dollar” liquidity is volatility against capacity where under “normal” conditions increased volatility perceptions would be more easily absorbed without too much exertion upon derivative pricing (swap spreads, I think, are indicative here as is especially the eurodollar curve; the flatter and more bearish the curve the more the system itself may be projecting greater volatility in the intermediate timeframe from it). That is, again, liquidity, but clearly any increase in “demand” for risk absorption isn’t being met particularly in these “dollar” outbreaks; to the point of what continues to look like a run that not only broke the PBOC’s “dollar” attempts (selling UST) but burrowed all the away into the heretofore invincible stock market. That suggests the same process along different scales, including the very short term when liquidity, self-reinforced by “wrong-way” prices, just vanished on August 24.

Since volatility perception is “running” this process, I don’t think it ends until a fundamental change is made; either the economy starts living up to the promises or liquidity subtracts until prices actually reflect that it won’t. That is, I believe, what occurred by March 2009 once actual market forces broke through the central bank-inspired, prior regime of mathematical illusions.

Monetary policy was not “printing money” as is commonly believed, even today, rather the banking system was through VaR direction of capital leverage and associated fractioning of sophisticated bank liabilities. While total bank reserves became irrelevant (and actually remain so), the “global dollar short” exploded as a combined expression of banking hubris about risk management (recency bias) and the interplay of Greenspan-type faith over smoothing out large historical variations in asset prices. That latter part, also known as the Greenspan “put”, had very real effects upon just these kinds of mathematical calculations even if only through what amounted to a self-fulfilling prophecy – financial agents believed the Fed could, if pressed, print liquidity in some form, which depressed mathematical calculations of expected variations in asset prices, reducing VaR numbers, thus allowing for far higher inductions of shadow/capital leverage.

Stay In Touch