With stocks selling off at least in morning trading, everyone is back asking “is it over” after last week supposedly quelled so much surface disquiet. The rebound in oil prices has been robust and a broad survey of “dollar” proxies indicated that the hugely negative run from August has relented. The notable exception to that trend has been Brazil and the real, which may seem like its own set of problems but as noted yesterday and before it is truly the “price” of eurodollar decay. With that in mind, it’s difficult to believe that the “dollar” is done even in the short run as the collapse there is a powerful reminder about vastly mispriced risk beyond even wholesale finance.

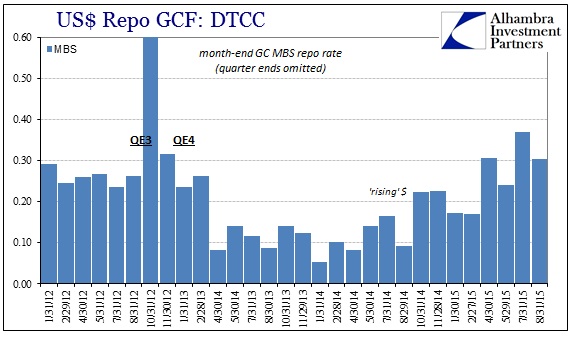

Yesterday being a month end, we got the now-familiar surge in repo rates which is itself indicative of continued funding problems (and bottlenecks). For a few years, repo rates were immune to even the quarter-end jump but that not only returned after the nasty funding environment in December it has pushed into each calendar month starting with April. The August end repo rates were sharp in all three classes, with MBS repo at 30.4 bps. Going simply by the history of month-end repo, you can easily observe the “dollar’s” recent history toward turmoil.

The end of July saw 36.9 bps for MBS and nearly 32 bps for UST so maybe that counts as an improvement, but I don’t think we are so lucky. To my view, the end of August rates are still in the same “zone” of desperation so I don’t think it all that much different in terms of general condition even if it might suggest something better about immediacy.

I think that point is fairly echoed by continued “safe haven” interest, particularly in gold and, somehow, the yen (and the franc to a lesser extent). Gold remains slightly bid into the $1,140 range still substantially above its “dollar” lows from before the PBOC broke. Similarly, the yen, which had traded almost steady at around 124-125, had only retraced to around 121 before breaking upward again to 119.7-120 this morning.

Some of that action today certainly concerns today’s developments in China (which I’ll get into later) but in a broader sense the disruption is clearly lingering even if it isn’t as acute or abrupt at the moment (compared to last week).

Stay In Touch