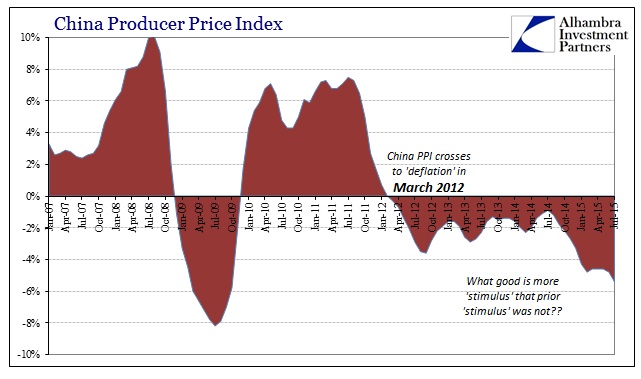

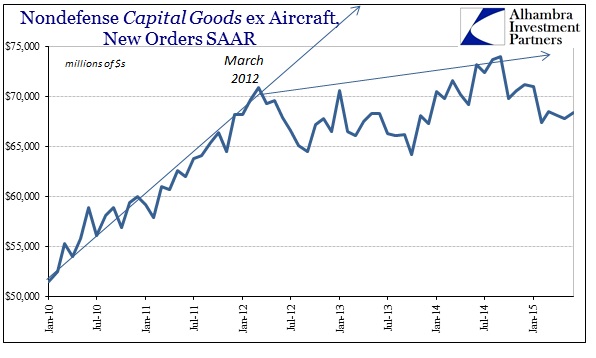

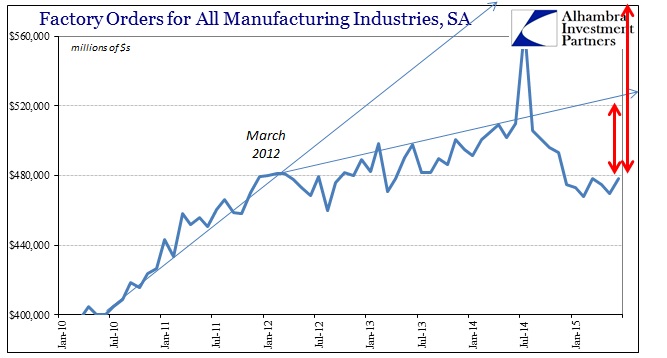

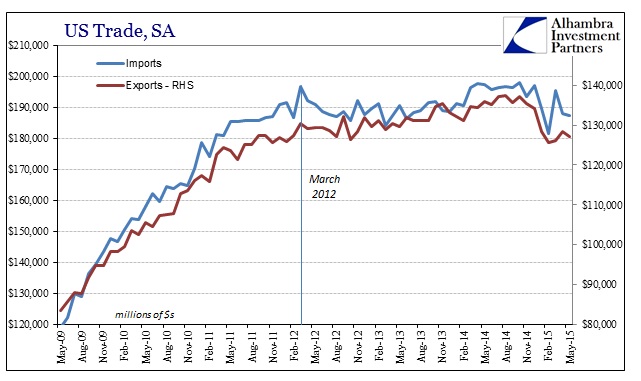

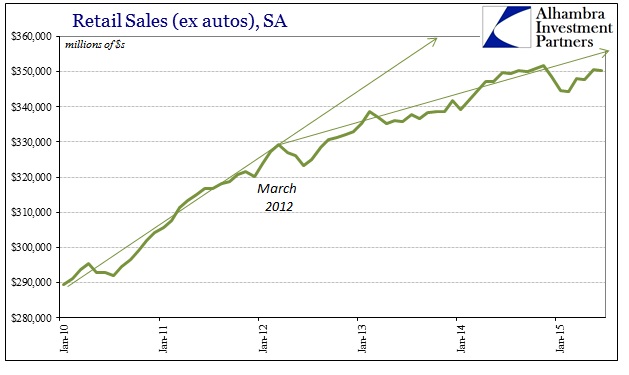

If we are being honest and using words as they exactly mean, the recovery actually ended in 2012. My sense of dating would mark that as March 2012 since so many various data series held that month for what has been a durable inflection. It was true not just here in the US, but across the globe as 2012 was a departure from the expectations about where all this was heading.

That meant what has been animating economic perception is not the recovery itself but rather dreams of what it might yet become. The entire point of “transitory” is to recognize, in some intentionally marginalized manner, the gap between what is and what should be. Even the whole point, in generic terms, of QE3 and QE4 was to raise the quotient of prediction about the future in recognition of the deficient past and present. There is always “next year” and QE was presented as insurance for it.

In that respect alone there was always expiration on the dreamworld. A less biased reading of China since 2012 would have that as the centerpiece of global expectations. From the Chinese perspective, after having pushed, as the orthodox textbook declares, perhaps the largest bubbles in human history all in the name of that recovery, to view the rest of the world renew the slump so soon after the Great Recession was a complete and total discredit to their intentions. Calling it a paradigm shift doesn’t actually capture the raw emotion of staring into that abyss; those bubbles were built to bridge the divide between the Great Recession and the “demand” levels that dominated before it as every orthodox economist on the planet assured.

You can understand and begin to appreciate why the Chinese would be first to recognition of reality and letting go of the imaginary; they had no margin for error in either the economy or the bubbles (same thing, unfortunately). There was a bit more room in Europe, but not much as re-recession was the stirring ideal. In the US, the corporate bond bubble offered a much larger space for the dream to linger.

But even as economists declared themselves fully involved in actually seeing not just full recovery but the dangers of “overheating” just on the other side, there were innumerable inconsistencies and problems – not least of which was the public; the voting public no less. As noted Wednesday, economists and policymakers have been living as if the recovery dream were real while the rest of the world (apart from those living it up closely attached to all the asset inflation) has suffered continual reality.

Policymakers themselves have seemingly stayed within the fantasy, but recognizing the base alloy of “rational expectations” theory in setting almost everything a central bank does I have harbored intermittent doubts as to whether some policymakers were actually as raptured by the fantasy as they made themselves appear. The FOMC has, almost to a member, certainly voiced continual caution, but for every nod to the harsher actuality there was always immediately following voiced certainty about how that didn’t matter (transitory) as if rehearsed solely for the theater of the mainstream. Given the persistent negativity of the data, even in the more charitably adjusted series (unstable GDP, Establishment Survey), there loitered doubt.

That was the trap the FOMC set for itself; to keep the dream alive meant to keep acting as if the recovery was still on and real. But in order to do that, they had the problem of QE and ZIRP which were “emergency” provisions – again the expiration. If they worked they had to end; to declare that they worked meant that the FOMC must act in that fashion (this is, if you haven’t recognized, the terrain of true “forward guidance” which is a mishmash of theoretical soup about setting expectations against each other and then trying to untangle them with something hopefully close to actionable). Every missed opportunity to declare the recovery via action in the very exit the Fed has been focused upon for now two years meant danger in the world of perception slipping away from the dream state and edging perilously closer to the true picture of economic depression.

On several occasions this year Janet Yellen herself has moved in that proportion; even various FOMC statements have attained a noticeable slope toward that reckoning. In early May, Yellen acknowledged bubbles and valuations in assets (particularly corporate junk). At the July statement, the FOMC added a single word that changed far more than four letters should be able to. By going from “seen further improvement” to “seen some further improvement” the die was cast, the magic starting to seriously dissipate.

The word “some” as an addition may yet signal the two sides of the problem, that the asset bubbles can no longer be supported as they seem to be but that the economy will be whatever the economy will be; some labor market improvement is apparently deemed now as good as it may get.

Just prior to that, Janet Yellen essentially declared more rationality than the dream-state might have afforded:

The low unemployment rate “does not fully capture the extent of slack,” she said. “I think a significant number of individuals still are not seeking work because they perceive a lack of good job opportunities and that a stronger economy would draw some of them back into the labor force.”

The media, of course, unable to actually bring itself to this arithmetic, has spun this as just the Fed trying to gain more room or “flexibility” so as not to be pinned down. That misses the entire point, as in order for the “next year” sentiment to continue any further it must be shown tangible progress beyond rote, future tense hyperbole. The FOMC was stuck because to continue on with the dream meant taking steps that bury it – that is what the market had been saying since November 20, 2013, and the Fed knows it no matter how much they try to deflect or misdirect. The collapse in “inflation” expectations more recently coinciding with the “dollar” run into August could not have been received any other way.

The Fed had no real choice by its own hand – to act as if the recovery hallucination were real and thereafter produce real damage, or not act and kill the recovery dream.

“The signaling by the Fed yesterday doesn’t see confidence to pull the trigger to raise from zero to 25 basis points, I think is negative sentiment that’s hitting the market,” said Art Hogan, chief market strategist at Wunderlich Securities.

“I think they’ve done more harm than good,” he said.

I don’t want to write for Mr. Hogan, but his sentiment “more harm than good” applies to far more than just what didn’t occur yesterday. We have wasted three years pretending that the economy is doing or is about do what it really has not nor will ever. Time, as Einstein supposedly recognized of compounding, is the most powerful force in the universe and the Fed through its absurd notions of control and influence has squandered far too much of it. Assets and even the economy must come to terms with that and eventually align with it rather than still to live the dream. Even the Fed is doing so.

Stay In Touch