Even before the payroll report was issued, there was already an effort underway to downplay any negative potential. Global markets have been upset and in turmoil, but the US consumer and the consumer economy are supposedly undeterred by all that. So any weakness in September, as August, is being suggested as “residual seasonality.” This view was amplified by a Bloomberg article published yesterday with the sub-head stating boldly, “Private employers are taking on more workers to meet US demand.”

The initial September print may suffer from the same “downward bias” as the previous month, according to analysts at Stone & McCarthy Research Associates. August and September payroll readings have each been revised up by the Labor Department in 12 of the past 14 years, they said in a note. Fr [sic] that reason, economists may dismiss a lower-than-projected reading, particularly if hiring in August is revised up.

Once again we find economists supremely disappointed. August payrolls were not revised upward as expected but significantly downward. That makes two quite subpar months that actually reflect much worse than that since the internals were much, much uglier.

Employers added a mere 142,000 jobs in September, the Labor Department said on Friday, suggesting that the American economy is losing momentum after a similarly lackluster report for the previous month.

The official unemployment rate held steady at 5.1 percent, but hourly wages for private sector workers actually fell slightly after jumping by a relatively robust 0.4 percent in August.

So economists that actually think, “Private employers are taking on more workers to meet US demand” are once more mystified by “unexpected” weakness even though markets have been projecting as much since July; and, of course, the “dollar” since the middle of last year.

“Disappointing across the board,” said Brad McMillan, chief investment officer at Commonwealth Financial Network. “This is not what the markets were looking for, this is not what pretty much anybody expected.”

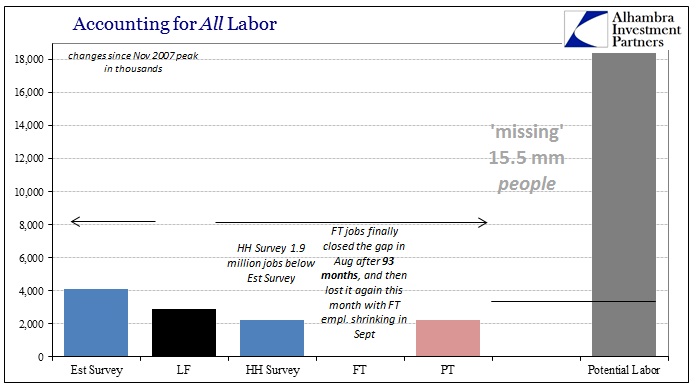

The problem is the Establishment Survey itself and the relationship with the unemployment rate. Both simply took off last year without any kind of corroboration in wages and certainly not spending. Worse, the unemployment rate has been “boosted” more by the denominator than the numerator. The labor force, which is likely the most important and relevant piece of the monthly payroll reports, shrunk again in September – by 350k!

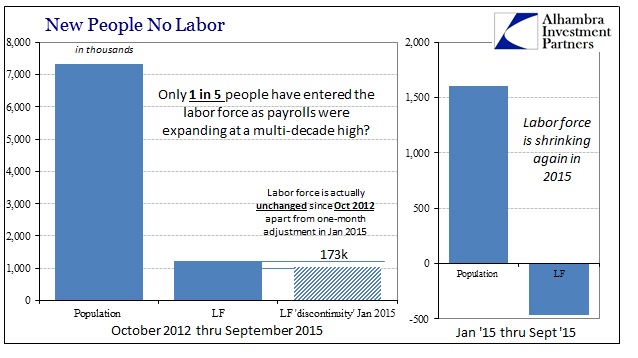

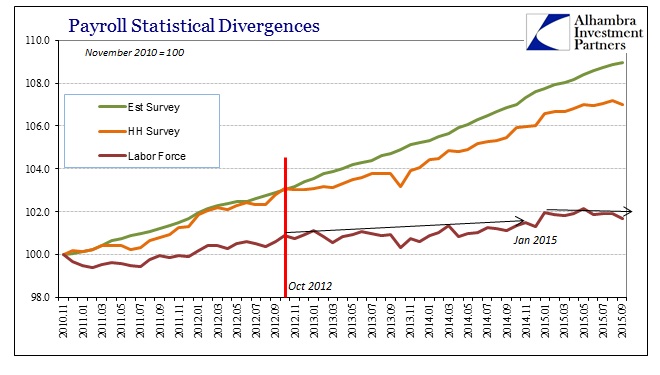

Apart from a one-time adjustment of 1.05 million in January 2015 (clearly a discontinuity), the labor force is barely above where it was in October 2012. Across just shy of three years, the pool of potential labor (civilian non-institutional population) has expanded by 7.3 million but only 173k of those joined the labor force (setting aside January 2015)? There is no way to reconcile that with the idea, “Private employers are taking on more workers to meet US demand.”

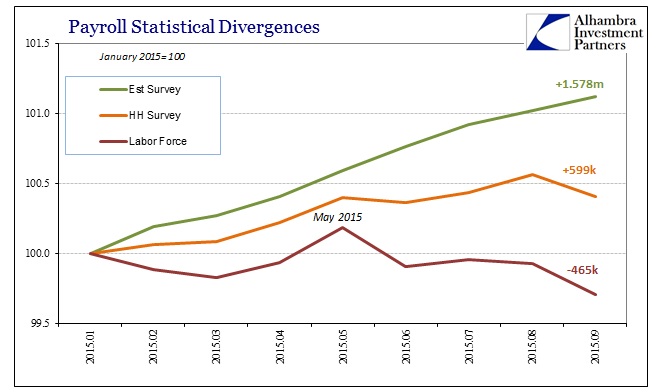

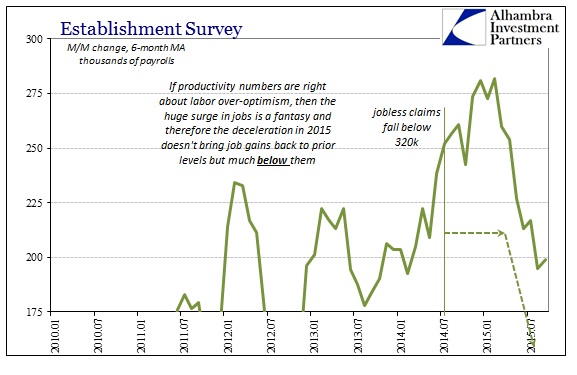

And it only gets worse from there. While gains in the Establishment Survey have clearly slowed, the Household Survey has done so with greater vigor and emphasis. The six-month average for the Establishment Survey is under 200k for the second straight month (with August’s sharp downward revision) for the first time since October 2013, but the Household Survey estimates employment gains at just 78k per month since April; again, while the labor force is shrinking.

That leaves a massive disparity even where the Establishment Survey is already stumbling; a difference of nearly 1 million jobs! This divergence also applies to the projected direction of the labor market, especially since May, as is clearly visible in the chart immediately above. It lends further weight to the appearance of trend-cycle over-enthusiasm on the part of the main jobs report statistic.

In other words, there is dire unison in the fact that all the payroll metrics have deteriorated and all that remains is to determine by how much and what that might mean for what is coming. Given the clear trend-cycle interjection and the sizable decay in the other parts of the overall payroll report, it seems quite likely that the US economy is already feeling the “dollar’s” heavy hand and that the mainstream labor market statistics are seriously understating the slump to the point that economists and conventional commentary still assume there is a “strong” domestic economy even though it can’t be found anywhere else.

Economists still claim recession is nearly impossible, but the trends are all pointing in that direction – even the payroll reports. And that is all before the full weight of the recent “dollar” turn and the heaviest parts of “supply side” recessionary processes (inventory correction, capex adjustment, etc.). If the final break for inventory, for example, is simply waiting on confirmation that “transitory” was always an illusion then this month’s payroll reports have to be significant, unfortunately, toward maybe assuring now that potential shift in sentiment (especially when combined with the renewed market views that have been far more attuned than economists and the recovery/booming narrative). Combine that all with the lack of actual recovery so far in this “cycle” and the supercycle potential is beyond description.

Stay In Touch