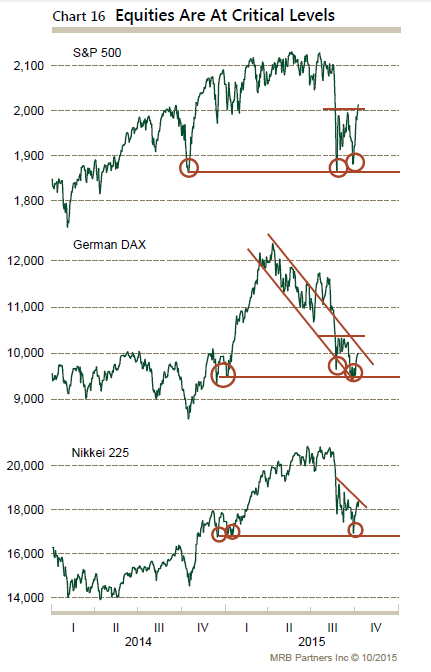

After a relief rally, risk assets are at a critical juncture. We may be seeing a bottoming in global risk assets and hopefully another up-leg in the current expansion. But pessimism and risk aversion are high. We will need to see better economic news to alleviate the fears that higher interest rates will push us into recession.

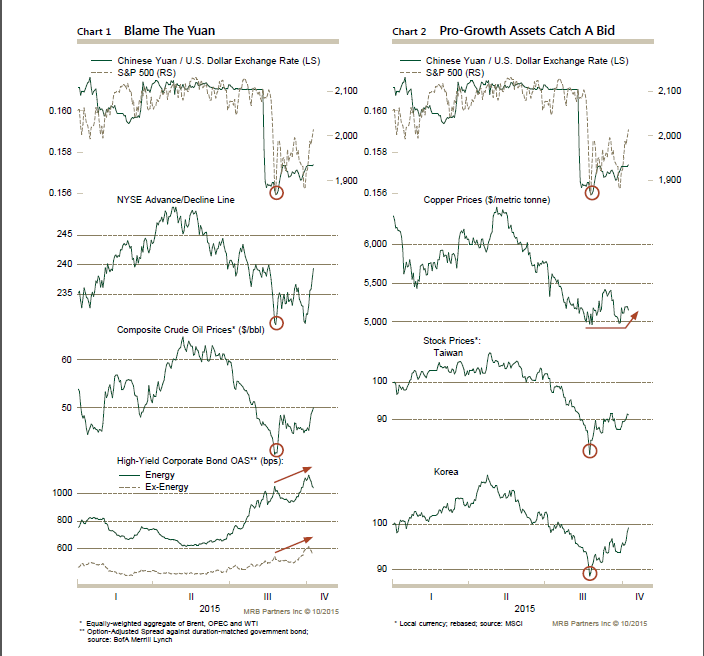

The popping of the commodity bubble had already sunk the commodity dependent emerging economies. But, the catalyst to recent market weakness was the drop in the Yuan. Rising debt levels in China may have recently buoyed the global economy. But, the drop in the Yuan indicates that investors fear the higher debt levels coupled with potentially higher interest rates may cause big problems, Trouble in China would not only damage an important piece of global demand; but, as we’ve seen, would be highly disruptive to financial markets.

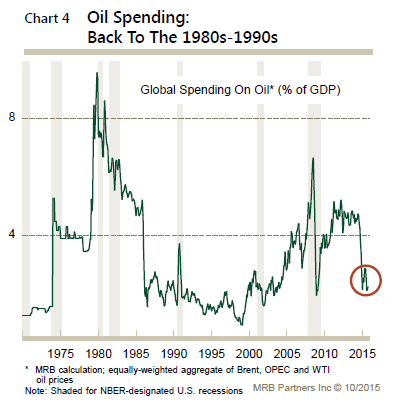

On a positive note, global spending on energy is back down around 2% of global GDP. Energy spending has been greater than 4% of global GDP for most of the last decade. We are now back to levels commonly seen in the 80’s and 90’s. The narrative here is that, though this appears as a negative 2% on the global economy, it is not a bad macro economic circumstance. The savings can be used to pay down debt or raise investment which would produce lower volatility and higher growth over time.

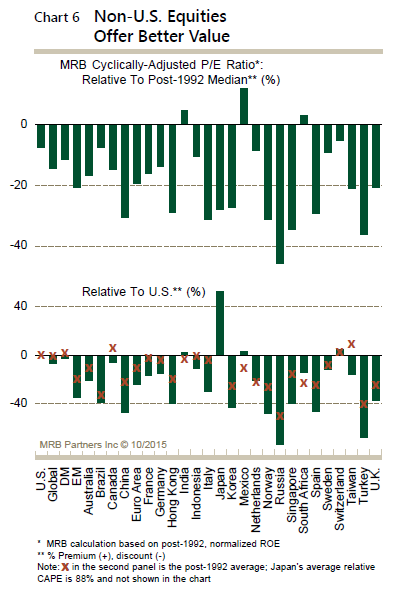

If equity markets are starting a new uptrend, international stocks offer the best historic value.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch