Goldman Sachs just reported an extremely rough quarter, and not just for a bank that has earned a reputation as being on the “right” side of trading. The bank’s (and it is a bank, now) annualized return on equity put it next to BofAML and below Citigroup, of all indignities. The reason, as always, is FICC. Reported revenue there was just atrocious, far worse than the firm’s peers which is illustrative of several points.

Goldman’s fixed income, currency and commodities traders had a worse time than their counterparts at larger rivals for the second quarter in a row. Revenue fell 27 percent from the same period last year, after stripping out a one-off gain. BofA and JPMorgan earlier this week reported top-line declines of just 11 percent, while Citi on Thursday said FICC trading revenue fell 16 percent.

The nature of Goldman’s customers hobbles the bank to some extent. It relies more than its peers on institutional investors and other big trading houses. These players are more likely to scale back their activity when markets are volatile than corporate clients whose daily business involves treasury services and commercial banking.

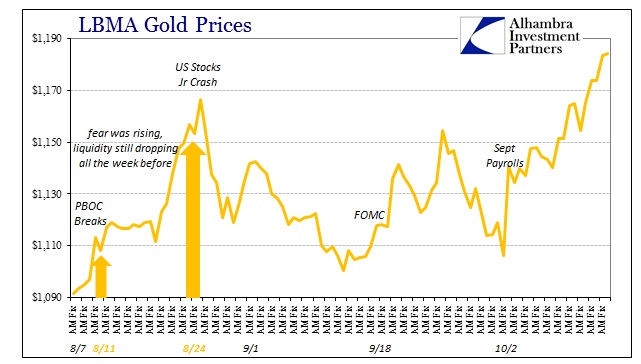

None of those factors are good for banking or for global liquidity, especially as the second straight quarter of it, but that still doesn’t account for what we see of Goldman or the “dollar.” Fitch comes closer (via Reuters):

The company’s FICC business was down during the quarter with net revenue decreasing 9% from the sequential quarter and 33% from the year-ago quarter as a challenging market environment and comparatively low levels of client activity impacted these businesses… While GS has a strong franchise as evidenced by market share positioning in league tables, in Fitch’s view this quarter’s results also continue to reflect the inherent cyclicality of the company’s activities. [emphasis added]

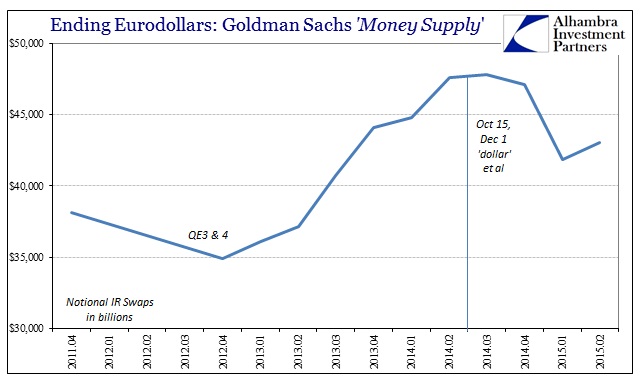

I think that unpacks the direction for Goldman and the firms like it, but stops just short of explaining the magnitude distinction. In other words, like Deutsche Bank and Credit Suisse, Goldman had clearly been betting on the ideal Fed (and fed) scenario. Just by count of its gross notional IR swaps book, the firm was moving up the ladder in terms of resources supplied in the eurodollar arena heading into what Fitch is calling a potential “cycle” turn.

Compared to the other money dealers, Goldman is far out of line (overextended) with its balance sheet capacity. Compared to JP Morgan, for example, Goldman not only had seriously increased its resources dedicated to dark leverage and so forth after QE3 (where Morgan did only slightly; again profit not regulation drives all this) it has been relatively slow to withdraw them in 2015 (so far). Whereas JPM’s IR book has been cut by $14 trillion, or 27%, in this “dollar” turn (thru Q2), Goldman Sachs reduced its book by only $4.8 trillion, or 10% (thru Q2). I think what we are seeing now in its consecutive Q2 and Q3 numbers bears that out as a big mistake (as Deutsche and CS).

Though we don’t have an updated full balance sheet yet, it doesn’t take much to guess what the likely response will be from all these banks. And that is what makes even a simple study of something like reported gross notional exposures, without any greater detail, a useful tool in identifying and relating eurodollar prices and indications to the overall implied environment. Too often people get lost in the trillions or the utter complexity and expanse of all the kinds of derivatives to appreciate the worthwhile information especially in relative terms, which is often what truly matters out in front of all the detailed messiness:

JP Morgan’s gross notional interest rate swap book has declined (through Q2; I can only imagine what that might be when the Q3 figures, incorporating the events of August and September, are published) by $14 trillion (-26%) since the middle of last year, this “rising” or “strong dollar.” Bank of America (Merrill Lynch) -$10.7 trillion (-24%); Credit Suisse -CHF14.7 trillion (-27%); UBS -CHF5.5 trillion (-30%); Goldman Sachs -$4.8 billion (-10%; though I suspect that will be a much larger negative after the FICC quarter they just handed in) and on and on. All of those figures are just gross notionals reported for interest rate swaps, but that is the beauty of such simplicity. You don’t have to understand all the angles, all the intricacies and complexities of why dealers might take both long and short, fixed and floating and everything in between. You don’t need to note convexity or its nefarious opposite, negative convexity, or to even know what correlation skews might do to a whole eurodollar pack, white through gold. To tally gross notional derivative books in this way is to fly above all that and realize, despite the imperfection of such a proxy, that these numbers indicate an aggregate intention of participating in the dark leverage that sustains the eurodollar in all its forms; including global market liquidity.

Or, as these profits numbers and notional trends indicate, to not participate in the eurodollar. In this sense, the math is extraordinarily easy: banks are profits, profits are bad in FICC and getting really bad, FICC is eurodollars, and there’s your general and disruptive 2015 global “dollar” trend. You might even add to that how Goldman Sachs, Deutsche Bank, Credit Suisse and the few others that initially bucked the trend and followed Janet Yellen have only instead confirmed her folly (and theirs), but that would just be more unnecessary complication.

It adds up to a much more uncertain forecast, but one less clouded by inane “transitory” denseness.

Stay In Touch