There probably should be a cottage industry trying to figure out what Albert Einstein actually said or wrote quite against what is typically attributed to him (or Abraham Lincoln, Winston Churchill and many others). One such nugget purported from his genius was that compound interest is the most powerful force in the universe. That is how the sentiment seems to appear recently, though I have also seen a more direct “quote” in which Einstein may have put it, “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t pays it.” Einstein is also cited as having said, “When you got a reputation of a genius, you need get used to people misquoting you on all kinds of matters, even those which are as far away from your area of expertise as they can possibly be.”

So the very human logical fallacy of appeal to authority applies but does not necessarily blunt the forceful message of expression. It doesn’t really matter whether it came from Einstein’s brain, the meaning is well-taken and applicable. And since compounding is truly a function of time, that suggests time is a great force in the real world in consequence to finance even though it is often underappreciated. It takes almost no bearing on economics, however, particularly the modern orthodoxy that runs directly from John Maynard Keynes’ schoolyard solecism about how everyone dies.

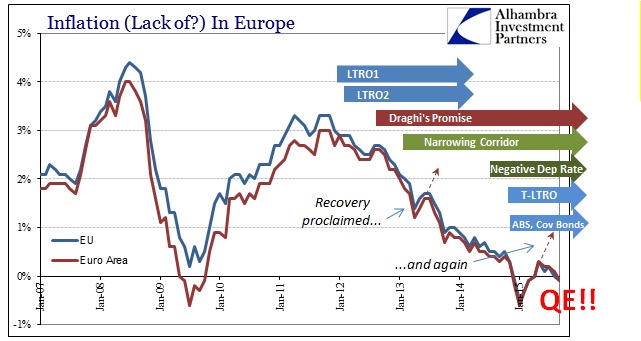

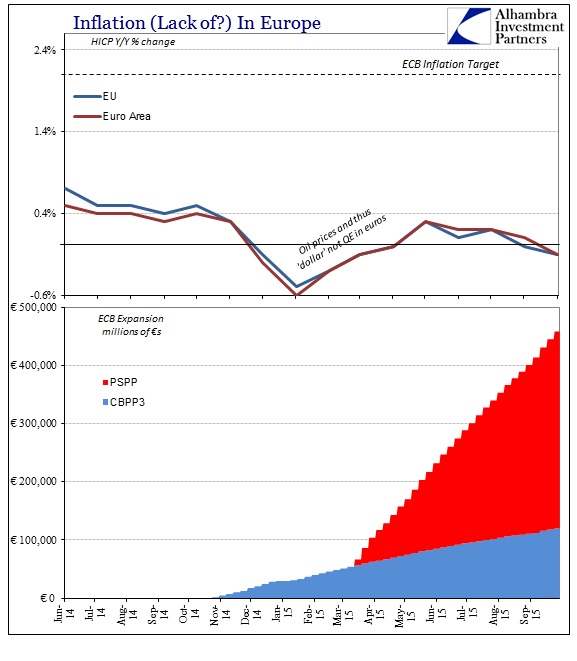

In Europe, the HICP measure of “inflation” came out once more negative in September despite 6 months of completed PSPP (QE) and almost a year of monetary adventure in covered bonds that had once set commentary and expectations alight. Combined, the ECB has added nearly half a trillion euros under those programs and hasn’t moved the needle on lending let alone “inflation.”

The euro’s persistent rise came to a juddering halt after a European Central Bank policymaker voiced concerns about its ability to tackle inflation, raising expectations of further easing to boost the eurozone’s fragile economy.

Ahead of next week’s ECB policy meeting, Ewald Nowotny said the ECB was “clearly missing its inflation target”.

The stark nature such unusual truth apparently makes no difference, as “markets” simply took that to mean even more extreme “dovishness” and thus still more QE. The inconsistency in any such sentiment is frightening, but that is the world Janet Yellen, and those like her, wishes us to inhabit.

Europe clearly has its own set of problems unique to their situation, including the ECB’s structure but more so the euro itself, but rather than let them off the hook about it all that difference is quite damning for QE as a design and theory. Ben Bernanke has been of late taking to pointing out how the US is better situated, economically speaking, than Europe as if that were proof his early QE interventions were the whole difference. Setting aside how embarrassing that comparison actually is for him, given that his suggestion of US output being only 8.9% above the prior peak is already woefully inadequate and further does not include other measures of “output” such as labor utilization (even pollution), on “inflation” the two seemingly distinct systems are actually far too comparable.

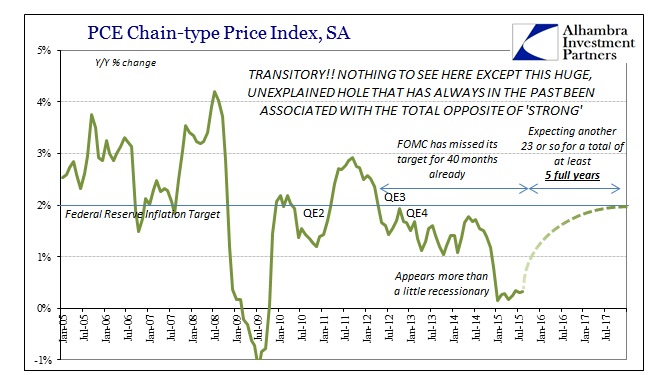

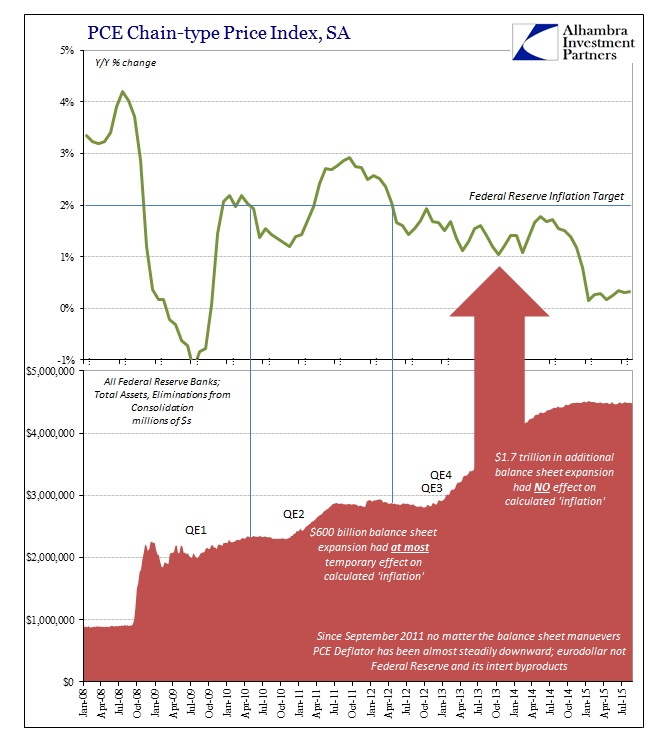

The last time the US PCE Deflator, the Fed’s preferred measure of “inflation”, was above the 2% target was April 2012. That index’s growth rate peaked in September 2011! Since then, the Fed has expanded its balance sheet by $1.7 trillion under QE3 and then an added QE4; and the PCE Deflator has meandered only lower during that time. At best, you could suggest no correlation; at worst a slightly inverse one.

That defines the troubled association between QE-style monetarism and orthodox conventions on inflation (and further how that intended redistribution is supposed to follow Keynes’ “pump priming” principles). The best association you can make is a very loose one, as inflation may or may not have responded to prior QE’s, but even if you think it did not for very long. Economists may disregard time as a factor, but in the real world it isn’t so clean and academic.

Every time the PCE Deflator had threatened below 2%, the Fed responded with a QE (or two). The first two were, again, more mixed especially since the change in the deflator out of 2009 was likely far more natural reversion than monetary influence. No matter, since none of them have “stuck” and the last two were woefully inaudible from this intended perspective. In that sense, QE in Europe has been as QE in the US; which is, unfortunately, just confirming the major QE lessons that economists refuse to take from Japan.

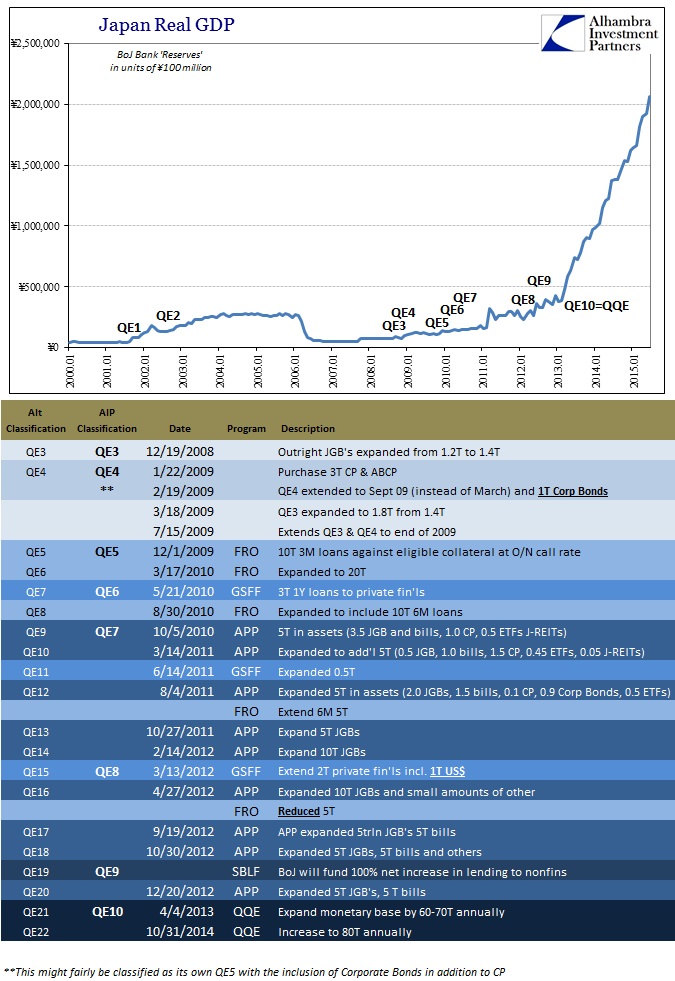

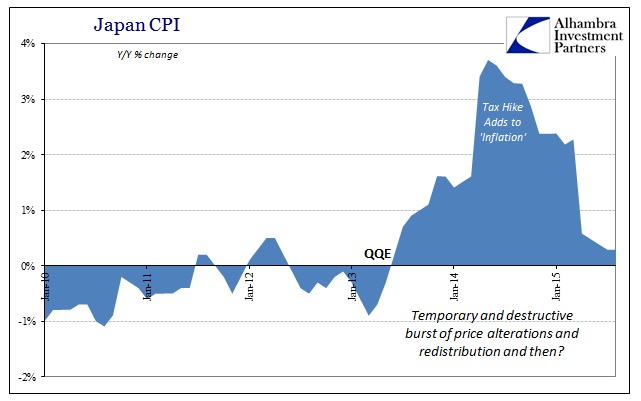

The Bank of Japan has been conducting QE almost regularly for the whole of the 21st century, admitting only to being bested by a mindset; a “deflationary mindset” is thus, apparently, an order of magnitude or two more powerful than balance sheet expansion into the tens of trillions. For QE10, or QQE (which adds “qualitative” now to “quantitative”, suggesting that the quantitative needs at least more count of letters?), the idea was to just overwhelm that “irrational” emotion by wholesale fury of leaving trillions far behind and stretching toward quadrillion.

The result was the same; not just by Japanese standards, which amount to destroying the economy a little more in discrete pieces each time, but by the same as was “gained” in the US. Outside of a temporary and reversible burst of inflation, it leaves no positive lasting impact (and quite a lot of, again, negatives).

So we have, across this QE world, explored quite a lot of variation in the QE’s and the conditions upon which they entered. The results are generally the same every single time and specifically never living up to their stated goals and promises. Even in statistics that proves that the QE itself is not the answer in any format or shape. We have seen it within a strangling currency regime of mismatched national interests and circumstances; expanded to all different kinds of scales; by virtue of different asset classes and purchases; across culturally expansive divides; fiscal in, fiscal out; and almost everything in between. And the results are always the same – wasting time.

Economics has never been a science else it would take note of such squandering and condemning the world to being on the wrong end of “the most powerful force in the universe.” Taking “money printing” to such extremes can only lead one to conclude none of it is, in fact, money printing. It is all just a fairy tale that central banks want you to believe in and thus act out. We have paid for that in time already, and now the ideological carelessness (blindness) is about to be given a more visible quantification.

Stay In Touch