Written Tuesday Oct 27

It bears repeating and re-emphasizing, but had the guts of the actual global financial system been fully appreciated in a timely manner the current state of the global “dollar” would be cause for celebration. It would matter not that the eurodollar is in full and often violent retreat because that is the exact method by which a real recovery would be born; if only there were a reasonable market for money (actual, not ephemeral and pliable) and money dealing in place to absorb the transition. The happenstance of the current state of the “dollar” owes itself to the rededicated financialism of every central bank as if 2008 never happened. Rather than look for an actual solution, views of cyclicality ruled where the panic was judged nothing more than a temporary disruption.

It is that general outline that accounts for the recovery, lack of. Market forces practically begged for a total re-alignment, especially since the status quo only survived through the greater oligarchy in money of TBTF. The larger banks have only gotten larger and now they have very little competition since there are practically no new banks anymore. Wholesale continues to dominate, amazingly even more so now than pre-crisis which more than suggests the rotten nature of the very antics proclaimed as monetary heroism.

Except that the wholesale banks themselves no longer want the job of supporting that system. Before 2008, prop trading and spreads were not just favorable but undoubtedly so as any number of unrelated firms suddenly became FICC centric. GE Capital became a leading provider of mortgage warehousing as well as “investing” while formerly uninteresting insurance companies like AIG transformed into both securities dealers and prime purveyors of dark leverage, especially CDS. It was all, of course, artificially inflated by the nature of that time, the Great “Moderation” because the whole system long ago departed basic and operational sense.

Behind it all was the eurodollar. As I wrote at the outset above, some timely appreciation for it might have saved a whole lot of acute trouble and maybe would have pushed for some real reform (and then a real recovery to follow). What is really frustrating, maybe criminally so, however, is that monetary officials were debating eurodollars not in 2006 but rather 1979. At that early stage, the Fed along with other central banks couldn’t quite make out what it was, how it got there or where it was all going. They were even debating at that time whether a eurodollar was actually “money” at all:

It has long been recognized that a shift of deposits from a domestic banking system to the corresponding Euromarket (say from the United States to the Euro-dollar market) usually results in a net increase in bank liabilities worldwide. This occurs because reserves held against domestic bank liabilities are not diminished by such a transaction, and there are no reserve requirements on Eurodeposits. Hence, existing reserves support the same amount of domestic liabilities as before the transaction. However, new Euromarket liabilities have been created, and world credit availability has been expanded.

To some critics this observation is true but irrelevant, so long as the monetary authorities seek to reach their ultimate economic objectives by influencing the money supply that best represents money used in transactions (usually M1). On this reasoning, Euromarket expansion does not create money, because all Eurocurrency liabilities are time deposits although frequently of very short maturity. Thus, they must be treated exclusively as investments. They can serve the store of value function of money but cannot act as a medium of exchange.

In other words, at least parts of the Fed all the way back in 1979 appreciated how Greenspan and Bernanke’s “global savings glut” was a joke. Rather than follow that inquiry to a useful line of policy, monetary officials instead just let it all go into the ether of, from their view, trivial history. But the true disaster lies not just in that intentional ignorance but rather how orthodox economists and policymakers were acutely aware there was “something” amiss about money especially by the 1990’s. Because these dots to connect were so close together the only reasonable conclusion for this discrepancy is ideology alone. Economists were so bent upon creating monetary “rules” by which to control the economy that they refused recognition of something so immense because it would disqualify their very effort.

And so, the Fed and central banks bent over backwards to avoid the eurodollar, even taking to ridiculous efforts to do so. Not only was Greenspan waddling on in the “global savings glut”, the Fed itself discontinued M3 in 2005 just to avoid the topic altogether. That part has to be considered purposeful negligence, because by that point the eurodollar figures were not unimportant but simply too immense to calculate.

When M3 was discontinued, the Fed wrote that it, “does not appear to convey any additional information about economic activity that is not already embodied in M2 and has not played a role in the monetary policy process for many years.” Given the time period, that was a material discrepancy upon reality. It was, after all, Greenspan himself in 1996 (the “irrational exuberance” speech) who first reported that traditional monetary figures like M2 were no longer correlating much to economic expectations. So cutting out M3 by 2005 is nothing but a tangled mess of contradictions that, again, point to nothing but religious-like expedience over proper science.

It would, as we know now, come back to haunt the world only a few years later:

But the second part of that official justification should have been something of a warning about all things in the monetary realm. The “costs of collecting” excuse was greeted by Fed critics with more than a hint of derision since it smacked of too much disingenuousness. It seemed like a lame attempt to hide banking gone into overdrive.

The Fed, however, was actually honest here, and that should have been, and should be still, meaningful in the context of monetary engineering and the economy’s paradigm shift in 2008/09. Those two elements of M3, repos and eurodollars, were the epicenter of crisis. The fact that it would have cost the Fed too much to attempt to measure these “money” aggregates shows just how far the banking system strayed from the light of the regulated regime. Yet, as the Fed demonstrated in the first sentence of its official rationale, our central bank had little interest in that monetary/banking arena.

Nothing has changed in that regard, as global central banks still have little interest in wholesale banking. The reason is just as simple and the same; they haven’t figured out how to incorporate the factor into their “rules.” As it was, nobody had any idea just how far the eurodollar system had expanded and penetrated because they weren’t even looking at it – and we still don’t know (witness now China and the potential for an “Asian dollar”). The BIS in October 2009 came up with a conservative estimate just in the “global dollar short” of at least $2.5 trillion for European banks alone. But that was just the money dealing, as that liquidity support was angling about:

The outstanding stock of banks’ foreign claims grew from $10 trillion at the beginning of 2000 to $34 trillion by end-2007, a significant expansion even when scaled by global economic activity (Figure 1, left panel). The year-on-year growth in foreign claims approached 30% by mid-2007, up from around 10% in 2001. This acceleration took place during a period of financial innovation, which included the emergence of structured finance, the spread of “universal banking”, which combines commercial and investment banking and proprietary trading activities, and significant growth in the hedge fund industry to which banks offer prime brokerage and other services.

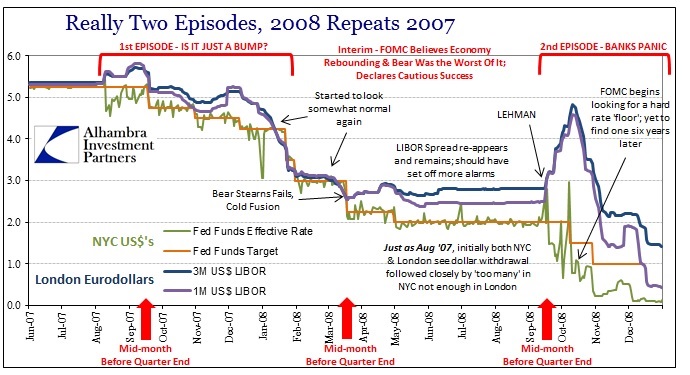

So where and while the US central bank was showing and delivering even less appreciation for wholesale banking the scale was an enormous up-to-30% per year expansion by 2007? I have never worked for a central bank but even an outsider would be easily impressed that a $24 trillion increase in offshore banks’ “foreign claims” should have been not just a part of the monetary setting but perhaps the lone and central focus. That is especially true as the great and massive increase during the ultimate mania (in finance) occurred exactly as the Fed was raising its federal funds target; as with dark leverage, we see now what should have been easily seen then, that the Fed’s traditional mode of operation was wholly and totally obsolete. Monetary policy had not just been reduced, it had been disemboweled and obliterated by an “outside” force. The lack of curiosity, let alone appreciation, is staggering and telling.

Again, going back to 1979, the FRBNY discussion predicted the exact manner of liquidity crash that followed just more than a quarter-century later:

One of the traditional responsibilities of any central bank is to act as lender of last resort – to supply funds to a solvent bank or to the banking system generally in an emergency that threatens a sharp contraction of liquidity. This role normally has been framed with respect to commercial banks in the domestic banking system. But the emergence of the extraterritorial Euromarket created ambiguities about which central bank would be responsible for providing lender-of-last-resort support for overseas operations.

No final resolution of those ambiguities has yet been reached, and it is doubtful that central bankers will ever codify their respective roles or lay down conditions for lender-of-last-resort assistance.

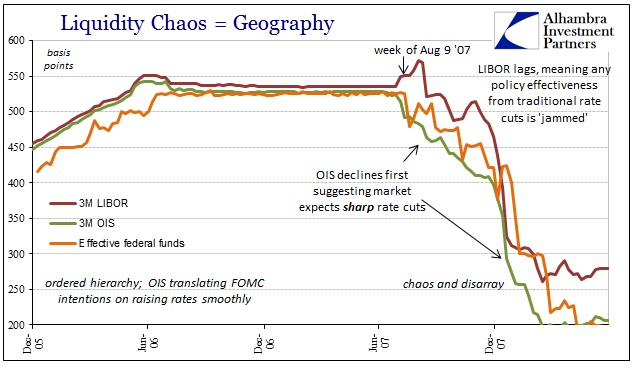

Here was the Fed debating in 1979 the very geographic divide in the “dollar” that would condition the full weight of panic by September 2008. Worse, it continues now especially after the events of 2011 and with the amplification of wholesale eurodollar retreat post-June 2014. There is a great deal that disqualifies orthodox economics from the levers of economic power, but this is not close to the top but the very top of that list. When that prescient conjecture was written nearly forty years ago, the eurodollar intrusion had already grown to an estimated 10% of M3 (and that was just, again, what was reported on-the-books).

Yet, from 10% to wiping out M3 altogether over three decades, the Fed studiously ignored it all. They took greater care in not looking anywhere close in the direction of the eurodollar than they did about their own ridiculous attempts at soft central planning. It could not be, now, anymore asinine than what we have: the Federal Reserve religiously neglecting to incorporate the very case the institution warned itself about four decades ago even though that warning has now been applied in two separate and dangerous episodes (one still to reach its ultimate settled state). There is no analogy or metaphor suitable for this level of carelessness and deliberate stupidity. You might make the argument that it wasn’t clear in 1979 the trajectory of the wholesale direction, but by at least the mid-1990’s there was no longer any doubt. Again, it could only be ideologically-driven blindness that would prevent acknowledgment and appreciation of such obvious shifts and alterations – especially of that magnitude.

The relevance to today’s discontinuity is as I wrote at the beginning; if the eurodollar decay was occurring in a regime of planned obsolescence and retreat, with a waiting solution ready to take up the slack of the global work eurodollars still, badly, engage, then the cause of financialism would be welcomed toward extinction. Rather than that useful paradigm alteration, however, central banks simply persist as if there has been no wholesale violence at all at any time; leaving the global “dollar” system to again bear the brunt of the obvious and again gaining savagery. After all that has transpired and the great cost in terms of time and bubbles (globally) we remain on Step 1 in the program out of a “lost decade.” We are still fighting to recognize that we have a problem and to plead the obvious about what that exactly is.

That is why the only answer, in my opinion, will be political. If after all that has taken place in the past forty years (really fifty or sixty) and orthodox economics still denies direct and easy observation then it is equally obvious that it never will (and why that is). “Markets” may still aspire in pieces to central banks as the ultimate guarantor, but that is just the business end of intentional financial illiteracy.

Stay In Touch