Top News Headlines

- October best month for stocks in four years.

- Valeant troubles continue.

- Pfizer, Allergan consider merger.

- Earnings, earnings, earnings.

- CNBC botches Republican debate.

- Debt deal reached between President and Republicans.

Economic News

- Fed leaves rates unchanged; statement points to December hike. Yeah, right.

- BOJ leaves QE program as is.

- GDP disappoints at 1.5% for 3rd quarter.

- New and pending home sales both less than expected.

- Dallas, Richmond Fed reports still negative; Chicago PMI bucks the trend.

Random Thought Of The Week

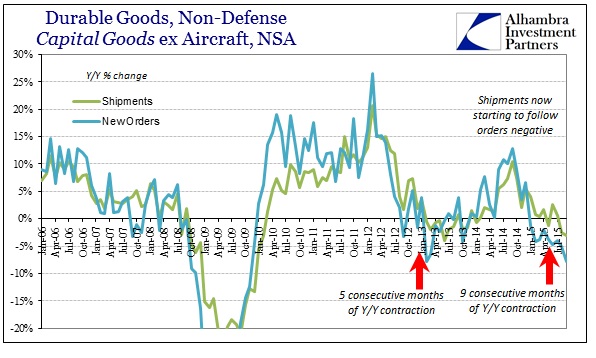

The FOMC statement this week said that “Household spending and business fixed investment have been increasing at solid rates in recent months” a statement almost completely at odds with, you know, reality. One can certainly make a better case for household spending since part of the recent “weakness” can be explained by lower gas prices but business fixed investment is harder to spin. The durable goods report this week continued the trend for core capital goods, down over 7% from last year. That isn’t solid or any other word that denotes positive.

Chart Of The Week

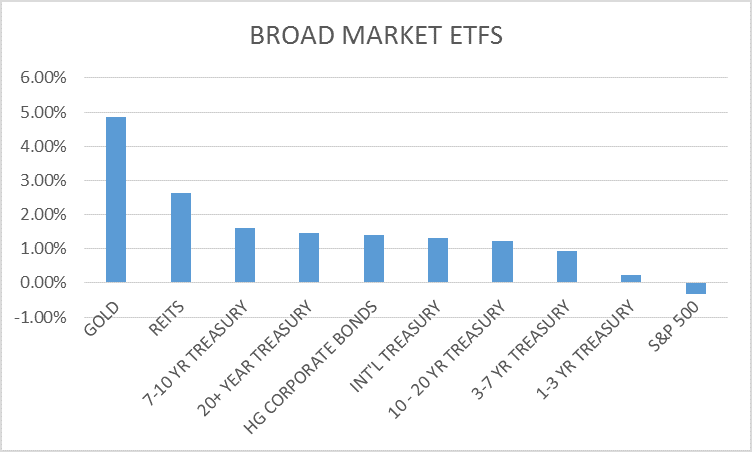

Broad Market Top 10 – 3 Month Returns

MOMENTUM ASSET ALLOCATION MODEL

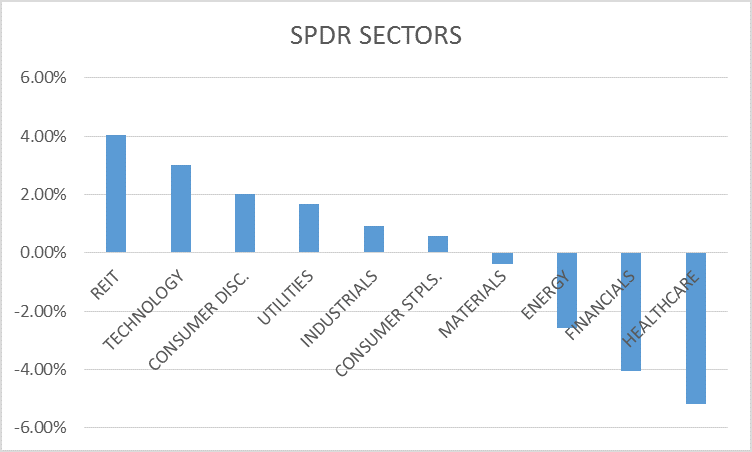

SPDR Sector Returns – 3 Month Returns

SPDR SECTOR ROTATION MODEL

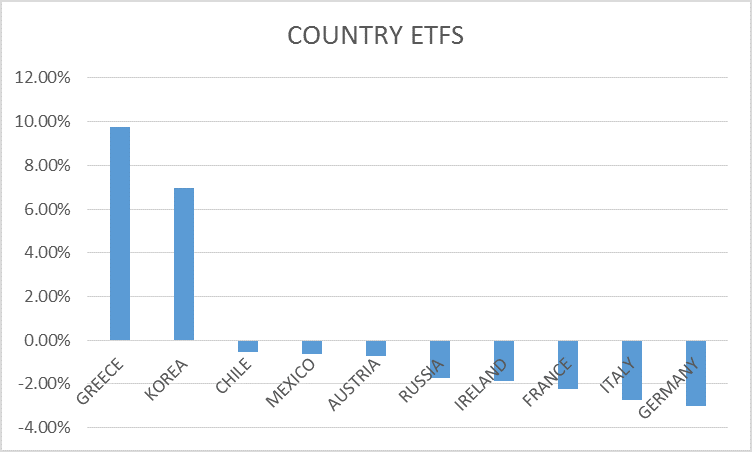

Country Returns Top 10 – 3 Month Returns

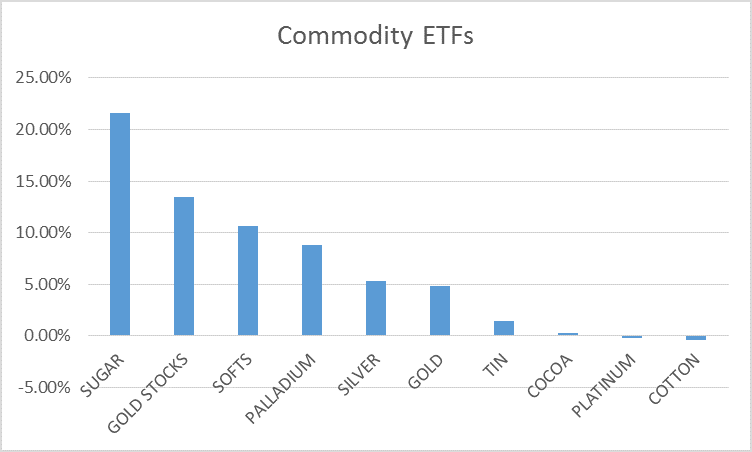

Commodity Returns Top 10 – 3 Month Returns

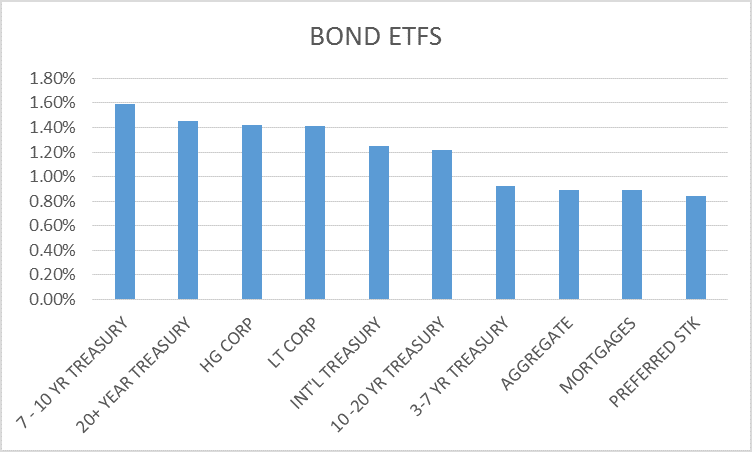

Bond Returns Top 10 – 3 Month Returns

Stock Valuation Update

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773. You can also book an appointment using our contact form.

786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch