Behavioral Finance in investing has been around for some time. The market reflects the collective opinion of investors. These opinions contain a human element and to the extent that they are completely rational is the source of much of the academic work in this field. Alan Greenspan’s use of the term irrational exuberance is a memorable allusion to the existence of investment psychology.

Keen awareness of these market biases can potentially lead to alpha in your portfolio. But for the many, biases can impose a cost on the portfolio. Unfortunately hindsight is the only true way to know the irrationality of markets. But veteran investors are always on the lookout for potential opportunity or pit falls presented from these heuristics.

In a recent CFA Institute survey of 724 investors, herding was voted the #1 bias affecting investment decsions. If the collective investment world is likely to be influenced by each other to follow trends, then we might benefit from looking at the possibility that these trends go too far. Because, bucking the trend can often lead to enhanced long term returns.

Here are 3 recent extremes in the market for your consideration.

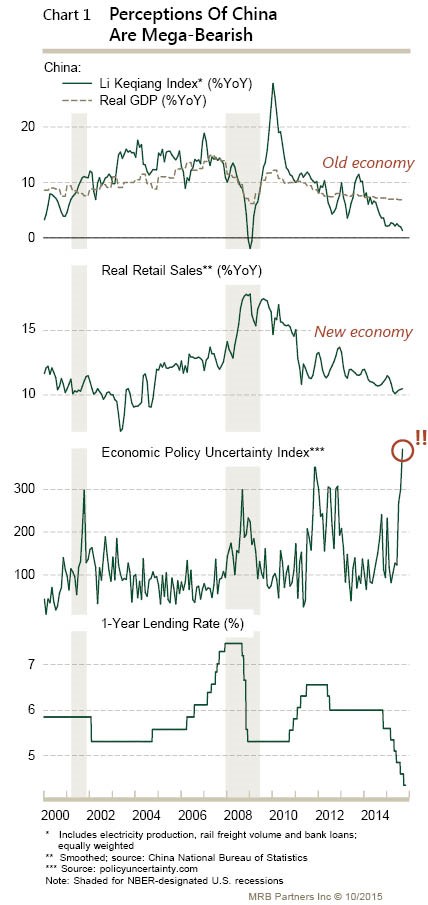

- Negative perceptions of a faltering Chinese economy are at an extreme based upon surveys of widely read press reports and investment analysis reports. Economic uncertainty is higher than the last 2 recessions and measures of manufacturing are signaling recession. Chinese equities took a recent 30% haircut in a matter of 3 months. But, Chinese stocks had soared 25% in the 1st quarter of 2015 and are essentially unchanged YTD and China is attempting to move their economy away from the heavy reliance on manufacturing. Is recent pessimism too extreme?

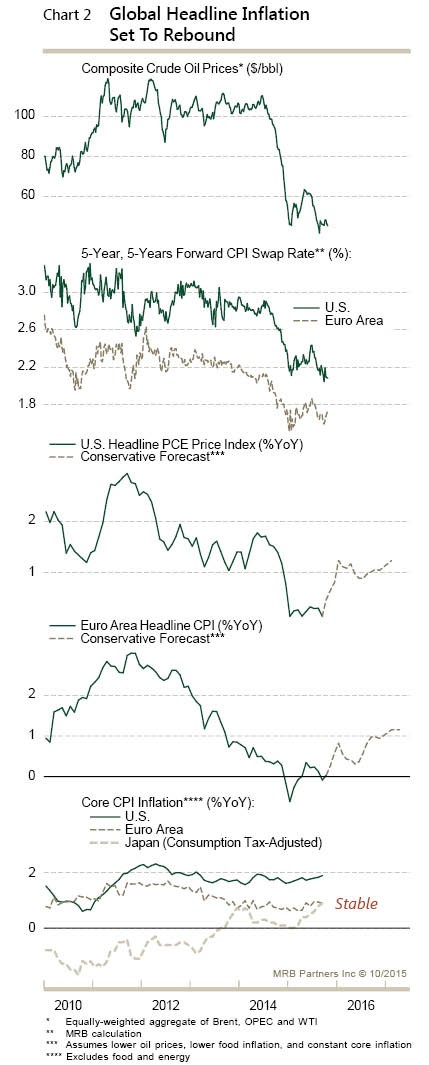

- The strength of the US Dollar and the collapse of oil prices have been extreme. The dollar rallied 25% from July 2014 to March 2015. At the same time, oil is down over 60%. As a result, inflation is extremely low and negative by certain measures. Additionally, inflation expectations are lower. The fear is that there is collapsing demand in a debt ridden world. Are we truly in the midst of a deflationary spiral?

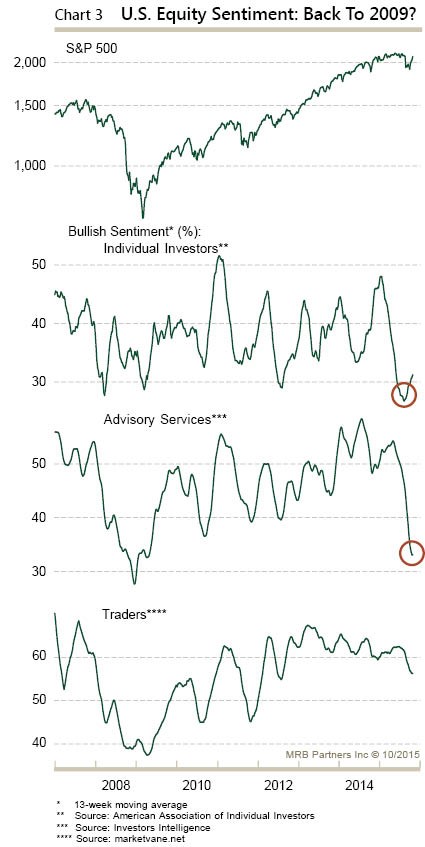

- US equity investor sentiment is as low as during the height of the recent financial crisis for individuals and advisors. Is this bearishness too extreme?

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch