For those inclined to see only the positive side, the current downdrift in at least manufacturing globally still holds no special distinction. Either it is to be dismissed as a trivial concern unconnected to the “real” economy or, more blatantly, it doesn’t matter because it only means more “stimulus.” Thus, the positive side can never lose as every negative account is effortlessly rejected or just as easily fixed.

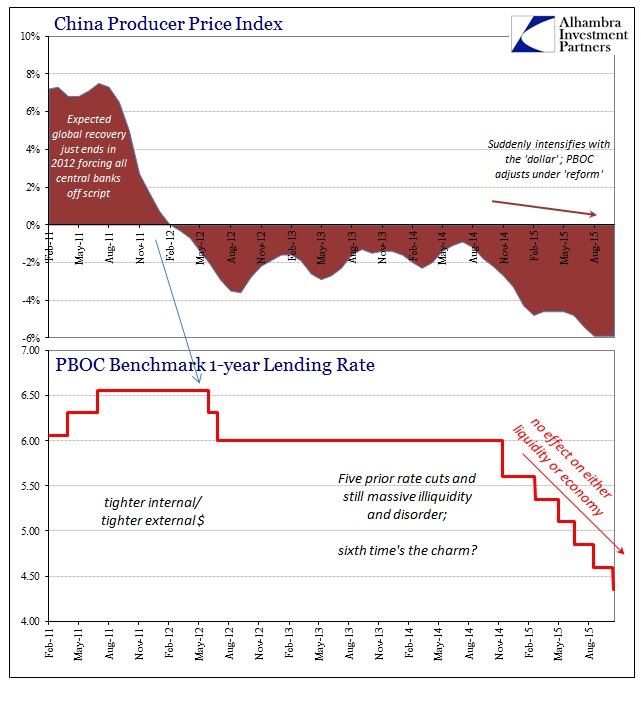

Given the global PMI submerging of late, both sides of that equivocation have been offered in greater emphasis; if not manufacturing as “only” 12% then the surety by which global “stimulus” and “easing” will come and wash away the doldrums. China is most on that point in late 2015, especially as its slowdown is no longer arguable:

“We do think there is more easing to come in China. They are in the midst of a long-running easing cycle that is probably going to go on until late next year,” said Andrew Kenningham at Capital Economics.

There are, of course, any number of problems with such shorthand; as that is all it amounts to. The PBOC (or ECB, BoJ, BoE, FOMC) does something and it is just accepted that its exact form doesn’t make a difference nor how it is even supposed to get from A to B. A good deal of that generic appeal, if not all of it, is that nobody seems to want to know the details; better to simply assume than to pull back the curtain and be averted from all the sustained ugliness. It is far more than from A to B, obviously, as there are innumerable channels and pathologies standing in between that turns “stimulus” into wasted hope.

That much should be fully apparent by now, as everything the PBOC has done in the past year amounted to no change in the downslope. Though every minor uptick variation was taken as a herald for the believed-resurrection, the sinking remains completely undeterred and unmoved. If five “rate cuts” since last November have had so little effect, why consider the sixth any different? Imagining any affirmative answer is to deny the complexity.

That starts with yuan liquidity which is far from straightforward particularly in the Chinese version of the “dollar” connection. Unlike so many other systems, renminbi is greatly and directly affected by “dollar” imbalance to the point that action in the former can lead disastrously to the latter – even by the PBOC itself. That action has been taken in the mainstream as the PBOC “selling UST” all throughout the past few months in an effort to supposedly stem “capital” outflows. In truth, the eurodollar problems have forced the PBOC to essentially supplement China’s local “dollar” short because of this transverse mechanism (a leftover of the former peg).

As noted back during the “devaluation”, the “band” with which the PBOC “allows” trading, centered on the official yuan “fix”, acts as an artificial restriction on that “dollar” short. If the “dollar” problem gains beyond some unknowable threshold, the currency fix and its band restrict Chinese banks from rolling over daily “dollar” funding. In non-fixed currencies, this is the “rising dollar” which is nothing more than an indication of greater local cost to access eurodollars (or Asian “dollars”, as it were). China’s central bank supplementing this private process allows, for a time, the fix to remain whatever the PBOC has decided consistent with its policies and mandates.

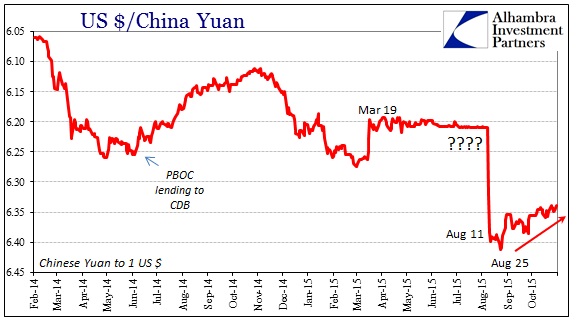

Until it turns catastrophic; as it did on August 11.

At that point, the PBOC could only maintain the fix and the band by providing obviously some kind of “dollar” source that it no longer wished to provide (wholesale dynamics mean that the exact form of the “dollar” liability needed in the onshore China market might take any kind of form, especially derivative contracts such as swaps and forwards). Thus, either Chinese banks were to default on those “dollar” rollovers or the PBOC could allow them to bid at the “market” cost; which was a “depreciating” yuan against a “rising dollar.” They took the latter course which has caused mainstream angst from an inability to decipher all this “dollar” mess.

Around September 1, the PBOC announced a new “dollar” requirement whereby Chinese banks acting on behalf of customers that were “buying dollars” were to provide a one-year 20% reserve to the PBOC. There was never any clarification provided as the exact nature of that reserve, so naturally it has been assumed in various forms, mostly as if the PBOC’s only concern was and is “volatility” and offshore. My theory has been that it was an attempted backdoor association to redistribute “dollars” onshore.

The reasoning would be as obvious, namely that the PBOC, despite “better” capital numbers in September, has been continuously acting in “dollars” all along. The yuan/dollar cross remains significantly out of line with the pre-August regime, meaning a greater relative cost for bidding “dollars” that persists to this day. To that point alone, the PBOC has also an obvious interest in eventually re-aligning the yuan with its forced “parity” pre-August 11. And the Chinese central bank has been trying to move in that direction almost steadily since September, so I believe the reserve shift was instituted to assist in that direction.

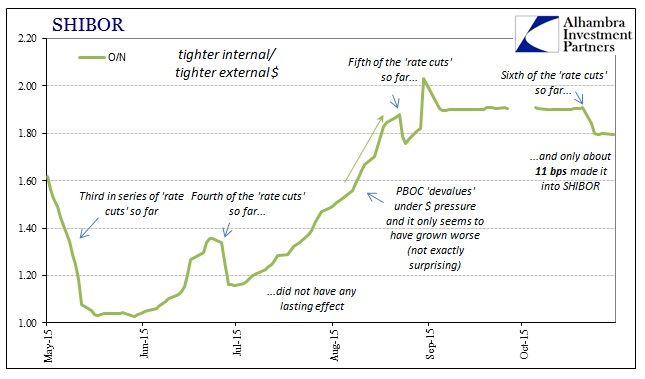

They clearly need that assist, if that is truly the case. The PBOC has certainly pegged overnight SHIBOR in association with its attempt to reduce visibility of the “dollar” strain, which can only lead to “dollar” imbalances breaking out elsewhere. Thus, without any possible aid from the “dollar” reserves there might be no window with which to attempt redrawing the yuan/”dollar” cost.

Consistent with pegging SHIBOR, fixing the yuan much higher seems to be the track the PBOC wishes to take (so much for “devaluation”). It started with the last rate cut on October 23 which should have, under orthodox theory, provided some internal support to yuan liquidity as the central bank’s currency appreciation tactic would draw down internal RMB (pegged SHIBOR or not). However, the effort was in trouble from the start as O/N SHIBOR has only been reduced by about 11 bps from its prior peg near and around 1.90%.

For whatever reason, the PBOC decided today to accelerate the issue, fixing the yuan at its highest point in some time and by the largest single-day move in a decade:

The People’s Bank of China fixed the yuan mid-price 341 basis points, or 0.54 per cent, stronger at 6.3154 against the US dollar yesterday, the biggest daily jump since July 2005. But onshore yuan, or CNY, shrugged off the central bank support and closed 0.32 per cent lower at 6.3379.

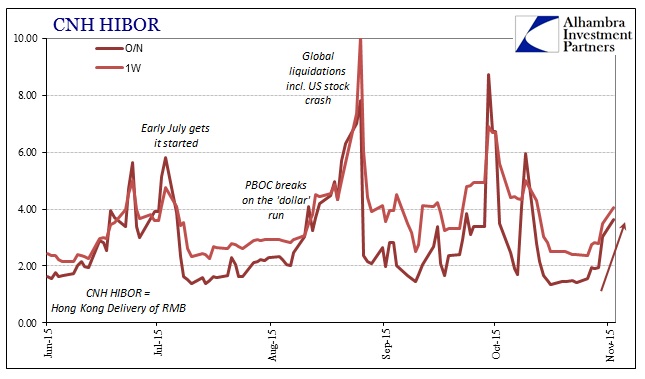

There are a few reasons why the PBOC would choose that course, but I won’t speculate here without at least some solid indication for any individual possibility (naked conjecture on my part doesn’t help anyone). As expected, yuan liquidity has not responded well, particularly offshore. That means neither the onshore yuan condition nor its connections offshore appear remotely willing (or able) to bid for “dollars” cheaper (in whatever wholesale form) regardless of whatever IMF conditions are assumed to be at work.

Where O/N SHIBOR only settles 11 bps lower despite not just rate cuts but also a 50 bps “release” in yuan reserve requirements, CNH HIBOR jumps up again starting the Monday right after the “stimulus.” Again, that suggests “dollar” not yuan. From that, I have to believe that the PBOC overestimated both (or either) its “dollar” reserve that inaugurated on October 15 and the unknown forwards the PBOC has issued to quiet the obvious nature of the liquidity drain in “dollars.”

There are, of course, a great number of assumptions on my part here, and though I think them reasonable given these outcomes in many ways it is all beside the relevant point in the context of what truly matters. In short, the media and economists point to “stimulus” as if it were just that easy, a generic concept generically embedded in generic “money.” That is all pure nonsense even in traditional banking, but far, far more so under wholesale arrangements. In other words, for these purposes it doesn’t matter if I am right about the exact what’s and why’s, instead the only solid conclusion in any of this is that “stimulus” is so easily lost and swallowed up by any number of unknown financial assailants. Given the distinctness with which these kinds of indications continue in China, there is absolutely no valid reason to simply assume the most favorable monetary dynamics (and a great deal of actual evidence to in its place presume more the worst).

That much is at least consistent with the fact that whatever the PBOC does has had, to this point, no discernable effect whatsoever. So many central banks have found that taking on the “dollar” as it is now, not unlike, in category, what it was in 2007-09, is a losing proposition. That leaves China, inarguable in its economic deficiency in 2015, without the mainstream’s safety blanket of central banks just wishing it all away. The PBOC is clearly and often visibly struggling with its “dollar” problem, a representative sample for the global economy.

Stay In Touch