The deletion of “dollar” capacity in money dealing globally is not just a theoretical impugning upon asset prices alone. Corporate debt issuance has been obviously provoked to an increasingly smaller state. The numbers are starting to become serious, which may account for at least part of the economic misfortune that the Fed desperately wants the world to ignore.

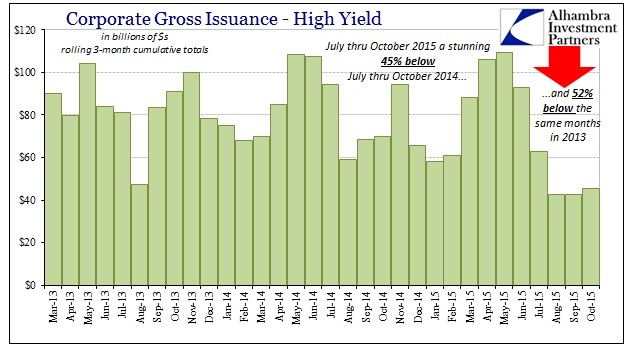

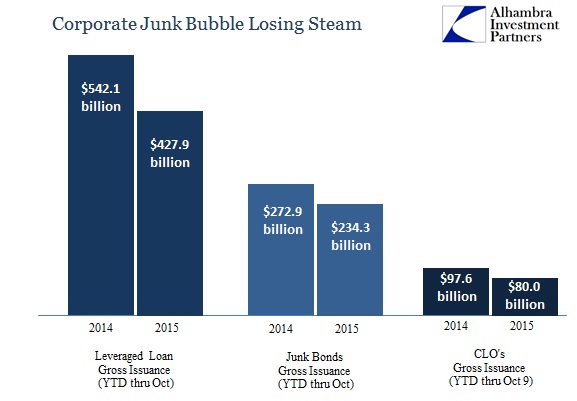

Where swap spreads indicate growing liquidity unrest, that translates into more dubious pricing regimes and thus imperils the smooth “flow” of the only real monetary transmission of this parched “cycle.” Junk bond debt gross issuance, which had hung in rather well through July, has taken a serious downward turn in the past few months. Year-to-date, high yield gross is off about 14%, but just in the past four months cumulative totals are down an astonishing 44% from the same months in 2014; and 52% from the July-October period of 2013.

The heavier months of September and October for corporate issues were almost a complete wipeout this year (not surprisingly given the continuous unsettled financial state of the “dollar”). Whereas gross supply was $39.3 billion and $27.0 billion in September and October 2014, respectively, despite the fireworks of those months, this year the totals were just $21.3 billion for September (-21%) and an astounding $10.4 billion in October (-63%).

That trend persists across the whole of the junk bubble, with leveraged loan gross off still a steady 21% YTD (through October). CLO issuance is down now 18% through the week of October 9.

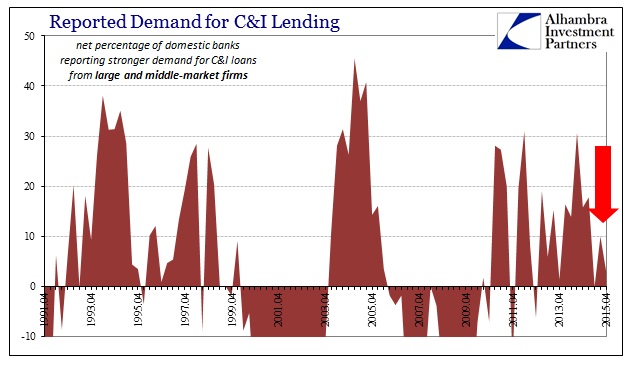

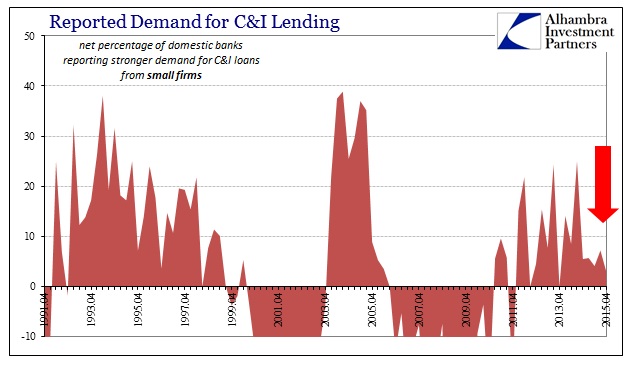

It is not just sticking with strictly junk bubble production, either. As my colleague Joe Calhoun flagged this week, reported “demand” for C&I lending at all domestic banks is now beyond soft, having sustained such weakness for, surprise, the whole of 2015 so far (for small firms going all the way back to Q4 2014).

I think we are seeing the inevitable contours already of the serious and severe lack of transitional capability. In other words, the removal of dealer money dealing capacity is not anywhere being met by some other factor or even process; the “dollar” is just left hanging as nobody knows quite what to do about it. That disarray has been the commonplace desperation of foreign central banks, particularly after July 6. It is, of course, directly traceable to the grand state of denial with which the entire orthodoxy remains firmly planted within; they, including policymakers, will only consider that there is and will be a recovery to contain any such financial conversion and re-arrangement.

Back in May, I examined the efforts of a few people who were at least contemplating the necessity of the dealer transition and what it might look like upon successful completion. While there was a great deal of messiness to accompany the whole works, I had difficulty even getting that far and wondered why there wasn’t more appreciation for the fact that the entire process may be just unfeasible to begin with. The inevitable, from my view, disownment would be rendered fully where banks might no longer constrain themselves to the whole recovery narrative. That had already begun back in the middle of 2013, which was the basis for my skepticism, but has attained new and more intense emphasis with each obvious “dollar” wave.

I personally find way too much complacency in blindly believing that going from B to C will be only a minor inconvenience. It would be dangerous even under the circumstances where the system shifted from the dealers to the Fed and back to the dealers, with an infinite series of potential dangers even there. But to undertake a total and complete money market reformation from dealers to the Fed to money funds? There are no tests or history with which to suggest this is even doable under current intentions. Poszar and Mehrling’s contributions more than suggest that difficulty, but I think that still understates whether or not we ever get that far.

The ridiculous nonsense and insanity of swap spreads in the past few months more than suggest that I was right to point out that rather stark systemic fissure, and, ultimately, what that might mean. Dealers are exiting the “dollar” and there is nobody or nothing with which to cushion that “unscheduled” withdrawal. The prominence of the issuance statistics and estimates above, especially what Joe found and the physical and financial commodity price elements noted this morning, points to the real effects of that naked and impulsive devolution. Worse, as pointed out in today’s run through swap spreads, there won’t be anybody, official or private, to find a solution because none of them believe it is actually happening. They instead have all convinced themselves this is just a curious and trivial anomaly to be ignored on the way to the planned Utopia.

Stay In Touch