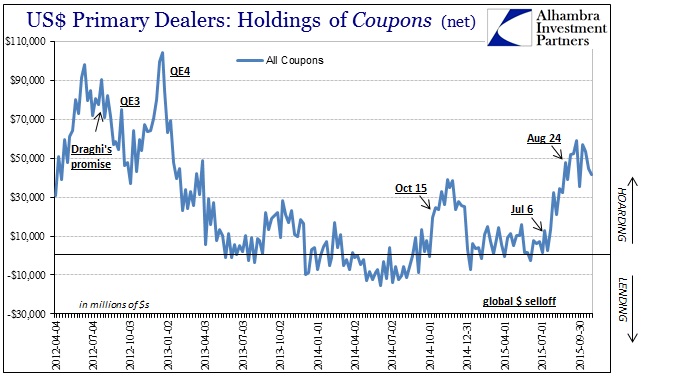

With the state of the “dollar” being what it is, including the devastating darkening afforded by negative swap spreads everywhere, it isn’t exactly surprising to find that primary dealers continue to hoard UST collateral. By September, dealers were reporting a net positive balance of all coupon holdings of nearly $60 billion. With everyone in the world predicting higher interest rates, including the banks themselves, it seems an odd pairing for dealer inventories to suddenly surge with longer maturity bonds and notes. In early July, after all, the net position was almost exactly neutral.

Dealer activities are, like most wholesale arrangements, misunderstood from any traditional monetary standpoint. Even that isn’t very surprising given that this kind of behavior is relatively new; dealers didn’t truly depart until the 21st century, and securities lending in repo isn’t much advertised or discussed. But if we calibrate dealer activities going back to the mid-2000’s, their footprint becomes clearer as does motivations and inferences about relative changes.

Until late July 2007, with a sharp reversion early that August, dealers were persistently “short” UST coupons around $100 billion to $150 billion. Those were massive positions but wholly unrelated to actual investments or even primary market warehousing. Instead, dealer inventories were accumulated in the robust securities lending business which was a constant and steady supply of “rentable” collateral for repo. Thus, the transition starting in July 2007 makes sense under terms of suddenly suspect rehypothecation chains and counterparty risk. Like the rest of the eurodollar system, this element of “dollar” liquidity eroded in waves so that years later by the time of QE3 (and undoubtedly one reason “convincing” Bernanke to act not once but twice in late 2012) dealers were almost as likely in net holding terms to hoard collateral as they once were to submit it into the liquidity market.

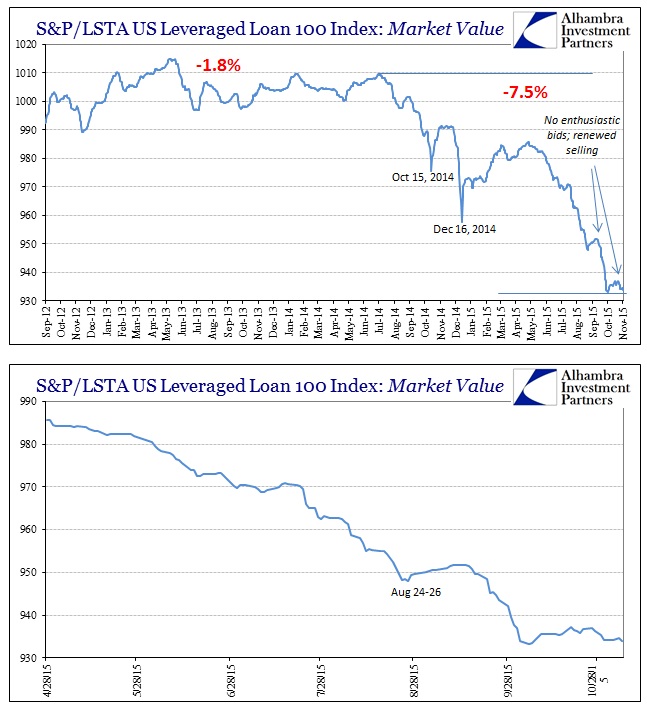

From that longer perspective, the past eighteen months of relentless “rising dollar” pressure can be placed more acutely by specific trend. With a major global selloff taking place October 15, 2014, the hoarding of collateral and thus repo fails and irregularity fix steady dealer dis-participation. That “wave” of repo and dealer repo mis-alignment lasted until the middle of December 2014 (recall the December 16 nadir of junk credit selling) and maxed out at a total reported “long” position of just less than $40 billion.

This second wave, beginning around the second week in July in these figures, surpasses 2014’s on its way to projecting wholesale illiquidity almost everywhere especially by mid-August. This is not to say that dealer hoarding of collateral, including UST’s, is the cause of the illiquidity but rather one element or expression of the more general attrition into vital funding imbalances. What stands out, then, in that regard is how dealers have continued to hoard throughout September and the whole of October (while optimism reigned elsewhere). That would certainly suggest as much as junk credit does, namely that the “dollar” problems have at least persisted this whole time (if not strengthened as might be determined via swap spreads).

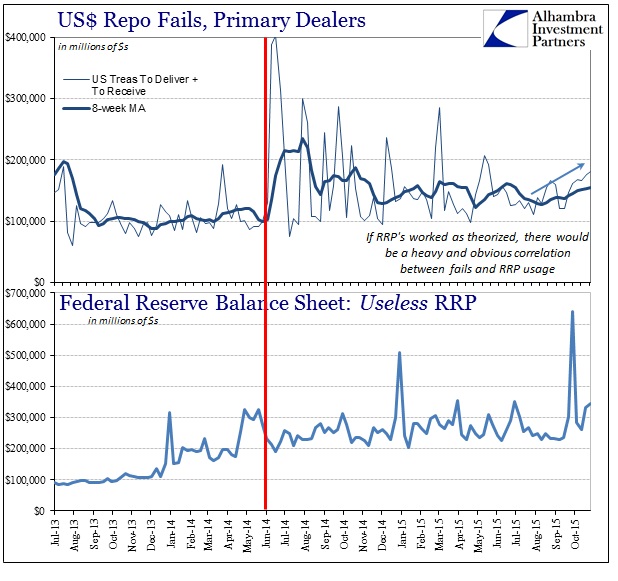

The Fed built upon its reverse repo plumbing to supposedly create an official sector bypass for such private hoarding, but there has been, still, no detectable benefit from that bureaucratic “solution.” Instead, repo fails in UST have steadily gained since the end of July – which is curious in and of itself given that repo fails far more tend to cluster and spike rather than foster a blander but steady upward trend.

The only interesting behavior from the Fed’s RRP was an immense surge at quarter end, long after funding temporarily disrupted almost every asset market on earth; in fact, RRP usage had been declining throughout this “dollar” wave until quarter end. Reaching a record $641 billion at the end of September, the RRP at best belatedly signals what anyone paying attention (obvious, that does not include the FOMC or economists) already figured out.

While that provides yet more color for events in the recent past, more immediate concerns dominate. As you can see from the first two charts above, again, dealers have continued to hoard UST coupon securities with no other explanation other than lingering and remaining “dollar” disruption. Repo rates have been rather well-behaved of late aside from following the same pattern as the prior two quarter-end/quarter-beginning periods. With fails rising through October, I think it reasonable to suggest that internal wholesale eurodollar mechanics are still easily disturbed. Further, we don’t quite know yet how swap spreads and bank desk withdrawals will impact this situation fully, since it takes some time for all that work on through into all the separate and disparate wholesale pieces.

At least in one respect, these dealer reports corroborate easily the behavior of the junk bubble including, it would seem, issuance degradation. Lack of fully available and flowing liquidity in repo in whatever disjointed form would certainly act negatively upon leveraged loan prices as well as institutional portions of junk and high yield. That has been the one constant through the whole of October; where stocks have enjoyed a tremendous rebound, the junk bubble cannot catch even the smallest sustained bid. It had already suggested that the last “dollar” wave had not dissipated, and dealer hoarding goes further in supporting that idea.

Stay In Touch