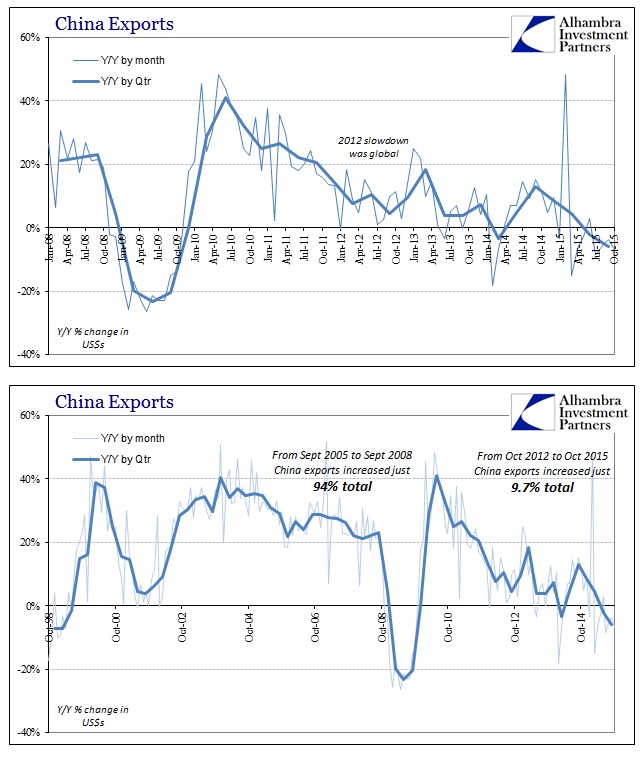

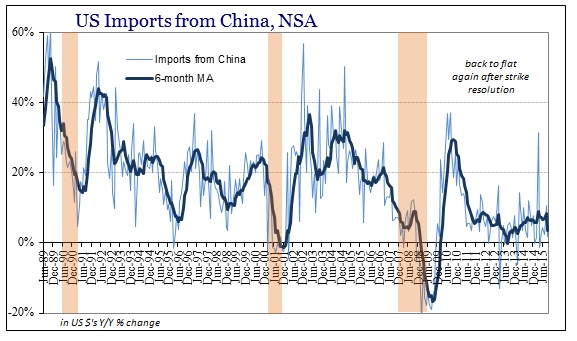

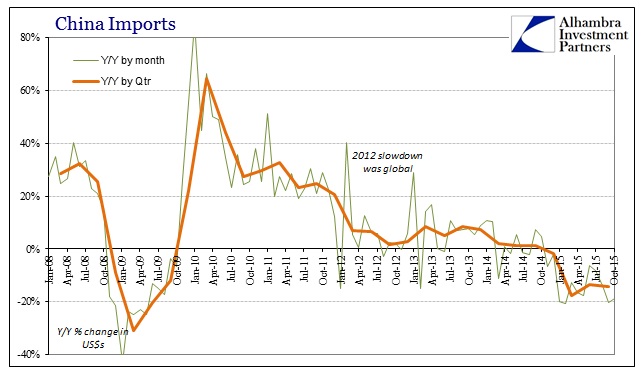

The unrelenting economic decline in China is finally getting the attention of economists and the media as something more than a big problem “for them.” Imports declined by 18.8% in October after having contracted by 20.5% in August. On the export side, Chinese goods sent abroad fell 6.9% year-over-year in dollars which confirms that the contraction is not China’s alone and, more importantly, continues on without as much as the smallest reaction to all the global “stimulus” (and persistent threats thereof).

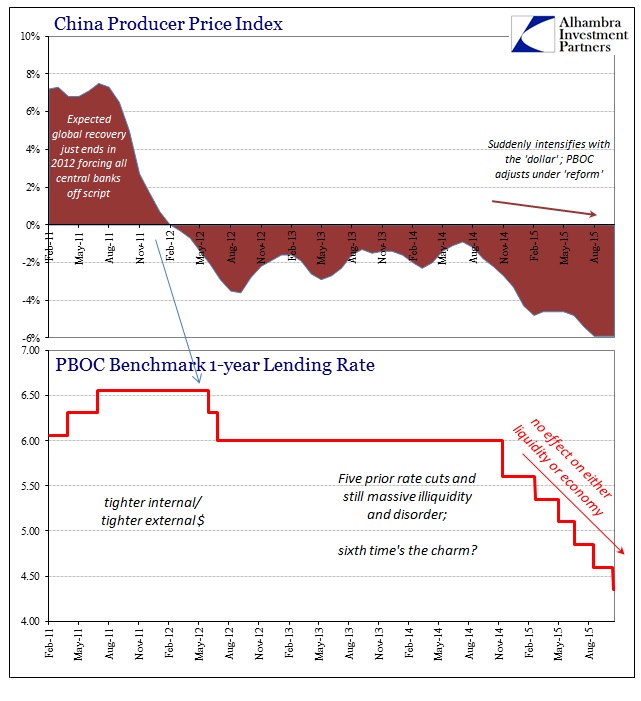

While nobody can seem to figure out why there is no response to monetary “easing” even in China, with the PBOC having cut its benchmark six times in the past year while also cutting domestic bank reserve requirements by 300 bps just since February 4, at the very least the overwhelming tendency to just ignore it all as trivial has finally been battered into submission and thus broad admission.

China’s exports fell in October for the fourth consecutive month, as a once-powerful engine of the country’s growth continued to sputter in the face of weak global demand.

The world’s appetite for goods from China—the world’s second-largest economy accounts for nearly one-fifth of global factory exports—has been lower than expected this year. Meanwhile, weak domestic demand continues to reduce imports. Both are contributing to China’s growth slowdown. “The mix of the data is again not encouraging,” said Commerzbank economist Zhou Hou. “Trade momentum is unlikely to turn around in the near term.”

For the longest time, descriptions of China’s economic descent focused only on its internal bubbles rather than the reason for their more recent reversals. The PBOC is faced with little plausible alternative to attempting to manage the bubbles as best as it might (however low probability that might be) which is what the import implosion reflects. That adjustment is entirely made as the global recovery first ended (2012) and now is reversing (2015). China was built up in the 21st century to service the eurodollar world of huge global trade expansion; without that “dollar” tailwind it all falls apart.

With the slowdown in Chinese exports past the midpoint of its fourth year, it was perhaps inevitable that the PBOC would run into unmanageable imbalance. There is significant self-reinforcing cycles at work, but overall that lack of recovery is driving the “dollar” as the “dollar” hits global trade. The August liquidations and PBOC “devaluation” were an indirect response to the end of “transitory” in the global economy, especially as the US economy no longer suggests one contrary outlet of optimism and hope.

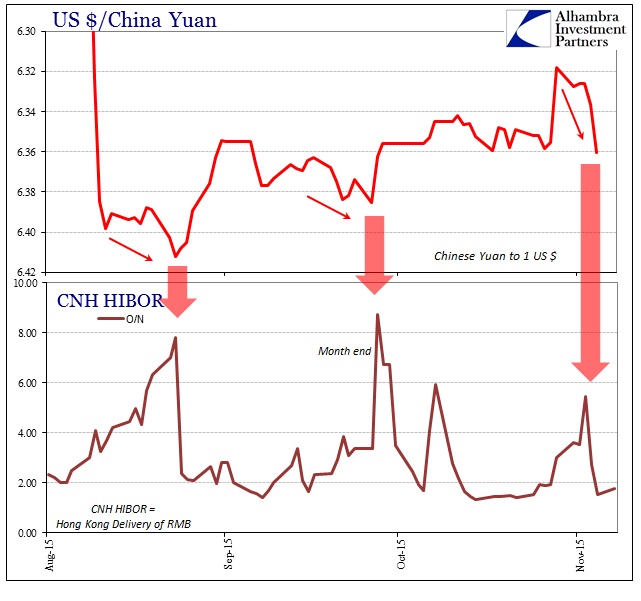

From that background and baseline, there is little the PBOC might do to counteract the exact agents of corrosion – both economic and financial. Not for lack of trying, but the PBOC has been reduced to overt simplification by pegging various prices and indications in the hope of averting further negative interpretations. The first was the renminbi that spent five months doing as little as possible, only to be abruptly and violently lurched by “dollar” illiquidity artificially imposed by that very effort.

In the wholesale world, especially of this eurodollar brand, currency “prices” aren’t as much about “flows” in or out but rather an indication of the relative expensiveness with which local systems can bid for “dollars.” By imposing an artificial currency price restriction, the PBOC was instead enforcing a cap on the price by which Chinese banks (and related Asian trading, particularly in Hong Kong) could bid for rollovers of the eurodollar short (synthetic). The illiquidity gap that currency restriction levied simply became too large by August 11, compelling the Chinese central bank to remove its restraint even though that allowed open (“dollar”) disorder to be presented globally. That is the primary evidence as to the severity of the “dollar” run given that it contradicted the PBOC’s seeming main directive of 2015 – to hide as much as possible.

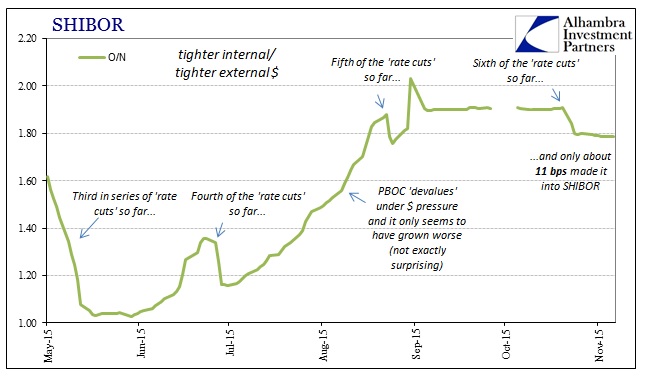

Since August, the PBOC has not fallen toward the background but rather shifted its focus. By early September, the central bank has been certainly involved in pegging overnight SHIBOR in order to project internal calm for renminbi liquidity. Unfortunately for the Chinese, the “dollar” and yuan liquidity are intimately and intricately connected so that disorder or disruption in the former ensures the same in the latter. Yuan reverse repos have been utilized in generous quantities to try to pacify yuan dynamics, but irregularity remains as “dollar” agitation.

To that end, the PBOC has further engaged wholesale means of all kinds to attempt to transform the nature of that “dollar” issue. Employing swaps and forwards, the central bank is pushing “dollar” liquidity in various directions but a fair amount of that effort is certainly aimed at projecting “dollar” serenity. In September, “capital outflows” appeared to be quite docile compared to the huge “outflow” (“dollar” run) in August and now October figures are suddenly and “unexpectedly” positive:

On Saturday, China’s central bank reported that foreign-exchange reserves in October rose by $11.39 billion to $3.526 trillion, ending a five-month streak of monthly declines. Economists said it signaled weaker expectations among investors that the yuan would depreciate further.

Economists have no idea what to make of all this, particularly since the reason for that positive number lies again in those forwards and swaps that have the effect of skewing these “money” figures (and twisting their very meaning). We also need to account for the October 15 imposition of one-way dollar reserves the PBOC imposed on any Chinese bank “buying” dollars for clients. All of these processes would have the same treatment, meaning less direct activity on the part of the PBOC in supplying “dollars.”

But where economists see the end of the CNY “outflow”, the “dollar” run remains only less visibly so (again, that seems the whole point; central banks can always count on economists to play that role). Where it truly remains is in the offshore yuan liquidity gap that appears to break out at crucial yuan/”dollar” intersections. Because the currency exchange price of renminbi in dollars equates to a wholesale cost of eurodollar rollover (and term) liquidity, the PBOC has an active and ongoing interest in yuan (CNY) appreciation, not devaluation. Yet, every time the PBOC has tried to push CNY/USD upward it has triggered an illiquidity countertrend in offshore yuan (CNH).

There was some success in early October where the “appreciation” in CNY against USD created only a short-lived CNH recoil that lasted but a few days as perhaps more cheery eurodollar conditions (relatively) covered any straining shortfall. However, for whatever ultimate reason, as you can see above, a huge push upward in the yuan fix toward the end of October (bring CNY up to almost 6.31) created the same negative CNH bias that was only unwound as CNY was allowed to “devalue” once more (permitting Chinese banks to bid for “dollars” at whatever price necessary). In my view, the PBOC far overestimated the liquidity impact of its October 23 rate cuts and particularly reserve “release” and got caught once again pushing too far against the “dollar” condition. We can only conclude that the PBOC and Chinese banks remain under the same kinds of “dollar” strains but the Chinese have at least succeeded in taking it off the front pages (and out of economists’ predictably uninquisitive posture).

From that point, we can also appreciate why and how all this monetary “stimulus” has no discernable economic (or even financial) impact. Rate cuts and reserve alterations make for great media stories and happy economists, but they have no practical place in this matter other than being overwhelmed by ongoing wholesale irregularity. The last of those rate adjustments, on October 23, has only “delivered” 11 bps to O/N SHIBOR despite the PBOC’s ongoing labors directed exactly there.

That leaves the downward bend in the global economy preserved alongside the decay in eurodollar function, with nobody apparently appreciating that those are two sides of the same coin and quite out of reach of local central banking. In short, there is no capable “stimulus” that will answer these disparities in China. And, further, it renders yet another monthly chapter in how China’s decline is a reflection of our own (and globally).

Stay In Touch