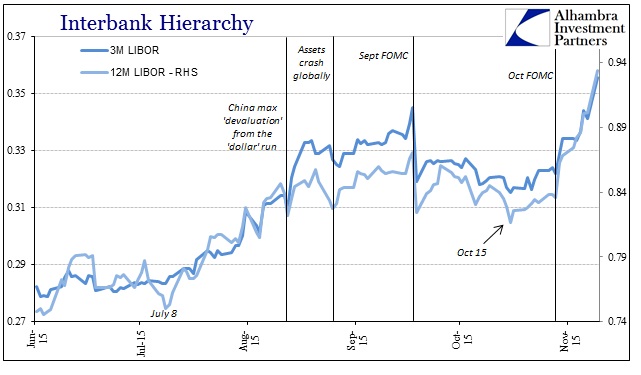

You couldn’t really call it a calming effect, as rates never truly settled down rather simply becoming less obviously meddlesome. At the September FOMC, the “dovish” sentiment that was apparently received brought LIBOR rates off their devastatingly devilish perch that had been building from all the way back in early July. As if it needed to be restated, that surge in rates coincided with all the messiness and fireworks in August as if to exclaim emphatically the “dollar” nature of all that was occurring. So the slack, for lack of a better term, into the end of September and early October in at least the LIBOR settings appeared to be a positive response to the “dovishness.”

As noted yesterday, however, that may have been the case but only in a narrow sense across the whole wholesale funding issue. If LIBOR was “better” then dealers still hoarding collateral showed that it was not in any way a universal reception (there were other senses of that, too, including and especially swap spreads). Maybe that provided just enough wiggle-room for the asset price rebound that swept through October, but all that (in money markets) is apparently ended now.

Though it is tempting to assign the more “hawkish” perceptions of the October FOMC statement as cause, there is more than enough evidence to look elsewhere for meaning. LIBOR rates especially 3-months and out have just swelled in an unwelcome and surreal echo of that early July impulse.

The 12-month maturity has now nearly matched the 2011 surge in terms of rate scale if further elongated in time. The 3-month maturity has, like the 12-month, found a great deal of nastiness just in the past few days (more on this below) which does not easily suggest FOMC policy incorporation.

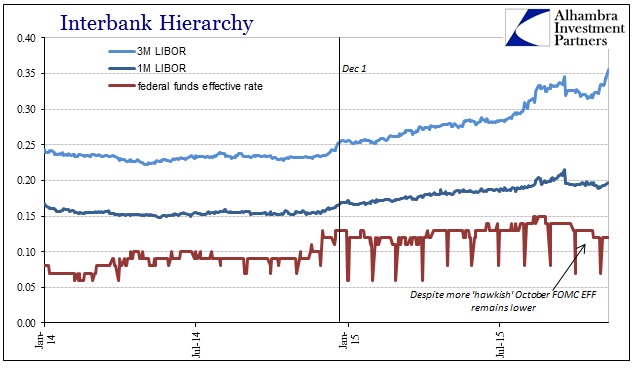

While there was an undoubted boost in the “tightening” of these money markets around the October FOMC, the transition occurred clearly two weeks before that meeting – right at October 15 (why not?). Further, this surge in LIBOR (London eurodollars) has not in any way been met by an increase in the effective federal funds rate (though I don’t want to make too much of that since EFF isn’t exactly voluminous in trade; it still is at least noteworthy given that EFF had through the September rise responded to LIBOR in kind). That would suggest something of a geographical fragmentation, though, again, it is best not to read too much into it further than a small factor for incorporating into analysis.

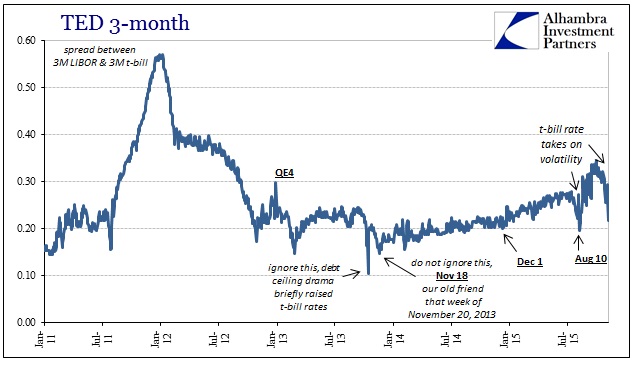

It would at least further, slightly, the suggestion that recent shift in eurodollars isn’t totally dedicated to the FOMC’s received sentiment alteration. We can observe that alternate in other money market indications of stress, including, ironically, a less strident TED spread. Since TED measures, relatively, the market’s perceptions of credit risk (eurodollar rates against US T-bills spread is decomposed as credit risk premia) a lower TED spread does not seem to add to the growing unease and oddities. Yet, it is the reason for that lower spread that produces this heightened suspicion.

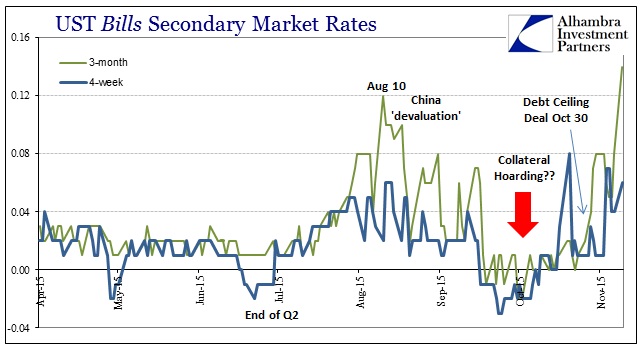

As with mid-August, just before the PBOC was broken by these “dollar” dynamics, TED is being driven more so by the T-bill rate than LIBOR. While it is also tempting to look to the latest debt ceiling nonsense for causation there, the fact is that T-bills have surged of late (more so than even August) long after the latest political “resolution” was agreed on October 30. In other words, there is “something” else forcing bills to be unusually and conspicuously offered.

Given that is highly likely the PBOC is involved in these mechanics, we thus have grasped perhaps a tortured piece of the renewed perturbed Asian “dollar.” As noted yesterday, there is a lot about China’s wholesale “dollar” connections that lead to misinterpretations and misdirection. The largest of late is how the country apparently experienced a dramatic “inflow” in reverse of the huge “outflows” of the previous months (all during this “dollar” run). That, of course, is mostly wishful thinking since the PBOC had clearly been aching to try to alter those perceptions through wholesale mechanics (forwards, swaps and certainly term repos, also the October 15 “dollar” reserve for local banks) which produce only relative blindness and not actual solution.

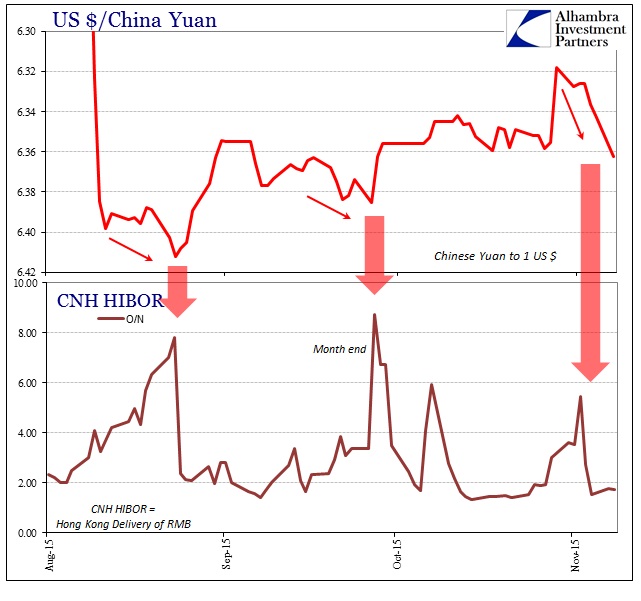

These T-bill fireworks align quite closely to the triggered tightening in offshore yuan that accompanied the PBOC’s efforts toward currency appreciation (rather than depreciation). Dating to the October 23 rate cut and reserve requirement “easing”, it seems increasingly clear the Chinese central bank instead might have unleashed more “dollar” turmoil by over-estimating everything it had been doing. As I wrote yesterday:

However, for whatever ultimate reason, as you can see above, a huge push upward in the yuan fix toward the end of October (bring CNY up to almost 6.31) created the same negative CNH bias that was only unwound as CNY was allowed to “devalue” once more (permitting Chinese banks to bid for “dollars” at whatever price necessary). In my view, the PBOC far overestimated the liquidity impact of its October 23 rate cuts and particularly reserve “release” and got caught once again pushing too far against the “dollar” condition. We can only conclude that the PBOC and Chinese banks remain under the same kinds of “dollar” strains but the Chinese have at least succeeded in taking it off the front pages (and out of economists’ predictably uninquisitive posture).

The T-bill rates of late can only add to that reasonable, in my view, conjecture. I have to further believe that as much more of a factor (coinciding perhaps intentionally?) than the FOMC; certainly in terms of direct impact upon “dollar” conditions, Asian and otherwise. The CNY/US$ exchange moved further down again in trading today, which is a still higher price for “dollars” in local Chinese terms.

November is therefore far different than October already, on either end, as global money markets seem equally and broadly likely to participate in the returning madness. While I detect the distinct flavor of the Asian character in this rerun, the FOMC’s “contribution” should not be dismissed entirely. As I have written many times over the past few years, the economists there do possess the distinct ability to make a bad situation that much worse.

Stay In Touch