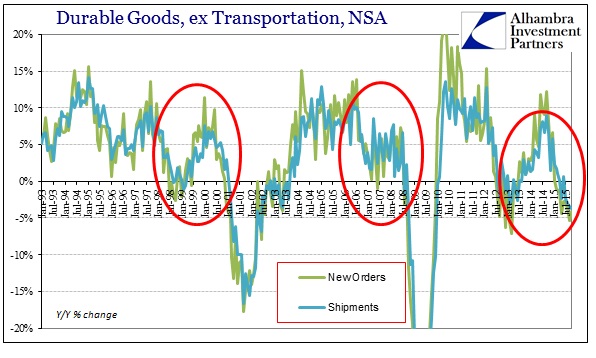

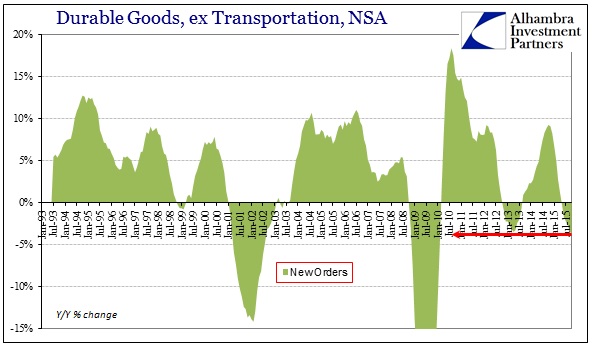

Durable goods orders and shipments were estimated still consistent with the depressive environment that has “unexpectedly” lingered for the whole of 2015. Year-over-year, new orders for durable goods fell 4.13% while shipments contracted by 3.74%. That is the ninth straight decline in orders and the fourth in shipments (and five out of the last six months). The 6-month averages in both are now below the prior cycle lows that showed up in the 2012 slowdown – that precipitated QE3 and then QE4.

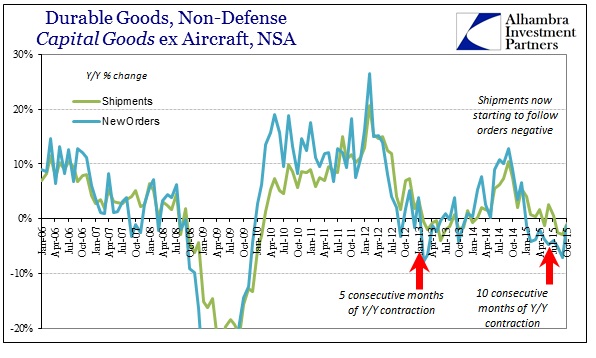

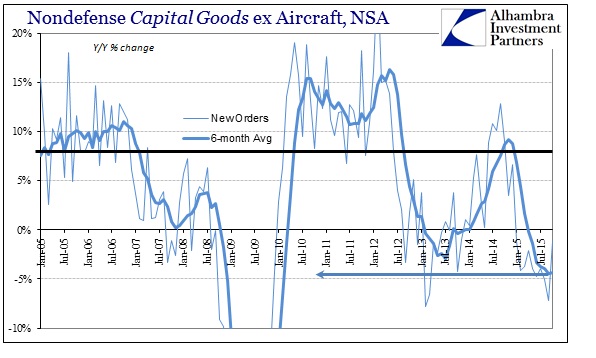

The ugliness extends still to capital goods orders and shipments, even though cap goods orders were better in October than September and August; new orders for capital goods declined only 1.23% in October after falling 5.03% and 7.17% in the prior two months. Still, capital goods orders have dropped in every month this year while shipments are just now starting to catch up to that. The 6-month average for capital goods shipments is now negative while the average for orders remains at less than -4%.

This contraction is persistent and accumulating while extending to “both” sides of the economic ledger – consumers and business capex. That suggests a serious weakness in economic circulation in the most efficient manner possible.

And still this is treated as if some sort of novelty, as if there aren’t any other economic accounts that confirm the possible exhaustion of consumers at the same time as horrible business condition. The unemployment rate is positively robust while GDP, if uneven and unstable, is still within the confines of the “meh” that has dominated since 2009. But those are distant data point: instead, retail sales continue to be plain awful and recessionary in their own right, and further consumers have suddenly begun to borrow this year just for that reproachable level. As far as businesses, consumer spending is revenue and we just so happen to find a large and growing depression on that count:

About 96 percent of S&P 500 companies have reported 3Q results so far, and their aggregate net income from continuing operations for the first three quarters is $804 billion, compared with $828 billion for the first three quarters last year, data compiled by Bloomberg shows.

The aggregate revenue for S&P 500 companies has fallen by $287 billion over the same period last year. [emphasis added]

Falling corporate income of about $25 billion against $287 billion in less revenue does not suggest a continued, epically-awesome hiring environment. Simple math determines quite easily otherwise, especially with both revenue and income not expected (even where top-down economic optimism and Janet Yellen’s fairy tale remain the dominant setting) to turn around for some time.

“The question for us is not are we in a U.S. profit recession, but how bad is it likely to get and what are the implications for the wider U.S. economy, and with that massive consensus long on the U.S. dollar,” they [Societe Generale quantitative analysis research team] write.

Changes in U.S. import prices usually lead profitability by about 12 months, and without a reversal in the dollar’s rally, a U.S. industrial profit recession looks “baked in the cake” for 2016, they say.

Economists tell us that hiring is at least stable to good, with incomes (through revisions) pointing up, and that services spending will rescue whatever “irrelevant” weakness in the 12% of GDP that makes up manufacturing will amount. Those are all highly adjusted and often inconsistent stochastic estimations. While durable goods and capital goods are likewise stochastic, they are closer to the source and thus subject to far less imputations and trend-cycle incapacity. Corporate revenues and incomes, however, are not stochastic in any way and thus provide actual dollar figures to the growing economic discontinuity the purely stochastic statistics suggested at this year’s beginning was impossible.

It is interesting (and telling) that Societe Generale’s analysts reference the dollar and the “longs” as if that were the traditional understanding of the “strong dollar”; and thus their suggestion that a US recession or even further weakening would be contrary to that position. As we well know, that is not the case at all in the wholesale financial world where that “strong dollar” is nothing like one, and is thus not at all contrary to a looming global and US recession, instead all but predicting it. Durable goods, capital goods (consumer PCE, retail sales, factory orders, freight billings, tonnage miles, industrial production, etc.) as well as corporate revenue and now almost a year of negative earnings are just continuing confirmation in that unfortunately steady direction.

Stay In Touch