Top News Headlines

- Turkey and Russia spar over airspace. Russian promises retaliation for fighter shoot down.

- Brussels shuts down for days in terrorist hunt.

- Chicago policeman charged with murder.

- Stocks little changed on the week, no follow through from last week’s rally.

- Pfizer, Allergan agree to merge for tax benefits, politicians posture, threaten.

Economic News

- Japan unveils new stimulus measures.

- US corporate profits decline nearly 5% year over year, most since recession.

- Spain economy grows 3.4% year over year, no one notices.

- Durable goods orders rebound for the month but ex-transportation still down year over year.

- Consumer confidence tanks as expectations fall.

- Manufacturing data still weak. Flash PMI, CFNAI, Richmond Fed all less than expected.

- Income up, spending up 0.1%, savings rate rises.

Random Thought Of The Week

I recently ran across a re-run of the Mecum car auction of the Tim Wellborn collection from earlier this year. The cars were mostly 1970s Mopar (Dodge/Chrysler products) muscle cars and the prices were stunning. A 1971 Dodge Daytona sold for $900,000 and almost every one of the cars fetched at least six figures. Two things came to mind as I watched the bidding. First, I really, really wish I’d bought a few of these back in the ’80s when you could get them for next to nothing. Second, these were not particularly good cars, a product of Detroit’s worst decade. That either says something about the collector car market or the memories of baby boomers.

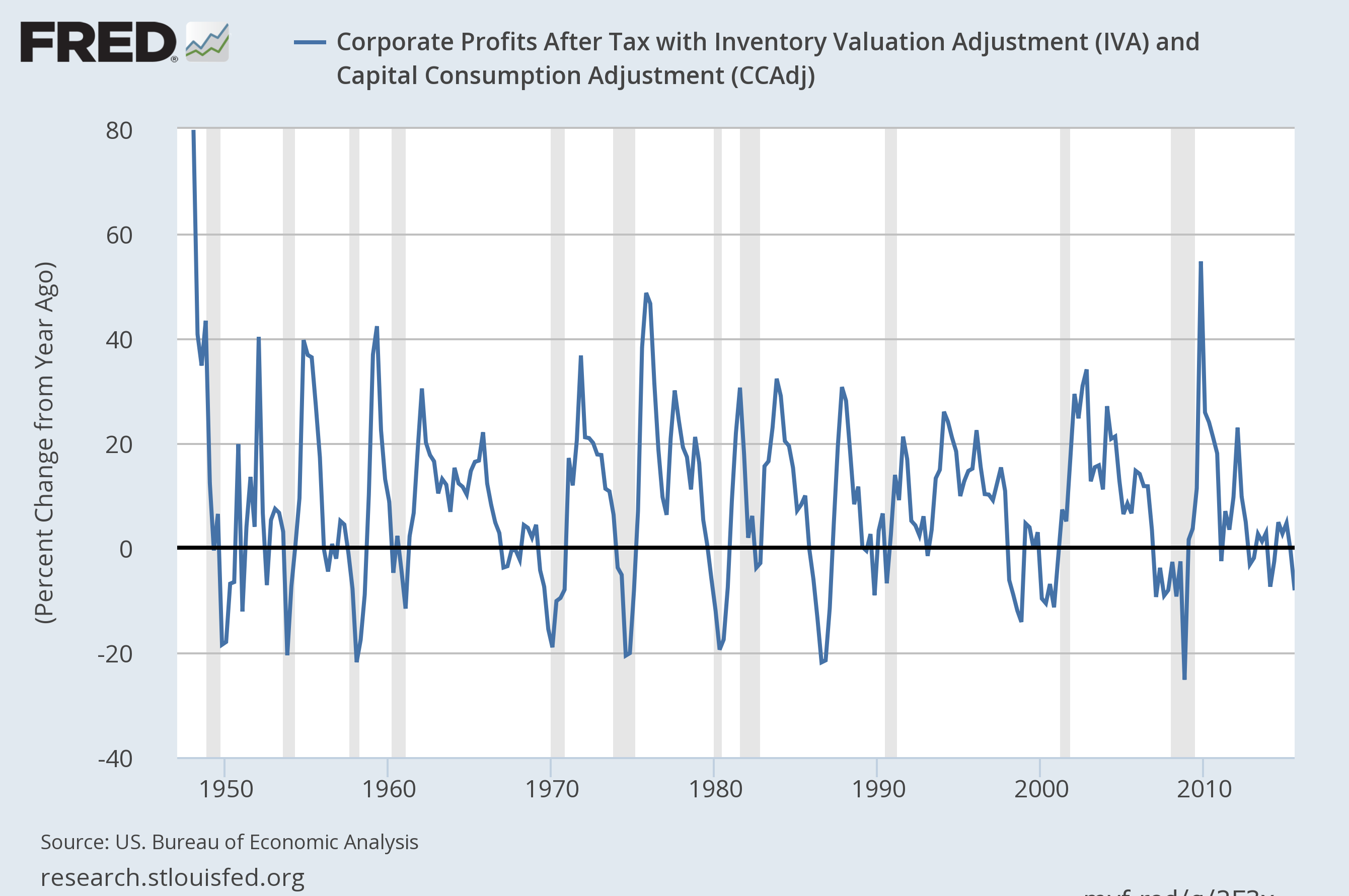

Chart Of The Week

Corporate profits rarely fall outside of recession as they are now. That’s not a prediction but one probably ought to factor it into one’s outlook.

Broad Market Top 10 – 3 Month Returns

MOMENTUM ASSET ALLOCATION MODEL

SPDR Sector Returns – 3 Month Returns

SPDR SECTOR ROTATION MODEL

Country Returns Top 10 – 3 Month Returns

Commodity Returns Top 10 – 3 Month Returns

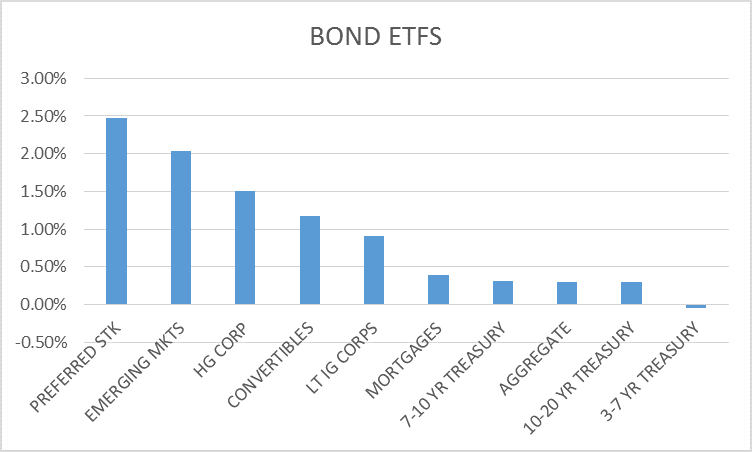

Bond Returns Top 10 – 3 Month Returns

Stock Valuation Update

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Joe Calhoun can be reached at: jyc3@4kb.d43.myftpupload.com or  786-249-3773. You can also book an appointment using our contact form.

786-249-3773. You can also book an appointment using our contact form.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch