-

Global Growth

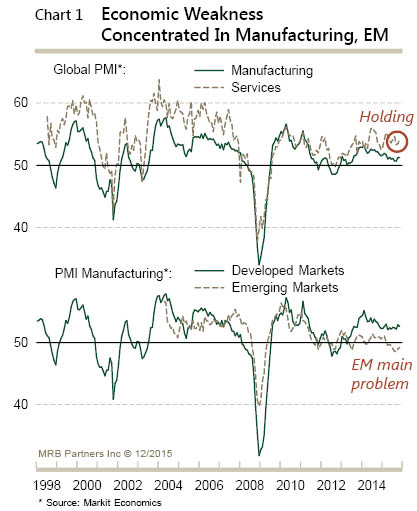

Recession risks are low and growth should improve in 2016. Excess supply is especially apparent in the raw materials/commodities sectors. This state of overcapacity/supply and a strong dollar combined from 2014-2015 to create an environment of falling prices and sluggish growth in global manufacturing. The services sector continues to perform well. Continued expansion in the US coupled with a recovering Europe and a stabilizing China should lead to a recovery in manufacturing, leading to more global trade and continued expansion in the service sector.

-

Federal Reserve

The Fed looks poised to start a cycle of rate hikes on Dec 16th. Expect policy rates to slowly rise throughout 2016. Recession risks in the US are currently low and should not rise significantly given the expected slow pace of increase to policy rates.

-

US Dollar

Interest rate differentials and growth expectations continue to favor a firm US Dollar. Do not expect the sharp rise in the greenback seen since 2014.

-

Inflation

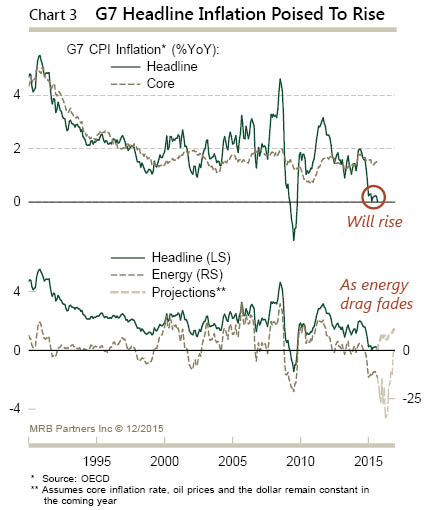

The drop in oil prices has caused headline inflation statistics near 0%. Expect headline inflation to rise toward core inflation or a level of about 1.5-2%.

-

Trade

Expect continued sluggishness in global trade. In general, countries are looking inward more than outward. But, global trade should be better than 2015 as the worst of the commodity glut is hopefully behind us.

-

Corporate Earnings

Slowing global growth, the collapse in energy and material sector earnings and the strong dollar lead to a year of disappointing equity earnings. As such, expectations are extremely pessimistic. All 3 factors have a high chance of improvement in 2016 which would lead to improved expectations and boost stocks.

-

Commodities

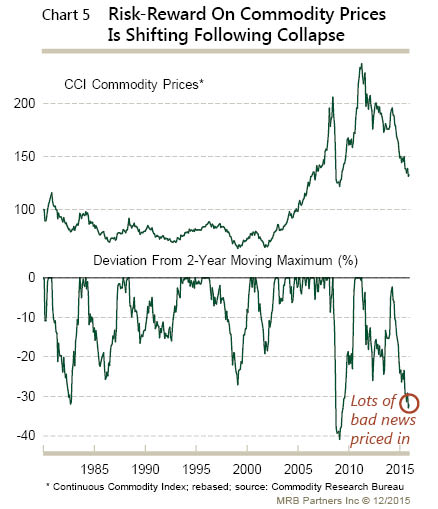

The price drop since 2014 is the 2nd worst in the last 35 years, exceeded only by the extreme market of 2008. Oversupply is the result of an investment boom and lack of demand is mainly the result of a slowdown in China. Do not expect the extreme drops seen since 2014. Abatement of the recent negative trend would buoy global trade and headline inflation.

Overall the macro backdrop looks constructive for 2016. Moderate improvement or even reversal of some of this year’s extreme trends will improve the outlook. Optimism will improve and investors will be willing to raise their risk appetite. At this time markets may even see the return of positive momentum. Equity valuations, while elevated, are not so high as to prevent equity gains in 2016.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@alhambrapartners.

This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Investments involve risk and you can lose money. Past investing and economic performance is not indicative of future performance. Alhambra Investment Partners, LLC expressly disclaims all liability in respect to actions taken based on all of the information in this writing. If an investor does not understand the risks associated with certain securities, he/she should seek the advice of an independent adviser.

Stay In Touch