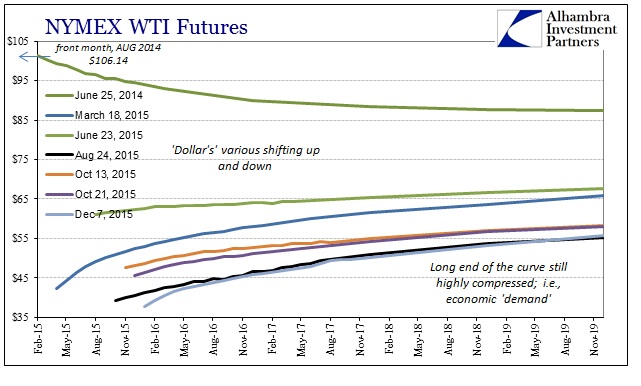

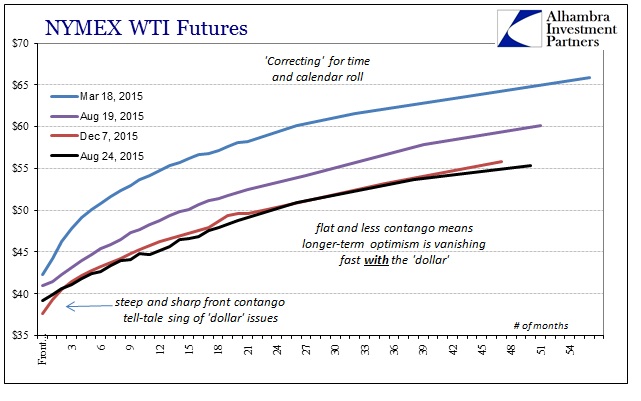

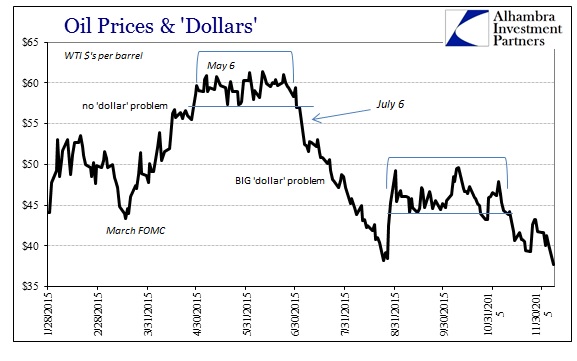

Crude oil prices are exhibiting all the signs of an increasingly difficult funding environment. The front end of the futures curve is being bent dramatically in relation to even close maturities just outside the next few months. Such contango is the obvious imprint of finance, though that is not to say that economic expectations are neutral in the curve. Far from it, as the entire curve shifts lower and lower, only with that acceleration of the “dollar” end leading the way.

Having stuck around $40 last week, this week opens with WTI under $38 and almost $3 contango to March 2016. While that represents a steeper front end, the March 2016 contract is itself trading at a new low for the first time since August 24 ($41.21 intraday then vs. $40.54 at last trade). It is the financial/economic meeting point hastened by a worsening “dollar” condition.

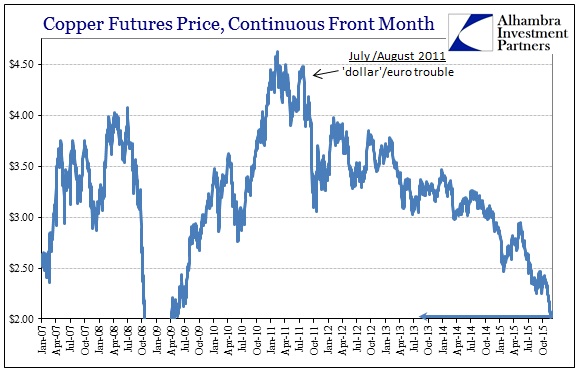

In some ways crude oil is just catching up to where other economically-sensitive commodities have traded already. Copper had sunk to just around $2 two weeks ago, along with iron ore and other industrial metals.

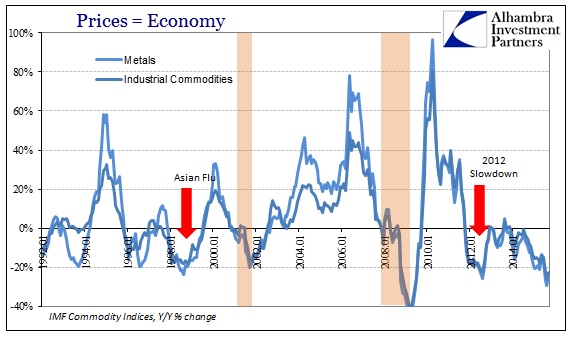

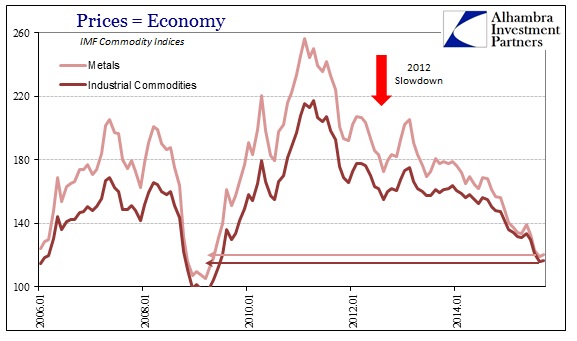

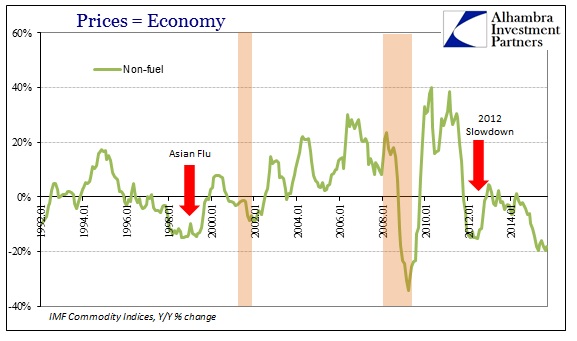

From that, the clear outlines of a global recession are visible as metals and commodity prices all across the industrial and economic landscape are trading already now in comparison to the worst parts of the Great Recession. According to the IMF’s various indices, that was the case through their latest estimates for October meaning that November updates will show new “cycle” lows in almost every index.

Where crude oil gets most attention, and thus becomes almost an excuse (“it’s only in oil”), non-fuel commodity prices are being distinctly sold and financial issues unwound. In other words, these are numerous and widespread indicators that “something” is very wrong in the global economy and certainly not something that should be simply dismissed as “transitory.”

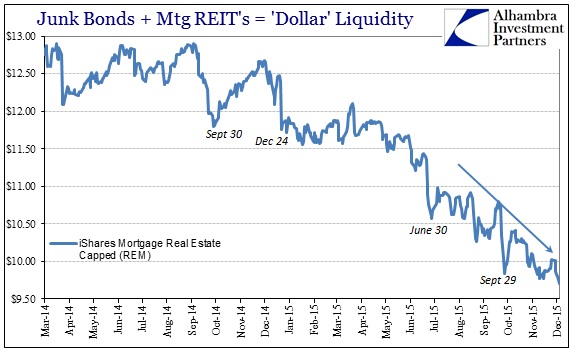

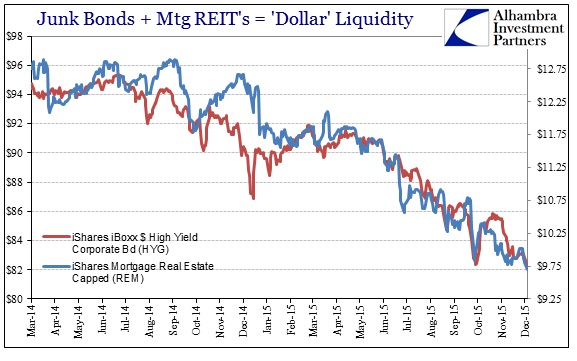

The indications already trading in December are, again, as the “dollar” projects for economic demand – which is why commodity prices so mimic the conditions in “dollar” funding (aside from more direct collateral relationships and issues). Not only does the front end of the WTI curve stand out for funding considerations, other even retail indications denote largely the same difficulty. From junk debt to mortgage REIT’s, the uniform interpretation looks like more than renewed financial retreat as one after another market price sets a new low.

What is astounding is how little attention is being paid in these areas and of their resounding, steady retreat. Some of these might be more esoteric in terms of general analysis, but the overall internal picture of desperate trouble is not relative to secondary or unimportant matters. When it may be something like mortgage REIT’s alone, some limited incorporation may be warranted, but we are seeing a spreading problem that is both widespread in scale and one that has already persisted for longer than the entirety of the last recession. That recessions have themselves broken out in far more areas (China, Brazil, Russia, Canada, Japan, US manufacturing, global revenue, profit recession, etc.) than “should” be the case given this contrary self-righteousness, that is only confirmation that funding and commodities were on the right track all along.

In other words, these internal indications are suggesting something as bad as the Great Recession for the global economy and yet economists and their eternally blissful forecasts still think nothing particularly troubling about next year’s economy even though they were belatedly dragged into writing off this year by the same financial aspects that earlier in the year forecast this very situation. If commodity and financial and “dollar” prices/indications were correct about 2015 getting worse rather than accelerating toward Yellen’s uselessly stable predictive state, what does lower and more troubling prices in December say about the start to next year (or, yet, the end of this one)?

As bad as that initial push was into January through March 2015, there was a clear shift at the end of Q2 in a very broad measurement of “dollar” funding and the economic expectations that followed (leading directly to the events of August). In some cases, that mid-year inflection has perpetrated “nonsense”, a qualification given to it because any straightforward interpretation of these, such as highly negative swap spreads, obliterates the recovery narrative in full. Having already taken apart “transitory”, that was probably inevitable anyway but the degree and speed to which these financially sensitive prices lately are transferring into dire economic expectations is quite alarming.

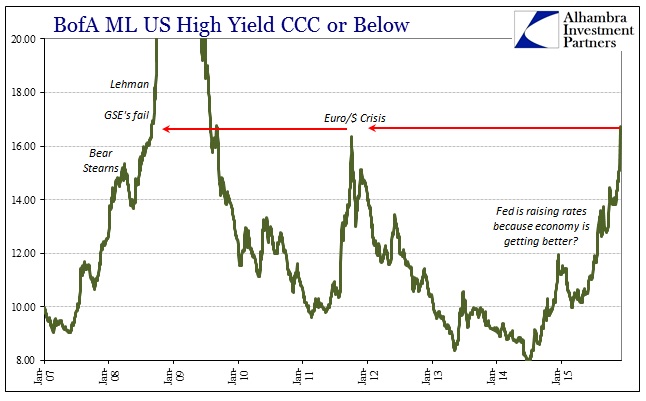

Again, the high degree of complacency just doesn’t apply to these situations. For junk bonds, at least a portion of that bubbled market anyway, to be trading almost equivalent to September 2008 just before the GSE’s and Lehman should be entirely shocking on all counts. While that by itself does not directly forecast something so terrible ahead, what it does prove is that there is now a far more than trivial probability for something economically and perhaps financially equivalent being actively traded right at this moment!

That, I believe, is the central axis of all these “dollar” relations, namely that prime-situated financial assets and indications have already shifted to such probability distributions. On the first part earlier this year the same occurred, only then it was skewing probability distributions increasingly toward Janet Yellen’s “transitory” narrative being wrong. Having proved that to be the case, probability distributions are now searching for just how wrong she might have had it and coming up with very nasty scenarios as more and more something like the baseline.

Stay In Touch