The problem with exchange rates is that they don’t always tell us anything about what everyone seems to think. In fact, the more wholesale financial exhibitions in a particular currency, the less traditional interpretations conform. In many ways, this is very much like transitioning between classical physics in the Newtonian, deterministic paradigm into quantum physics’ often strange and seemingly incoherent probabilism. What was once in a more traditional setting an easy determination to make (capital flows and such) is opened up instead to utter complexity and an entire range of inner workings that are difficult to comprehend even for seasoned observers.

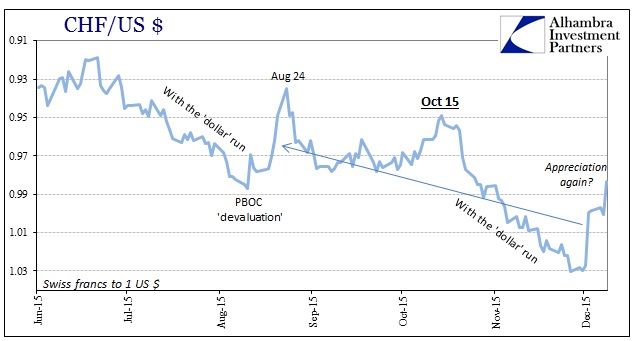

With more recent liquidations on offer in a broad range of financial spaces, and I mean far more than financial securities as suddenly financial disarray has become real balance sheet restructuring, certain currency movements that might defy the traditional fall into line of the wholesale dynamics. Right now that would apply most to the Swiss franc, which starting last week suddenly shifted away from the devastating depreciation that has plagued it for the past year and a half and back into an exhilarating countertrend that has developed in correlation with some of the worst conditions of late.

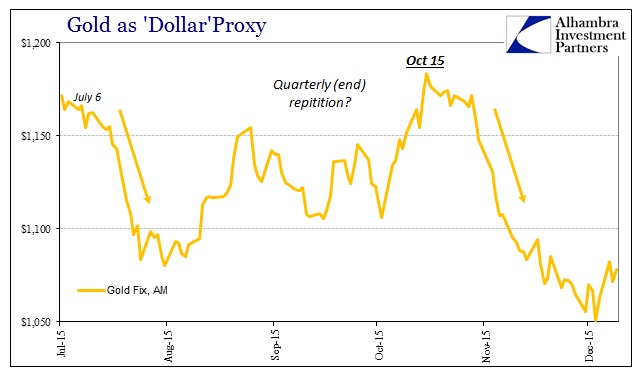

Again, it isn’t surprising to see junk bonds, oil, commodities and even stocks (today’s reversal included) struggle as the franc reverses toward appreciation. In one sense calling it “flight to safety” has purpose, but it might be better classified as global tabling of risk parameters and balance sheet offer (given the central function of Swiss banks in the eurodollar universe). Gold offers further evidence on that point, having itself behaved very much in line with the franc – particularly since October 15.

Gold, in its duality, had sunk to $1,050.60 on December 3 before following the franc upward; again, hedging for greater risk or the safety bid overwhelming in both franc and gold the downward pressure placed on it from general funding illiquidity.

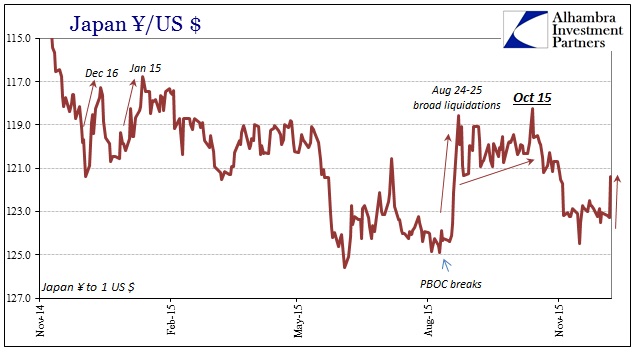

Where those might establish wholesale risk condition, it is very interesting to note two accompanying developments just this week. First, mostly today, the Japanese yen has once more joined the franc in the counter-trend toward indicating a reduction in wholesale “risk flow.”

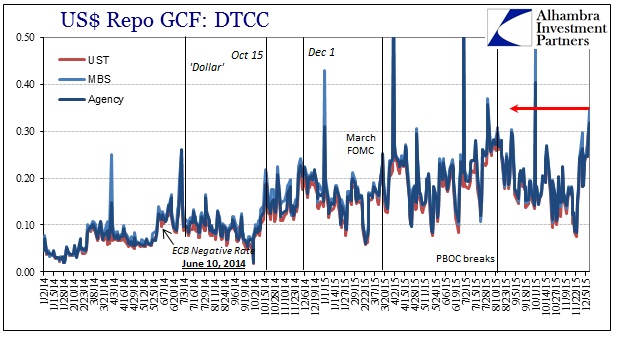

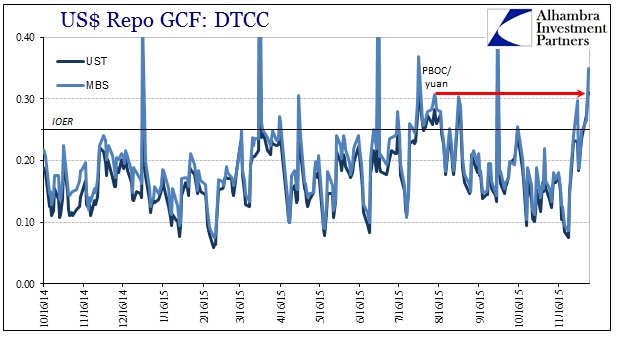

Second, maybe more important, repo rates have just exploded with the franc’s shifting position. After being almost completely benign for most of October and November (apart from a slight but noticeable elevation in UST fails), GC rates jumped yesterday to their highest level since the August PBOC CNY drama (in MBS; in UST yesterday’s published GC rate was actually higher than the worst of mid-August). Repo rates jumped again today, with the MBS at nearly 35 bps and UST at 31 bps!

It should be pointed out that these are the published GC rates from DTCC meaning they are indexed from only those repo trades conducted at the clearinghouse, leaving an enormous amount (vast majority) of funding still bespoke and bilateral, thus invisible. From that we can infer perhaps even more elevated stress in the wider repo market as the published, clearinghouse rates function as what the “last resort” funding options might look like. In that view, having the GC rate in the middle of December resemble something close to a month-end rate closer to outright and open turmoil is, undoubtedly, a significant elevation in funding irregularity if not great distress.

Given that the only comparable period to the last few days in repo was when the PBOC was under such huge “dollar” strain the last time, being so far as forced into abandoning whatever it was doing in CNY and allowing “devaluation”, it is unsurprising to find the PBOC once more fixing CNY in that direction almost to that degree. It bears repeating, the CNY exchange rate is not devaluation (classical thinking) but rather the relative “dollar” cost for rolling over the “dollar short” (quantum thinking); thus, a higher fix is the PBOC acknowledging the need for Chinese banks to bid more for that funding.

In that case, the events of the past few days in repo are quite confirming as the PBOC’s reference rate, or middle rate, for CNY exchange has similarly exploded. On November 30, the middle rate was set at 6.3985; on December 4, as the franc, gold and repo started to move toward reduced wholesale risk “flow” and offer, the middle rate was pushed up to 6.4039; yesterday the middle rate was 6.4185. Today, in a huge one-day move, again, telling us a great deal in cooperation with the surge in repo rates, the PBOC fixed the middle rate at 6.432!

Illiquidity has been the growing fact of global “dollar” markets for the past eighteen months, but from these prices and rates of the past week it is clear that even that drag has turned once more into an open problem. Coincident to the blowup in deeper junk debt, I can’t help but think that this is playing a good part in some of the recent shifts in real economic agents.

In other words, liquidity, for all that it is supposed to be in these kinds of conditions, really just describes the exits. Here, we see them already narrow and now far more uncertain even at that. The franc, gold and perhaps yen suggest that even the shrunken exits we see now are misleading as the Chinese can attest – try to use them, in size, and run the high risk of being visited close hardship. For commodity producers (and eventually industrial firms and manufacturers) this isn’t just some esoteric interest, if your balance sheet is replete with running debt rollovers better to start thinking of firesales now before it gets too late and the exits so narrow that your company is instead punished (forced toward its own liquidation) by the mere suggestion of it.

Economists and policymakers want to pretend that everything is fine with the economy despite all this, but nothing is fine here and it eventually becomes the economy through very distinct follow-through and associations.

Stay In Touch